Arw 3 Form

What is the ARW 3?

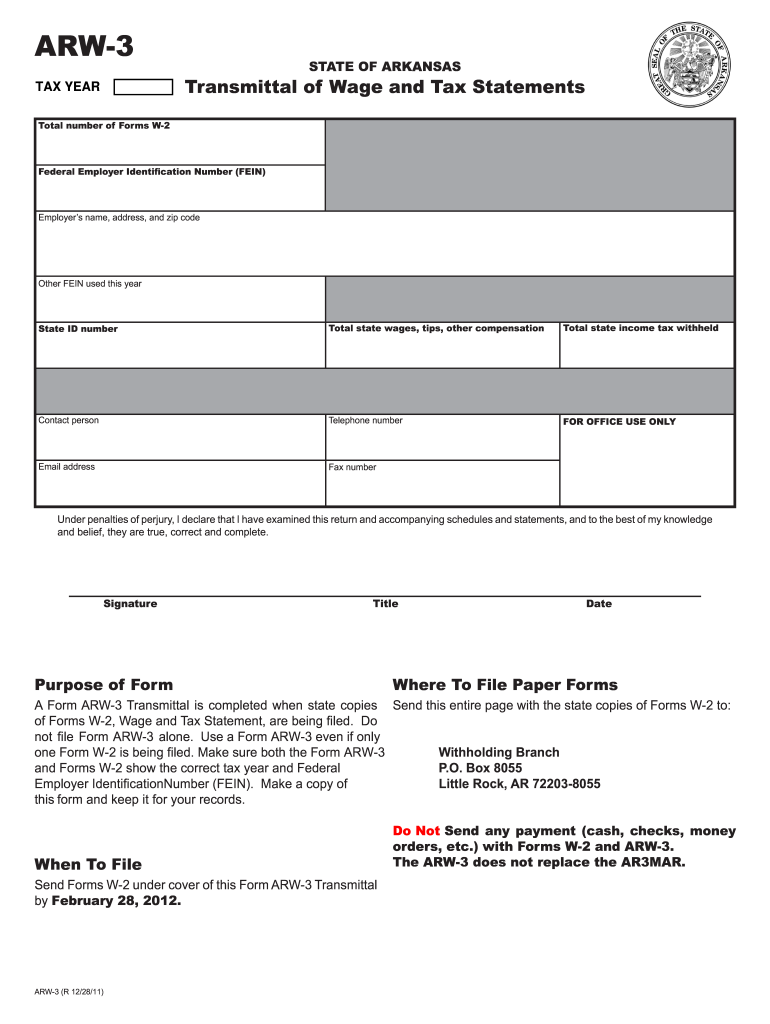

The ARW 3, also known as the ARW 3 form, is a crucial document used primarily for reporting wage tax information in the United States. It serves as a transmittal of wage tax statements, summarizing the earnings and tax withholdings for employees. This form is essential for employers to accurately report employee income and ensure compliance with federal and state tax regulations. Understanding the purpose and requirements of the ARW 3 is vital for businesses to maintain proper tax records and avoid potential penalties.

How to use the ARW 3

Using the ARW 3 involves a few straightforward steps. First, employers must gather all necessary employee wage information, including total earnings and tax withholdings for the reporting period. Once this data is compiled, it should be accurately entered into the ARW 3 form. After completing the form, employers must submit it to the appropriate tax authority, ensuring that all information is correct to prevent any compliance issues. Utilizing electronic tools can streamline this process, making it more efficient and reducing the likelihood of errors.

Steps to complete the ARW 3

Completing the ARW 3 requires careful attention to detail. Follow these steps for accurate submission:

- Gather employee wage and tax withholding information for the reporting year.

- Fill out the ARW 3 form with the required details, including employer information and total wages.

- Review the form for accuracy, ensuring all figures are correct and complete.

- Submit the form to the relevant tax authority, either electronically or via mail, depending on the requirements.

By adhering to these steps, employers can ensure that their ARW 3 is completed correctly and submitted on time.

Legal use of the ARW 3

The legal use of the ARW 3 is governed by various tax regulations in the United States. It is crucial for employers to understand that this form must be filled out accurately to comply with IRS guidelines. Failure to do so can result in penalties, including fines or audits. The ARW 3 serves as a formal declaration of wages and tax withholdings, making it a legally binding document. Therefore, it is essential to maintain accurate records and ensure that all submissions meet legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the ARW 3 are critical for compliance. Typically, employers must submit the ARW 3 by a specific date each year, often aligned with the annual tax filing deadlines. It is important to stay informed about these dates to avoid late penalties. Employers should also be aware of any state-specific deadlines that may apply, as these can vary. Keeping a calendar of important filing dates can help ensure timely submissions.

Who Issues the Form

The ARW 3 form is issued by the relevant tax authorities, typically at the state level, depending on where the employer operates. Employers should obtain the form from the appropriate state tax agency or official website. It is essential to ensure that the correct version of the form is used, as updates or changes may occur annually. Employers should verify that they are using the most current version to ensure compliance with all tax regulations.

Quick guide on how to complete arw 3 33843198

Effortlessly Prepare Arw 3 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Arw 3 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Arw 3 Seamlessly

- Find Arw 3 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Never worry about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Edit and electronically sign Arw 3 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arw 3 33843198

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is arw3 and how can it benefit my business?

arw3 is a powerful feature of airSlate SignNow that allows businesses to streamline their document signing process. With arw3, you can send and eSign documents seamlessly, which enhances efficiency and reduces turnaround time. This ultimately helps businesses save time and money while improving customer satisfaction.

-

How does the pricing for airSlate SignNow with arw3 work?

airSlate SignNow offers flexible pricing plans that can accommodate any business size. The cost associated with arw3 is included in the various plans available, allowing you to choose a package that fits your budget. Sign up today to take advantage of the competitive pricing and explore all the benefits of arw3.

-

What features does the arw3 functionality provide?

The arw3 functionality in airSlate SignNow includes electronic signatures, document templates, and automated workflows. These features help simplify your document management process, making it easier to track, send, and sign important paperwork. By leveraging arw3, users can enjoy a more organized and efficient approach to signing documents.

-

Can arw3 integrate with other software tools we use?

Yes, arw3 integrates seamlessly with a variety of software solutions, including CRM systems and project management tools. This integration allows you to import and export documents effortlessly, enhancing the overall efficiency of your operations. By connecting arw3 with your existing tools, you can create a more cohesive workflow.

-

Is airSlate SignNow with arw3 secure for document handling?

Absolutely! Security is a top priority for airSlate SignNow and its arw3 feature. All documents signed and sent through arw3 are encrypted, ensuring that your sensitive data remains protected. You can trust that using arw3 meets industry standards for document security.

-

How easy is it to use the arw3 feature for eSigning?

Using the arw3 feature for eSigning is incredibly user-friendly and intuitive. With just a few clicks, you can upload documents, send them for signatures, and track the signing process in real-time. Whether you're tech-savvy or not, arw3 is designed to make document signing a hassle-free experience.

-

What types of documents can I handle with arw3?

arw3 allows you to manage a wide range of documents, including contracts, agreements, consent forms, and more. This versatility makes it suitable for various industries and use cases. Whatever your document needs, arw3 can handle them seamlessly.

Get more for Arw 3

- How to avoid financial tangles american institute for economic form

- Control number ne et20 form

- Form an llc in nevadahow to start an llc

- Individual to a trust form

- Power of attorney for healthcare uw health form

- These powers will exist if you become disabled or incompetent form

- Must the operating agreement date ampampor the start doing business form

- General form for bill of sale of personal property

Find out other Arw 3

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors