529 Form

What is the 529 Form

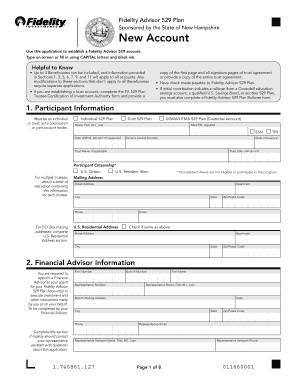

The 529 Form is a crucial document used to establish and manage a 529 college savings plan. This form allows individuals to contribute to a tax-advantaged account designed to help save for future education expenses. The Fidelity Advisor 529 plan is one of the popular options available, offering various investment choices tailored to different risk tolerances and time horizons. The form is essential for both account setup and for making contributions, ensuring that funds are allocated correctly and in compliance with federal and state regulations.

How to use the 529 Form

Using the 529 Form involves several key steps. First, individuals must gather necessary information, including personal identification details, beneficiary information, and investment preferences. Once the form is filled out, it can be submitted electronically or via mail, depending on the financial institution's requirements. It is important to ensure that all information is accurate and complete to avoid delays in processing. Additionally, users should keep a copy of the submitted form for their records, as it may be needed for future reference or tax purposes.

Steps to complete the 529 Form

Completing the 529 Form involves the following steps:

- Gather personal information, including Social Security numbers for both the account owner and the beneficiary.

- Choose the investment options that align with your financial goals.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form electronically or mail it to the appropriate address.

Taking these steps carefully will help ensure that the 529 plan is set up correctly and ready for contributions.

Legal use of the 529 Form

The 529 Form must be used in accordance with federal and state laws governing education savings plans. This includes compliance with the Internal Revenue Service (IRS) regulations regarding contributions, withdrawals, and tax benefits. To ensure legal validity, it is essential to maintain accurate records and follow the guidelines set forth by the state in which the plan is established. The Fidelity Advisor 529 plan adheres to these regulations, providing users with a secure and compliant way to save for education.

Eligibility Criteria

Eligibility for the Fidelity Advisor 529 plan is generally open to any individual who wishes to save for a beneficiary's qualified education expenses. There are no income restrictions for account owners, making this a flexible option for many families. However, the beneficiary must be a designated individual, typically a child or relative, who intends to pursue higher education. Understanding these criteria is crucial for maximizing the benefits of the 529 plan.

Form Submission Methods

The 529 Form can be submitted through various methods, depending on the financial institution's policies. Common submission methods include:

- Online submission through the financial institution's secure portal.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at a local branch, if applicable.

Choosing the most convenient method for submission can help streamline the process and ensure timely processing of the form.

Quick guide on how to complete 529 form

Prepare 529 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, alter, and eSign your documents quickly and efficiently. Manage 529 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign 529 Form with ease

- Locate 529 Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign 529 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 529 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fidelity advisor 529 plan?

A fidelity advisor 529 plan is a tax-advantaged savings plan designed to help families save for higher education expenses. It offers a variety of investment options and potential tax benefits, making it a popular choice for parents looking to fund their children's education.

-

How much does a fidelity advisor 529 plan cost?

The cost of a fidelity advisor 529 plan varies based on the investment options chosen and associated fees. Typically, there are no enrollment fees, but there are management fees that range from 0.2% to 1% depending on the investment portfolio.

-

What are the key benefits of a fidelity advisor 529 plan?

The key benefits of a fidelity advisor 529 plan include tax-free growth on investments, tax deductions in some states, and flexibility in using the funds for qualified educational expenses. Additionally, it can be used for a variety of educational institutions, from colleges to vocational schools.

-

Can I change my investment options in a fidelity advisor 529 plan?

Yes, you can change your investment options in a fidelity advisor 529 plan. The IRS allows one change per calendar year or upon changing the beneficiary. This flexibility helps you adapt your investment strategy based on market conditions and educational goals.

-

Are there any restrictions on withdrawals from a fidelity advisor 529 plan?

Withdrawals from a fidelity advisor 529 plan must be used for qualified education expenses to avoid taxes and penalties. These expenses include tuition, fees, room and board, and certain supplies. Careful planning of withdrawals ensures you maximize the benefits of your savings.

-

How can I integrate a fidelity advisor 529 plan with my financial planning?

Integrating a fidelity advisor 529 plan with your financial planning is straightforward. It works well alongside other savings and investment accounts, allowing you to allocate funds specifically for education. Consulting with a financial advisor can ensure that your 529 plan complements your overall financial strategy.

-

What happens to the funds if the beneficiary does not attend college?

If the beneficiary of a fidelity advisor 529 plan does not attend college, you have several options. You can change the beneficiary to another eligible family member or withdraw the funds for non-educational purposes, subject to penalties and taxes. This flexibility allows you to make the most of your investment.

Get more for 529 Form

- Asset sale agreement this agreement made thisday form

- Facilities ground lease agreement nys gaming commission form

- Georgia disclaimer of interest formsdeedscom

- 00 and other good form

- In the sellers possession and notify the buyer of any known lead based paint hazards form

- Notice of entry by the landlord cplea landlord and tenant form

- Name and address of assignor form

- Sample letter request funding form

Find out other 529 Form

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple