K 120s Form 2015

What is the K 120s Form

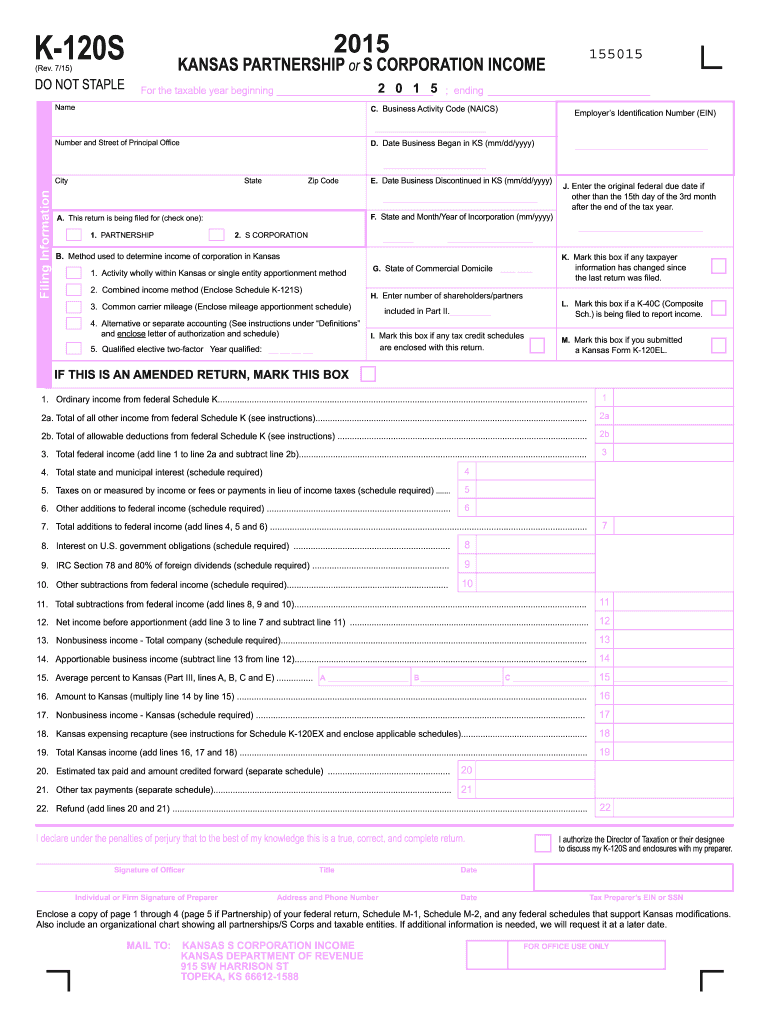

The K 120s Form is a tax document used primarily for reporting income and expenses for certain business entities in the United States. This form is essential for partnerships and limited liability companies (LLCs) that choose to be taxed as partnerships. It allows these entities to report their income, deductions, and credits to the IRS, ensuring compliance with federal tax regulations. The K 120s Form is a critical component for tax filing, as it provides the necessary information for partners to report their share of the business income on their individual tax returns.

How to use the K 120s Form

Using the K 120s Form involves several steps that ensure accurate reporting of business income and expenses. First, gather all relevant financial documents, including income statements, expense receipts, and prior year tax returns. Next, complete the form by entering the business's financial information in the designated sections. It is important to ensure that all figures are accurate and reflect the business's financial activities for the tax year. Once completed, the form should be distributed to all partners, who will use the information to fill out their personal tax returns. Proper use of the K 120s Form helps maintain compliance and avoid potential penalties.

Steps to complete the K 120s Form

Completing the K 120s Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including income statements and expense records.

- Fill in the entity's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report all sources of income in the designated sections, ensuring accuracy.

- List all deductible expenses, categorizing them appropriately to maximize deductions.

- Calculate the total income and expenses to determine the net income or loss.

- Distribute the completed form to each partner for their records.

Legal use of the K 120s Form

The K 120s Form is legally recognized as a valid tax document when filled out correctly and submitted on time. Compliance with IRS regulations is essential to ensure that the form is accepted without issues. It is important to adhere to all guidelines regarding the reporting of income and expenses, as inaccuracies can lead to audits or penalties. Additionally, maintaining proper records and documentation supports the information reported on the form, providing a legal basis for the claims made.

Filing Deadlines / Important Dates

Filing deadlines for the K 120s Form are crucial for compliance. Typically, the form must be submitted by the fifteenth day of the third month following the end of the tax year. For calendar year filers, this means the deadline is usually March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is advisable to check for any changes or extensions announced by the IRS, as these can affect filing dates.

Required Documents

To complete the K 120s Form accurately, several documents are required:

- Income statements detailing all sources of revenue.

- Expense receipts for all deductible costs incurred by the business.

- Prior year tax returns for reference and consistency.

- Partnership agreements that outline the distribution of income among partners.

Quick guide on how to complete k 120s 2015 form

Complete K 120s Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage K 120s Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to modify and eSign K 120s Form with ease

- Locate K 120s Form and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information thoroughly and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form: by email, SMS, an invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign K 120s Form and ensure exceptional communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 120s 2015 form

Create this form in 5 minutes!

How to create an eSignature for the k 120s 2015 form

How to make an eSignature for the K 120s 2015 Form in the online mode

How to make an eSignature for the K 120s 2015 Form in Chrome

How to create an electronic signature for putting it on the K 120s 2015 Form in Gmail

How to generate an eSignature for the K 120s 2015 Form right from your smart phone

How to create an eSignature for the K 120s 2015 Form on iOS

How to create an electronic signature for the K 120s 2015 Form on Android OS

People also ask

-

What is the K 120s Form and how does it work?

The K 120s Form is a specialized document designed for seamless electronic signatures. With airSlate SignNow, you can easily create, send, and eSign the K 120s Form, ensuring compliance and enhancing your workflow efficiency.

-

Is there a free trial available for the K 120s Form?

Yes, airSlate SignNow offers a free trial that allows you to explore features related to the K 120s Form. This trial gives you a firsthand experience of how our platform can streamline your document signing processes.

-

What are the key features of the K 120s Form?

The K 120s Form includes features such as customizable templates, secure eSignature capabilities, and automatic file storage. These features ensure that your documents are processed quickly and securely.

-

How does airSlate SignNow help in enhancing the K 120s Form workflow?

airSlate SignNow speeds up the workflow of the K 120s Form by allowing users to send documents for eSignature within minutes. The platform automates reminders and status updates, ensuring that you never miss a signature.

-

What are the pricing options for using the K 120s Form?

airSlate SignNow offers flexible pricing plans that accommodate various business sizes. You can choose a plan that suits your needs and budget, ensuring that you get the best value for managing the K 120s Form.

-

Can the K 120s Form be integrated with other applications?

Yes, the K 120s Form can be integrated with popular applications such as Google Drive, Dropbox, and Salesforce. This flexibility helps streamline your document management processes and enhances collaboration.

-

What are the benefits of using the K 120s Form in my business?

Using the K 120s Form simplifies the signing process and reduces paperwork, which in turn saves time and money. It enhances customer satisfaction by facilitating quick responses and provides a clear audit trail for all transactions.

Get more for K 120s Form

Find out other K 120s Form

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form