Checking Form

What is the bank reconciliation form?

The bank reconciliation form is a crucial document used by businesses and individuals to compare their financial records against bank statements. This form helps identify discrepancies between the two records, such as outstanding checks, deposits in transit, or bank fees that may not have been recorded. By regularly completing this form, users can ensure their accounting records are accurate and up-to-date, which is essential for effective financial management.

Steps to complete the bank reconciliation form

Completing the bank reconciliation form involves several systematic steps to ensure accuracy and thoroughness. Here is a straightforward process:

- Gather financial records, including the latest bank statement and your accounting records.

- Compare each transaction listed on the bank statement with your records, marking off matching items.

- Identify any discrepancies, such as missing transactions or errors in amounts.

- Adjust your records for any errors found, including bank fees or interest earned that were not recorded.

- Calculate the adjusted balance for both your records and the bank statement.

- Ensure the adjusted balances match. If they do not, investigate further to resolve any remaining discrepancies.

Legal use of the bank reconciliation form

The bank reconciliation form holds legal significance as it serves as a record of financial activities and discrepancies. Maintaining accurate reconciliations can protect businesses during audits and legal disputes. In the United States, electronic signatures on this form are considered legally binding under the ESIGN and UETA acts, provided that the necessary security measures are in place. This ensures that the form is not only accurate but also compliant with legal standards.

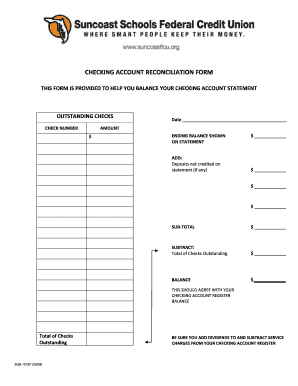

Key elements of the bank reconciliation form

Several key elements must be included in the bank reconciliation form to ensure its effectiveness:

- Bank statement balance: The ending balance as reported by the bank.

- Company records balance: The ending balance in your accounting system.

- Outstanding checks: Checks issued but not yet cleared by the bank.

- Deposits in transit: Funds that have been recorded in your accounting system but are not yet reflected in the bank statement.

- Adjustments: Any corrections made to account for errors or omissions.

How to obtain the bank reconciliation form

The bank reconciliation form can typically be obtained directly from your bank or financial institution. Many banks provide templates or forms on their websites that can be downloaded and printed. Additionally, accounting software often includes built-in reconciliation features that simplify the process, allowing users to generate a reconciliation form electronically.

Digital vs. Paper Version

Using a digital version of the bank reconciliation form offers several advantages over traditional paper forms. Digital forms can be easily edited, stored, and shared, reducing the risk of loss or damage. They also facilitate quicker updates and adjustments, enabling users to maintain accurate records in real time. Moreover, electronic signatures can be added, ensuring that the form meets legal requirements for validity.

Quick guide on how to complete checking form

Easily Prepare Checking Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documentation, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Handle Checking Form on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven workflow today.

The Easiest Way to Edit and eSign Checking Form Effortlessly

- Find Checking Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your updates.

- Choose how you’d like to send your form, via email, text (SMS), or shared link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Checking Form and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the checking form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank reconciliation form?

A bank reconciliation form is a document used to compare a company's financial records with the bank's records. This form helps identify discrepancies between the two sets of records, ensuring accuracy in financial management. Using airSlate SignNow, businesses can easily create, send, and eSign bank reconciliation forms.

-

How does airSlate SignNow help with bank reconciliation forms?

AirSlate SignNow streamlines the process of creating and signing bank reconciliation forms. Our platform allows for easy customization and sharing of these forms, making reconciliation efficient and straightforward. You can also track the status of each form in real-time, enhancing your financial oversight.

-

Is there a cost associated with using airSlate SignNow for bank reconciliation forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our plans are designed to be cost-effective while providing robust features for managing bank reconciliation forms and other documents. You can choose the best plan based on your business size and requirements.

-

Can I integrate airSlate SignNow with my existing accounting software for bank reconciliation forms?

Absolutely! AirSlate SignNow supports integration with various accounting software tools, helping you automate the process of managing bank reconciliation forms. This integration allows for seamless data transfer and ensures your financial records remain consistent and up-to-date.

-

What features does airSlate SignNow offer for bank reconciliation forms?

AirSlate SignNow includes features such as templates for bank reconciliation forms, custom branding, and secure eSigning capabilities. Additionally, you can easily collaborate with team members on these forms and access a comprehensive audit trail for compliance purposes.

-

How secure are the bank reconciliation forms created with airSlate SignNow?

Security is a top priority at airSlate SignNow. All bank reconciliation forms are encrypted and stored securely, ensuring that your sensitive financial information remains protected. Our platform complies with industry standards, providing peace of mind for users.

-

What are the benefits of using airSlate SignNow for bank reconciliation forms?

Using airSlate SignNow for bank reconciliation forms simplifies the entire reconciliation process, saving you time and reducing errors. With our user-friendly interface, you can efficiently manage documents while enhancing collaboration with your team. The ability to eSign forms also expedites approvals and helps maintain a smooth workflow.

Get more for Checking Form

- Guidelines for individual executors ampamp trusteessection of real form

- One individual to three individuals as joint form

- Will adult children form

- Field 28 form

- Death to persons designated form

- Married with children from prior marriage form

- Trust agreement or declaration of trust what are they form

- Promissory note secured by real property with a fixed interest rate and installment form

Find out other Checking Form

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document