1041 I Form 2017

What is the 1041 I Form

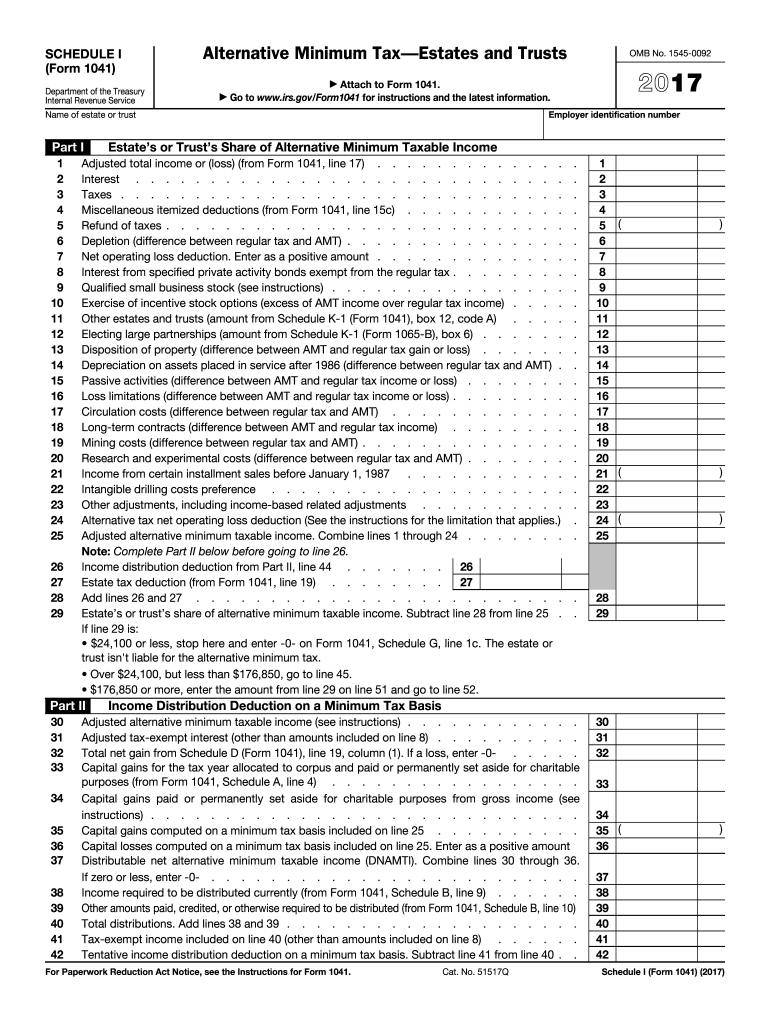

The 1041 I Form, also known as the U.S. Income Tax Return for Estates and Trusts, is a tax form used by estates and trusts to report income, deductions, gains, and losses. This form is essential for fiduciaries managing estates or trusts to ensure compliance with federal tax regulations. It helps in calculating the tax liability for the estate or trust and is crucial for accurate reporting to the Internal Revenue Service (IRS). Understanding the purpose of this form is vital for anyone involved in managing an estate or trust.

How to use the 1041 I Form

Using the 1041 I Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial information related to the estate or trust, including income sources, deductions, and any applicable credits. Next, carefully fill out the form, ensuring that all entries are accurate and reflect the financial activities of the estate or trust. After completing the form, review it for any errors before submission. It is important to retain a copy for your records, as well as any supporting documents that substantiate the information provided.

Steps to complete the 1041 I Form

Completing the 1041 I Form requires careful attention to detail. Follow these steps for a thorough process:

- Gather all financial documents related to the estate or trust.

- Identify all sources of income, including interest, dividends, and capital gains.

- Calculate allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Fill out the form, ensuring that all entries are accurate and complete.

- Review the form for accuracy, checking calculations and ensuring all required fields are filled.

- Sign and date the form, confirming the information is correct to the best of your knowledge.

- Submit the form to the IRS by the appropriate deadline, either electronically or by mail.

Legal use of the 1041 I Form

The legal use of the 1041 I Form is governed by IRS regulations, which stipulate that estates and trusts must file this form if they have gross income of $600 or more for the tax year. Additionally, the form must be filed for any estate that has a non-resident alien beneficiary. Proper use of the form ensures compliance with tax laws and helps avoid potential penalties for non-compliance. It is essential for fiduciaries to understand the legal implications of the information reported on this form.

Filing Deadlines / Important Dates

Filing deadlines for the 1041 I Form are crucial for ensuring compliance with IRS regulations. The due date for filing the form is typically the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these dates to avoid late filing penalties.

Form Submission Methods

The 1041 I Form can be submitted in several ways, providing flexibility for fiduciaries. The primary methods include:

- Online Submission: Many tax software programs allow for electronic filing of the form, which can expedite processing and confirmation of receipt.

- Mail: The form can be printed and sent via postal mail to the appropriate IRS address based on the estate or trust's location.

- In-Person: While less common, some may choose to deliver the form directly to an IRS office.

Quick guide on how to complete 1041 i form 2017

Achieve 1041 I Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage 1041 I Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

How to modify and eSign 1041 I Form with ease

- Obtain 1041 I Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you want to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Change and eSign 1041 I Form while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1041 i form 2017

Create this form in 5 minutes!

How to create an eSignature for the 1041 i form 2017

How to generate an electronic signature for the 1041 I Form 2017 in the online mode

How to make an eSignature for the 1041 I Form 2017 in Chrome

How to make an eSignature for signing the 1041 I Form 2017 in Gmail

How to create an electronic signature for the 1041 I Form 2017 straight from your mobile device

How to create an eSignature for the 1041 I Form 2017 on iOS

How to generate an electronic signature for the 1041 I Form 2017 on Android

People also ask

-

What is the 1041 I Form and why is it important?

The 1041 I Form is a tax return form used by estates and trusts in the United States to report income, deductions, and tax liability. It's important for ensuring compliance with IRS regulations and properly managing the financial affairs of the estate or trust. By using the 1041 I Form, executors and trustees can accurately report income and avoid potential penalties.

-

How can airSlate SignNow help me with the 1041 I Form?

airSlate SignNow streamlines the process of completing and signing the 1041 I Form by providing an easy-to-use platform for document management. You can create, edit, and eSign your 1041 I Form and other tax documents quickly and securely. This efficiency helps ensure that your tax submissions are timely and accurate.

-

Is airSlate SignNow cost-effective for filing the 1041 I Form?

Yes, airSlate SignNow offers a cost-effective solution for filing the 1041 I Form. With competitive pricing plans, businesses can choose the package that best fits their needs without overspending. This affordability, combined with its robust features, makes airSlate SignNow a great choice for managing tax documents.

-

What features does airSlate SignNow offer for managing the 1041 I Form?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning capabilities for the 1041 I Form. Users can easily collaborate with multiple parties, track document status, and ensure compliance with IRS requirements. These features enhance efficiency and accuracy when handling tax-related documents.

-

Can I integrate airSlate SignNow with other tools for the 1041 I Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow when preparing the 1041 I Form. You can connect it with cloud storage services, accounting software, and more, creating a comprehensive solution for managing your tax documents.

-

How secure is my information when using airSlate SignNow for the 1041 I Form?

Security is a top priority at airSlate SignNow. When you use our platform to manage the 1041 I Form, your data is protected with industry-standard encryption and secure servers. This ensures that sensitive information remains confidential while you eSign and share important tax documents.

-

Can I access the 1041 I Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to complete and eSign the 1041 I Form on the go. The mobile app provides a user-friendly interface, enabling you to manage your tax documents anytime and anywhere, making it a convenient option for busy professionals.

Get more for 1041 I Form

Find out other 1041 I Form

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer