Bc Pst Exemption Form

What is the BC PST Exemption Form?

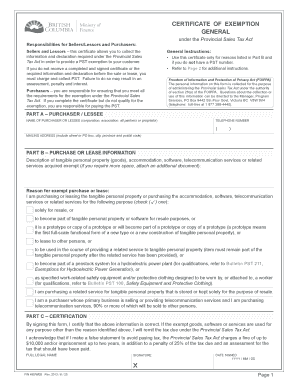

The BC PST Exemption Form, commonly referred to as the fin 490, is a crucial document used in British Columbia for businesses and individuals seeking exemptions from the Provincial Sales Tax (PST). This form is essential for those who qualify under specific categories, such as farmers, non-profit organizations, or certain businesses that make qualifying purchases. By completing the fin 490, eligible parties can avoid paying PST on eligible goods and services, thereby reducing their overall tax burden.

How to Use the BC PST Exemption Form

Using the BC PST Exemption Form involves several straightforward steps. First, ensure you meet the eligibility criteria for exemption. Next, download the fin 490 form from the appropriate government website or obtain it from a local tax office. After filling out the form with accurate information, present it to the vendor at the time of purchase. This process allows the vendor to verify your exemption status and avoid charging PST on your transaction.

Steps to Complete the BC PST Exemption Form

Completing the BC PST Exemption Form requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary information, including your business number or personal identification.

- Clearly indicate the type of exemption you are claiming, ensuring it aligns with the categories provided.

- Fill in all required fields on the form, ensuring clarity and accuracy.

- Review the completed form for any errors or omissions.

- Submit the form to the vendor at the time of purchase to validate your exemption.

Legal Use of the BC PST Exemption Form

The legal use of the BC PST Exemption Form is governed by the Provincial Sales Tax Act in British Columbia. To ensure compliance, it is essential to use the form only for legitimate exemptions as outlined by the law. Misuse of the fin 490 can lead to penalties, including fines or back taxes owed. Therefore, understanding the legal framework surrounding the form is critical for all users.

Eligibility Criteria for the BC PST Exemption Form

Eligibility for the BC PST Exemption Form is determined by specific criteria set forth by the provincial government. Common qualifying factors include:

- Being a registered farmer purchasing farm-related goods.

- Non-profit organizations making exempt purchases for their operations.

- Businesses purchasing goods for resale or manufacturing purposes.

It is important to review the specific requirements to ensure your eligibility before applying for the exemption.

Form Submission Methods

The BC PST Exemption Form can be submitted through various methods, depending on the vendor's preferences. Generally, the form is presented at the point of sale, allowing the vendor to process the exemption directly. Some vendors may also accept the form via email or fax, while others may require a physical copy. Always confirm the preferred submission method with the vendor to ensure a smooth transaction.

Quick guide on how to complete bc pst exemption form

Effortlessly Prepare Bc Pst Exemption Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, alter, and electronically sign your documents swiftly and without interruptions. Manage Bc Pst Exemption Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Bc Pst Exemption Form with ease

- Acquire Bc Pst Exemption Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for such tasks.

- Formulate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to capture your edits.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors necessitating the printing of new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Bc Pst Exemption Form and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bc pst exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fin 490 and how can airSlate SignNow assist with it?

Fin 490 is typically associated with financial management and accounting practices. airSlate SignNow empowers businesses to streamline their document signing processes, ensuring you can manage financial documents related to fin 490 easily and securely.

-

How much does airSlate SignNow cost for businesses focusing on fin 490?

The pricing for airSlate SignNow is competitive and specifically designed to be cost-effective for businesses engaged in fin 490 activities. You can choose from various pricing plans that suit your business size and needs, offering flexibility and value.

-

What are the key features of airSlate SignNow relevant to fin 490?

Key features of airSlate SignNow that support fin 490 include electronic signatures, document templates, and advanced security protocols. These features help ensure that documents related to financial transactions are managed efficiently and securely.

-

Can airSlate SignNow help with compliance in fin 490 transactions?

Yes, airSlate SignNow is designed to help businesses maintain compliance in fin 490 transactions. It provides audit trails and secure storage, ensuring that all signed documents meet legal and regulatory standards.

-

What benefits does airSlate SignNow offer for businesses managing fin 490 documents?

Businesses using airSlate SignNow for fin 490 documents enjoy increased efficiency, reduced paper waste, and improved turnaround times. The platform's user-friendly interface also eliminates the hassle of traditional document signing processes.

-

Which integrations can enhance my fin 490 workflows with airSlate SignNow?

airSlate SignNow integrates seamlessly with various popular applications, enhancing your fin 490 workflows. Integrations include platforms like Google Drive, Dropbox, and CRM systems that facilitate easy access and management of your financial documents.

-

Is airSlate SignNow suitable for small businesses focusing on fin 490?

Absolutely! airSlate SignNow is tailored for businesses of all sizes, including small businesses managing fin 490. Its affordability and ease of use make it an ideal solution for small teams looking to optimize their document signing processes.

Get more for Bc Pst Exemption Form

- Auto loan application wilderness adventure books form

- Alternative sentencing application placer county placer ca form

- Tsc payslip 2017 form

- Jdf 1413 form

- Jud ct 100515769 form

- Apex innovations nih stroke scale answers test a hnewaus form

- Prerequisite waiver request form eastfield college efc dcccd

- Commercial information sheet

Find out other Bc Pst Exemption Form

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online