Trust Created by Husband for Benefit of Wife in Lieu of Alimony and All ClaimsTransfer to Trust of Securities Form

What is the Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All Claims Transfer To Trust Of Securities

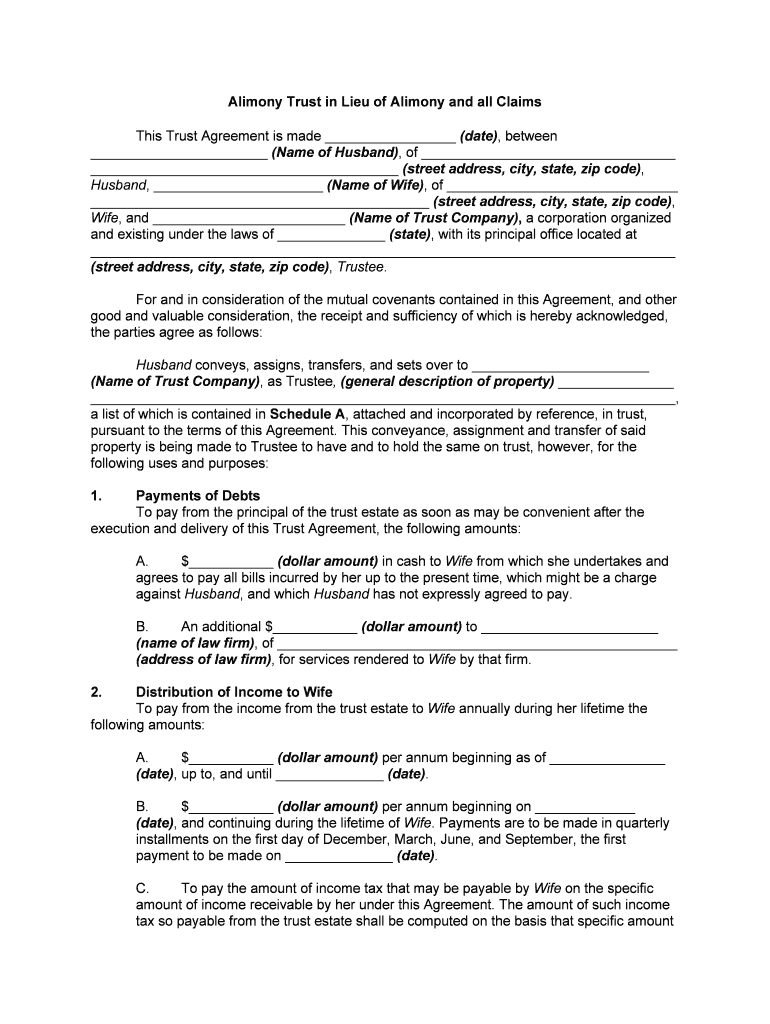

The trust created by a husband for the benefit of his wife in lieu of alimony is a legal arrangement that allows for the transfer of assets, typically securities, into a trust. This type of trust serves as an alternative to traditional alimony payments, ensuring that the wife receives financial support while also providing a structured way to manage and protect those assets. The trust is designed to meet specific legal requirements, ensuring that it is valid and enforceable under U.S. law. By transferring securities into the trust, the husband can secure the financial future of his wife while potentially minimizing tax implications associated with alimony payments.

How to Use the Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All Claims Transfer To Trust Of Securities

Using the trust involves several key steps to ensure that it is established and maintained correctly. First, the husband must draft a trust document that outlines the terms of the trust, including the assets to be transferred, the trustee's responsibilities, and the beneficiaries' rights. Once the trust document is created, the husband should transfer the specified securities into the trust. This transfer must be documented properly to ensure legal compliance. The trustee will then manage the trust assets according to the terms set forth in the trust document, ensuring that the wife receives the benefits intended for her support.

Steps to Complete the Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All Claims Transfer To Trust Of Securities

Completing the trust involves a series of organized steps:

- Draft the trust document, specifying the terms and conditions.

- Identify and list the securities to be transferred into the trust.

- Execute the trust document, ensuring all parties involved sign it.

- Transfer the identified securities into the trust, documenting the transfer.

- Appoint a trustee responsible for managing the trust assets.

- Regularly review and update the trust as necessary to reflect any changes in circumstances or laws.

Key Elements of the Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All Claims Transfer To Trust Of Securities

Several key elements are essential for the trust's effectiveness:

- Trust Document: A legally binding document that outlines the terms of the trust.

- Assets: Specific securities or other assets that are transferred into the trust.

- Trustee: An appointed individual or entity responsible for managing the trust.

- Beneficiary Rights: Clearly defined rights of the wife as the beneficiary of the trust.

- Compliance: Adherence to relevant state and federal laws governing trusts and alimony.

Legal Use of the Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All Claims Transfer To Trust Of Securities

The legal use of this trust is grounded in its ability to provide financial support while adhering to alimony laws. It allows the husband to fulfill his financial obligations without the need for direct cash payments. By placing assets in a trust, the husband can ensure that the wife has access to funds as needed, while also potentially reducing his tax burden. However, it is crucial to ensure that the trust complies with all applicable laws and regulations to prevent any legal challenges in the future. Consulting with a legal professional is advisable to navigate the complexities involved.

State-Specific Rules for the Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All Claims Transfer To Trust Of Securities

Each state may have specific rules and regulations governing the creation and management of trusts. It is important to understand the laws in the state where the trust is established, as they can impact the trust's validity and the rights of the beneficiaries. Some states may require specific language in the trust document or have particular procedures for transferring assets into the trust. Additionally, state laws surrounding alimony and divorce can influence how the trust is structured. Consulting with a local attorney who specializes in family law can provide valuable insights into these state-specific requirements.

Quick guide on how to complete trust created by husband for benefit of wife in lieu of alimony and all claimstransfer to trust of securities

Complete Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All ClaimsTransfer To Trust Of Securities seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without interruptions. Manage Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All ClaimsTransfer To Trust Of Securities on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to adjust and eSign Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All ClaimsTransfer To Trust Of Securities effortlessly

- Locate Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All ClaimsTransfer To Trust Of Securities and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All ClaimsTransfer To Trust Of Securities and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony?

A Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony is a legal arrangement that allows a husband to set up a trust that provides financial support to his wife instead of direct alimony payments. This arrangement can offer more control and flexibility over how funds are distributed and can help to simplify financial obligations.

-

How does the Trust of Securities work in relation to this trust?

The Trust of Securities involves transferring ownership of certain assets or securities into the trust. By doing so, the husband can ensure that the wife benefits from the income or value generated by these securities while keeping the assets outside of his personal estate, simplifying any future claims.

-

What are the benefits of a Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony?

The primary benefits include financial security for the wife, potential tax advantages, and protecting the assets from future claims. This type of trust also offers both parties peace of mind, knowing that the terms can be clearly defined and upheld legally.

-

What legal considerations should be taken into account when setting up this trust?

When establishing a Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony, it is essential to consider divorce laws, tax implications, and the specific terms of the trust document. Consulting with a legal professional can help ensure compliance and avoid any potential disputes.

-

Can the terms of the trust be modified later?

Yes, in many cases, the terms of a Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony can be modified if both parties agree. This flexibility can accommodate changing financial situations or needs over time, ensuring that the trust continues to serve its intended purpose.

-

How is the value of the assets determined for this trust?

The value of the assets in a Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony is typically determined by current market rates or appraisals for the securities involved. It's important to assess the value accurately to ensure fair and consistent support for the wife.

-

Is it necessary to hire an attorney to create this type of trust?

While it is possible to create a Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony without an attorney, hiring one is highly recommended. An attorney can ensure all legal requirements are met, help draft the trust documents properly, and provide guidance on implications.

Get more for Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All ClaimsTransfer To Trust Of Securities

Find out other Trust Created By Husband For Benefit Of Wife In Lieu Of Alimony And All ClaimsTransfer To Trust Of Securities

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now