Client Tax Organizer Worksheet PDF Download Form

What is the Client Tax Organizer Worksheet?

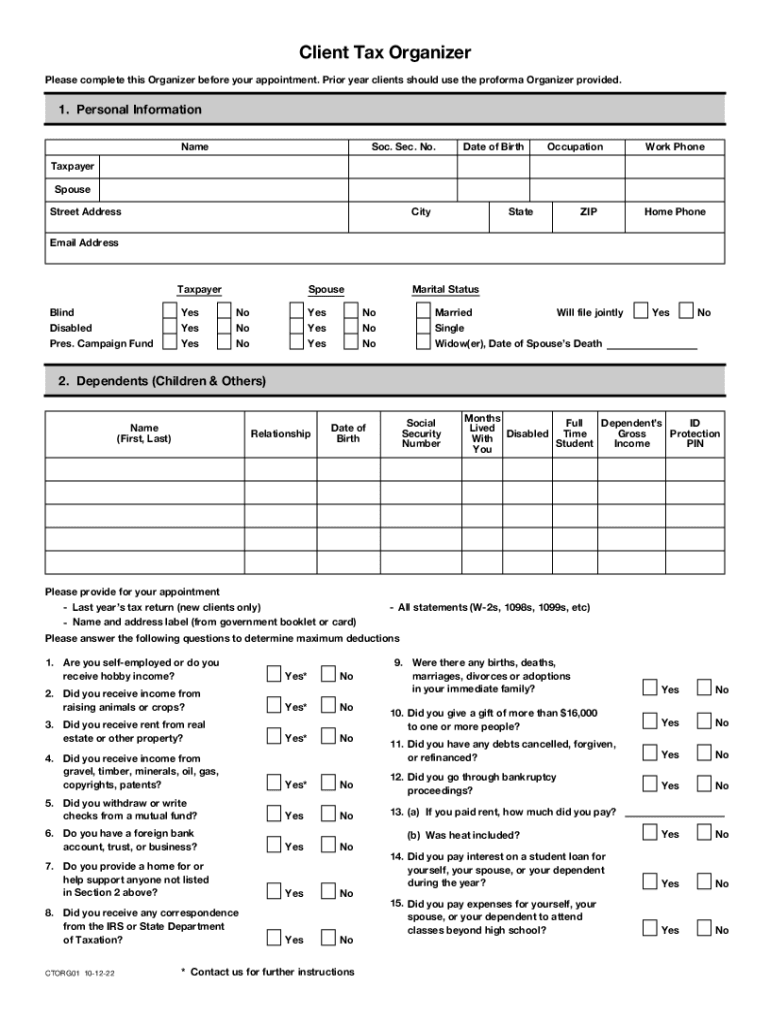

The Client Tax Organizer Worksheet is a structured document designed to assist individuals and businesses in gathering essential tax information. This worksheet serves as a comprehensive tool for organizing financial data, ensuring that all necessary details are collected for accurate tax filing. It typically includes sections for income sources, deductions, credits, and other relevant financial information. By using this worksheet, clients can streamline the tax preparation process, making it easier for tax professionals to assist them effectively.

How to Use the Client Tax Organizer Worksheet

To effectively utilize the Client Tax Organizer Worksheet, begin by downloading the template in PDF format. Fill out each section with accurate information regarding your income, expenses, and any deductions you plan to claim. It is advisable to gather supporting documents, such as W-2s, 1099s, and receipts, before starting. Once completed, review the worksheet for accuracy and completeness. This organized approach not only simplifies the tax filing process but also ensures that no critical information is overlooked.

Steps to Complete the Client Tax Organizer Worksheet

Completing the Client Tax Organizer Worksheet involves several key steps:

- Download the worksheet in PDF format.

- Gather necessary financial documents, including income statements and expense receipts.

- Fill in personal information, such as name, address, and Social Security number.

- Document all income sources, including wages, dividends, and business income.

- List potential deductions, such as mortgage interest, medical expenses, and charitable contributions.

- Review the completed worksheet for any missing information or errors.

Key Elements of the Client Tax Organizer Worksheet

The Client Tax Organizer Worksheet includes several important sections that facilitate tax preparation:

- Personal Information: Basic details about the taxpayer, including contact information.

- Income Sources: A comprehensive list of all income received during the tax year.

- Deductions: Potential deductions that can reduce taxable income, such as business expenses and medical costs.

- Credits: Information on any tax credits that may apply, which can directly reduce tax liability.

- Additional Notes: A section for any other relevant information or special circumstances.

Legal Use of the Client Tax Organizer Worksheet

The Client Tax Organizer Worksheet is legally valid as a preparatory document for tax filing. It helps ensure compliance with IRS regulations by organizing necessary information. While the worksheet itself does not serve as a tax return, the information gathered can be critical for accurate reporting. It is essential to maintain the integrity of the data provided, as inaccuracies can lead to penalties or audits. Utilizing a reliable platform for completing and storing the worksheet can enhance security and compliance.

Required Documents for Completing the Client Tax Organizer Worksheet

To fill out the Client Tax Organizer Worksheet accurately, certain documents are essential:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Bank statements and investment income reports.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Quick guide on how to complete client tax organizer worksheet pdf download

Effortlessly Prepare Client Tax Organizer Worksheet PDF Download on Any Device

Web-based document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools essential for quickly creating, modifying, and eSigning your documents without delays. Manage Client Tax Organizer Worksheet PDF Download on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Modify and eSign Client Tax Organizer Worksheet PDF Download with Ease

- Find Client Tax Organizer Worksheet PDF Download and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, and errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Client Tax Organizer Worksheet PDF Download and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the client tax organizer worksheet pdf download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax organizer worksheet template?

A tax organizer worksheet template is a structured document designed to help you collect all necessary information for tax preparation. It guides you in organizing financial data efficiently, ensuring no critical details are overlooked. Using a tax organizer worksheet template simplifies the tax filing process, making it more manageable.

-

How does airSlate SignNow enhance the use of a tax organizer worksheet template?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning your tax organizer worksheet template. The software streamlines the process, allowing for quick edits and secure sharing with tax professionals. This ensures all information is captured accurately and submitted on time.

-

Is the tax organizer worksheet template customizable?

Yes, the tax organizer worksheet template offered by airSlate SignNow is fully customizable. You can easily tailor it to suit your specific tax needs by adding or removing sections as necessary. This flexibility allows you to create a personalized document that best fits your financial situation.

-

What are the pricing options for airSlate SignNow and its templates?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Each plan includes access to essential features such as the tax organizer worksheet template and the ability to send and eSign documents. You can choose the plan that best aligns with your requirements and budget.

-

What are the benefits of using a tax organizer worksheet template?

Using a tax organizer worksheet template streamlines the tax preparation process, reduces the risk of errors, and saves time. This tool helps you gather and organize your financial information systematically, making it easier to submit accurate tax returns. Ultimately, it leads to a more efficient and stress-free tax season.

-

Can the tax organizer worksheet template be integrated with other software?

Yes, airSlate SignNow allows for seamless integration with various accounting and tax preparation software. By using a tax organizer worksheet template within this ecosystem, you enhance your workflow and improve collaboration with your tax advisor. This integration helps ensure that all your financial data is synchronized and accessible.

-

Is it secure to use airSlate SignNow for my tax organizer worksheet template?

Absolutely! airSlate SignNow employs robust security measures to protect your sensitive information. When using a tax organizer worksheet template, all data is encrypted, and features like secure eSignatures ensure that only authorized individuals have access to your documents.

Get more for Client Tax Organizer Worksheet PDF Download

Find out other Client Tax Organizer Worksheet PDF Download

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online