Wa Dot Form 1999-2026

What is the WA Dot Form

The WA Dot Form, officially known as the Washington Department of Transportation form, is a crucial document used for various transportation-related purposes within the state of Washington. This form is utilized for reporting vehicle information, employment status, and compliance with state regulations. It serves as a means for individuals and businesses to ensure that their transportation activities align with state laws and guidelines.

How to Obtain the WA Dot Form

To obtain the WA Dot Form, individuals can visit the Washington Department of Transportation's official website. The form is typically available for download in PDF format, allowing users to print it for completion. Additionally, physical copies may be accessible at local DOT offices or through authorized service centers across the state. It is advisable to ensure that the most recent version of the form is used to comply with current regulations.

Steps to Complete the WA Dot Form

Completing the WA Dot Form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including personal details, vehicle specifications, and employment data.

- Carefully fill out all sections of the form, ensuring that all required fields are completed with accurate information.

- Review the form for any errors or omissions before finalizing it.

- Sign and date the form to validate it legally.

If submitting electronically, ensure that the platform used complies with eSignature regulations to maintain the form's legal validity.

Legal Use of the WA Dot Form

The WA Dot Form is legally binding when completed and submitted according to Washington state regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal consequences. The form must be signed and dated by the individual or authorized representative to affirm its authenticity. Compliance with the legal requirements surrounding this form is crucial for avoiding penalties and ensuring that transportation activities are conducted lawfully.

Key Elements of the WA Dot Form

The WA Dot Form includes several key elements that must be addressed:

- Personal Information: Name, address, and contact details of the individual or business submitting the form.

- Vehicle Information: Details about the vehicle, including make, model, year, and VIN.

- Employment Status: Information regarding the employment of the individual or business, if applicable.

- Signature: A valid signature is required to authenticate the form.

Form Submission Methods

The WA Dot Form can be submitted through various methods, making it accessible for all users:

- Online Submission: Many users prefer to submit the form electronically through the Washington DOT's secure online portal.

- Mail: Completed forms can be mailed to the appropriate DOT office, ensuring that postage is accounted for.

- In-Person: Individuals can also submit the form in person at designated DOT offices for immediate processing.

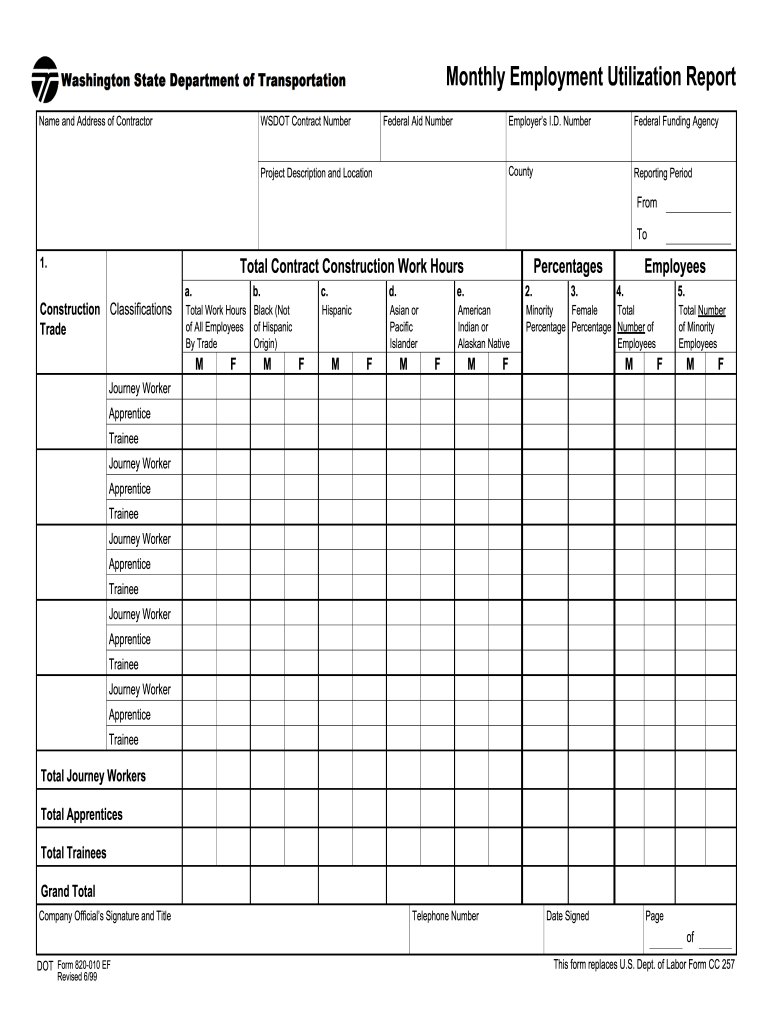

Quick guide on how to complete monthly employment utilization report wsdot wa

Simplify Your Life by signNowing Wa Dot Form with airSlate SignNow

Regardless of whether you need to title a new vehicle, register for a driver's license, transfer ownership, or complete any other task related to automobiles, managing such RMV paperwork as Wa Dot Form is a necessary chore.

There are several methods to obtain them: via mail, at the RMV service center, or by accessing them online through your local RMV website and printing them. Each of these options can be time-consuming. If you’re looking for a faster way to complete them and sign them with a legally-binding eSignature, airSlate SignNow is your top choice.

How to Easily Fill Out Wa Dot Form

- Click Show details to view a brief overview of the document you’re interested in.

- Select Get document to initiate and open the document.

- Follow the green indicator displaying the mandatory fields if applicable.

- Utilize the top toolbar and take advantage of our advanced feature set to modify, annotate, and enhance your document.

- Add text, your initials, shapes, images, and other elements.

- Click Sign in in the same toolbar to create a legally-binding eSignature.

- Review the document text to ensure there are no mistakes or inconsistencies.

- Press Done to complete the document execution.

Using our solution to complete your Wa Dot Form and other similar documents will save you considerable time and stress. Enhance your RMV document execution process from the very start!

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

If one is employed to a company, why does one have to fill in a Tax form when taxation is taken out of one's pay cheque automatically every month?

TAX EVASION IS ILLEGAL, TAX AVOIDANCE IS NOT!!!!!!IRS's game IRS's rules. Get a good Personal Tax Practitioner who is available year round that you trust, so when making financial decisions you can call and see how it will effect you tax wise and know the best way to implement it.Income tax reporting is voluntary. The IRS years ago felt that the American people as a whole were not being as forth coming as they should with income information. At this point IRS changed the rules by pitting the burden of proof on employers to report how much money they paid to each employee. This also helped IRS to balance businesses deductions against the populations income reporting. W-2's, 1099, a, b, c, misc, 1098 etc. is IRS's way of getting advanced information on the major things that happen to everyone in regards moneys earned and paid that effect personal & business taxes. Taxes withheld are only a percentage of your income and may not necessarily match the amount of taxes owed.Never for get that while the government is the government it is still a business that has to make money to operate. It forecast its earnings each year based on average working age and salaries of the population.Did you ever ask yourself why it is a IRS rule that taxes have to be filed within 3 years of the due date? IRS pays 6% simple interest on any refund held in their possession after the end of the filing season for that year. Years ago people who knew they had a refund just would not file for years, thus costing the IRS a lot of money when they did file. Now if you do not file within the 3 year time limit and you have a refund, guess who gets it? Yes, the IRS gets it. They confiscate your money for not doing something that they tell you is voluntary in the first place.The key thing to remember in reporting taxes is 1. Are your earnings below the reporting line? (yes) then 2. Were any taxes withheld federal or state? (Yes). Then file all w-2's to insure you get refunded all of the taxes that were withheld.If (No) to the same questions above no need to file IRS will have the same information and know you were below the filing requirement.

-

I'm filling out the employment verification form online for KPMG and realized that it's not asking me for phone numbers to my previous employers. Just curious as to how they verify employment without me providing a contact number to call?

Many US employers today won’t allow individuals (coworkers, supervisors) at a company respond to any questions or write recommendations. Everything must go through HR and they will often only confirm dates of employment.I know this, so I’m not going to waste time contacting phone numbers/email lists of supposed former coworkers or managers. Fact is, if anyone answered and started responding to my questions, I’d be very suspicious. Instead, I just ask for the main number of the company — which I can look up on line and verify to be the actual number of the claimed company.Same deal with academic credentials. I’m not going to use your address for “Harvard” … the one with a PO Box in Laurel, KS. I’m going to look up the address for the registrar myself.Sorry to say, there’s far too much lying on resumes today, combined with the liability possible for a company to say anything about you. A common tactic is to lie about academic back ground while giving friends as your “former supervisor at XYZ.”

-

How can I convince my mother to take me seriously when it comes to my mental health? When I went to the doctor, the form I filled out indicated that I have severe anxiety and depression. It's been 5 months, and she still hasn't made an appointment.

ask her again. Do you know why she wont take you? that can be helpful. time, money, or perhaps just very very uncomfortable with this? do you have anyone else to ask if she still doesnt respond? can you go to a school nurse and maybe she can talk to your mom? ok, another option, pretend you are sick somehow or need a dr check up and note for some school sport, running, whatevee, that she would take you to the dr for. Even though she may be in the appt room with you , you can also ask your dr for a few minutes alone with the nurse and dr. good luck! wishing you the best

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

Create this form in 5 minutes!

How to create an eSignature for the monthly employment utilization report wsdot wa

How to make an electronic signature for the Monthly Employment Utilization Report Wsdot Wa online

How to generate an electronic signature for your Monthly Employment Utilization Report Wsdot Wa in Chrome

How to create an eSignature for signing the Monthly Employment Utilization Report Wsdot Wa in Gmail

How to make an electronic signature for the Monthly Employment Utilization Report Wsdot Wa from your smart phone

How to generate an eSignature for the Monthly Employment Utilization Report Wsdot Wa on iOS

How to generate an eSignature for the Monthly Employment Utilization Report Wsdot Wa on Android OS

People also ask

-

What is a Washington DOT report?

A Washington DOT report is a comprehensive document that provides detailed information about a vehicle's registration, title history, and any on-road incidents. This report is crucial for individuals and businesses alike who need to ensure compliance and understand a vehicle's background before transaction.

-

How can airSlate SignNow assist with Washington DOT reports?

airSlate SignNow simplifies the process of sending and eSigning documents related to Washington DOT reports. By using our platform, you can securely manage all necessary paperwork, ensuring that you stay compliant and organized throughout the process of acquiring and using these reports.

-

What are the pricing options for using airSlate SignNow for Washington DOT reports?

Our pricing is competitive and tailored to meet the diverse needs of businesses dealing with Washington DOT reports. We offer flexible plans based on the features you require, ensuring that you only pay for what you use while enjoying the benefits of our comprehensive platform.

-

Are there integrations available with airSlate SignNow for accessing Washington DOT reports?

Yes, airSlate SignNow integrates with various applications and services to streamline your workflow regarding Washington DOT reports. These integrations allow for automatic data transfer and seamless collaboration, enhancing your efficiency and productivity.

-

What key features does airSlate SignNow offer for managing Washington DOT reports?

airSlate SignNow offers a range of features such as electronic signatures, document templates, and real-time tracking for your Washington DOT reports. These tools make it easy to manage your documents efficiently, ensuring that you have everything you need at your fingertips.

-

Can I securely store my Washington DOT reports with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including Washington DOT reports. This means you can access your files anytime and from any device, ensuring that your important records are always safe and organized.

-

What benefits does airSlate SignNow offer for businesses handling Washington DOT reports?

By using airSlate SignNow, businesses can streamline their document processes, reduce turnaround times, and enhance collaboration when dealing with Washington DOT reports. Our platform offers a user-friendly experience, making it easier to manage legal documents and ensuring compliance.

Get more for Wa Dot Form

Find out other Wa Dot Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT