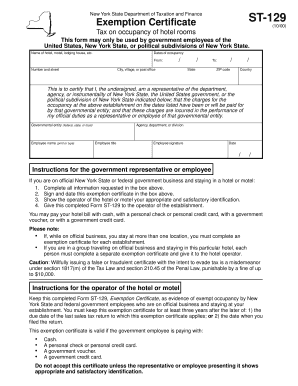

St 129 Form

What is the ST-129?

The ST-129 is a New York State tax exempt certificate that allows qualifying organizations to make purchases without paying sales tax. This form is primarily used by non-profit organizations, governmental entities, and certain other exempt entities to demonstrate their tax-exempt status when buying goods or services. By providing this certificate to vendors, organizations can ensure compliance with state regulations while minimizing their tax liabilities.

How to Use the ST-129

To use the ST-129 effectively, organizations must fill out the form accurately and present it to vendors at the time of purchase. The form should include the name and address of the purchaser, the type of organization, and a declaration of the intended use of the purchased items. It is essential to ensure that the vendors accept the ST-129, as not all businesses may recognize it as valid. Properly using this certificate can help organizations save on costs associated with sales tax.

Steps to Complete the ST-129

Completing the ST-129 involves several straightforward steps:

- Obtain the form from a reliable source, such as the New York State Department of Taxation and Finance website.

- Fill in the required information, including the organization’s name, address, and tax-exempt status.

- Specify the nature of the purchases and how they relate to the organization's exempt purpose.

- Sign and date the form to validate it.

- Provide the completed form to the vendor when making a purchase.

Legal Use of the ST-129

The legal use of the ST-129 is governed by New York State tax laws. Organizations must ensure that they meet the eligibility criteria for tax exemption to use this form. Misuse of the ST-129, such as using it for personal purchases or for items not related to the exempt purpose, can lead to penalties and loss of tax-exempt status. It is crucial for users to understand the legal implications of using this certificate to maintain compliance with state regulations.

Eligibility Criteria for the ST-129

To qualify for the ST-129, organizations must meet specific eligibility criteria set forth by New York State. Typically, these include being a recognized non-profit organization, a governmental entity, or another type of exempt organization. Applicants may need to provide documentation that supports their tax-exempt status, such as IRS determination letters or other official records. Understanding these criteria is essential for organizations seeking to utilize the ST-129 effectively.

Required Documents for the ST-129

When applying for or using the ST-129, certain documents may be required to validate the tax-exempt status of the organization. These documents may include:

- IRS determination letter confirming tax-exempt status.

- Bylaws or articles of incorporation for the organization.

- Proof of the organization’s activities that qualify for tax exemption.

Having these documents readily available can facilitate smoother transactions when presenting the ST-129 to vendors.

Quick guide on how to complete st 129

Effortlessly Prepare St 129 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to locate the necessary form and securely retain it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without hindrances. Manage St 129 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Alter and Electronically Sign St 129 with Ease

- Obtain St 129 and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Edit and electronically sign St 129 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 129

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ST 129?

ST 129 is a specific form used to outline the details associated with electronic signatures in transactions. With airSlate SignNow, users can easily create and manage ST 129 forms without any hassle, streamlining their document workflows.

-

How does airSlate SignNow help with ST 129 compliance?

airSlate SignNow ensures that all electronic signatures are compliant with the ST 129 requirements. Our platform follows industry standards for security and legality, making it a trusted solution for businesses needing to adhere to these regulations.

-

What pricing plans are available for using airSlate SignNow with ST 129?

airSlate SignNow offers several pricing tiers to meet different business needs, starting with a free plan for basic usage. For advanced features related to ST 129 and larger teams, premium plans provide more options at competitive prices, ensuring you get the best value.

-

Can ST 129 forms be customized in airSlate SignNow?

Yes, airSlate SignNow provides robust customization options for ST 129 forms. Users can tailor their documents by adding logos, altering fields, and personalizing templates to match their specific transaction requirements.

-

What are the benefits of using airSlate SignNow for ST 129?

Using airSlate SignNow for ST 129 offers signNow advantages, such as improved efficiency and enhanced compliance. Businesses can quickly send, sign, and manage documents, reducing the turnaround time for transactions while ensuring ever-important legal adherence.

-

Does airSlate SignNow integrate with other platforms for ST 129 management?

Yes, airSlate SignNow seamlessly integrates with various business applications, making ST 129 management even easier. Whether you use CRM systems, project management tools, or cloud storage services, our integration capabilities allow for a smooth workflow.

-

Is airSlate SignNow user-friendly for ST 129 users?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, featuring an intuitive interface that simplifies the process of creating and handling ST 129 forms. Even those who are not tech-savvy will find it easy to navigate and utilize the platform effectively.

Get more for St 129

Find out other St 129

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation