P45 2008

What is the P45

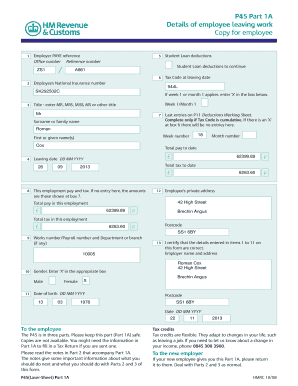

The P45 is a tax document issued in the United Kingdom that outlines an employee's tax details when they leave a job. It provides essential information such as the employee's tax code, the total earnings for the tax year, and the amount of tax deducted. While the P45 is not a common form in the United States, understanding its purpose can be beneficial for those working with international tax matters or in multinational companies.

How to obtain the P45

To obtain a P45, an employee should request it from their employer upon leaving a job. Employers are legally required to provide this document to employees as part of the offboarding process. If the employer fails to issue a P45, the employee can contact the payroll department or human resources for assistance. In cases where the employer is unresponsive, the employee may need to consult local labor laws or seek legal advice.

Steps to complete the P45

Completing the P45 involves filling out specific sections accurately. The employee's details, including name, address, and National Insurance number, must be entered. The employer should also fill in the relevant sections, including the tax code and details of earnings. It is crucial to ensure that all information is correct to avoid any tax discrepancies. Once completed, the P45 should be securely stored, as it may be needed for future tax filings or when starting a new job.

Legal use of the P45

The P45 serves as an official record of an employee's tax status and is important for compliance with tax regulations. It must be used correctly to ensure that the employee's tax affairs are in order. When starting a new job, the P45 should be presented to the new employer to ensure the correct tax code is applied. Failure to provide a P45 may result in incorrect tax deductions, which can lead to penalties or additional tax liabilities.

Who Issues the Form

The P45 is issued by the employer when an employee leaves their job. It is the responsibility of the employer to ensure that the form is completed accurately and provided to the employee promptly. Employers must keep records of all P45 forms issued, as they are required for tax reporting purposes. If an employee does not receive their P45, they should follow up with their employer to obtain this important document.

IRS Guidelines

While the P45 is not a form used by the IRS, understanding its implications can be useful for U.S. taxpayers working abroad or with international employers. The IRS has specific guidelines regarding foreign income and tax treaties that may affect how an employee reports income earned overseas. It is important for individuals to consult IRS publications or a tax professional to ensure compliance with U.S. tax laws when dealing with foreign tax documents.

Quick guide on how to complete p45

Effortlessly Prepare P45 on Any Device

Digital document management has grown increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Handle P45 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered task today.

How to Modify and eSign P45 with Ease

- Locate P45 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your alterations.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Edit and eSign P45 and ensure optimal communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p45

Create this form in 5 minutes!

How to create an eSignature for the p45

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a P45 and why do I need one?

A P45 is a document that details your tax contributions and earnings when you leave a job. Knowing how to get a P45 is essential for ensuring you have the correct tax information for your next employer or for tax purposes. It helps simplify your financial records and reporting.

-

How do I get a P45 from my employer?

To get a P45, simply ask your employer's HR or payroll department. They are legally required to provide you with your P45 upon leaving the job. It's important to understand how to get a P45 promptly to avoid complications with your next job's tax setup.

-

Can airSlate SignNow assist in the P45 process?

Yes, airSlate SignNow can streamline the process of requesting and sending documents like your P45. By using our eSigning feature, you can easily manage and send your P45 electronically, making it faster and more efficient to handle your paperwork.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides an array of features such as eSignature, document templates, and automated workflows. These can help you manage documents efficiently, including those related to how to get a P45. It's a cost-effective solution for your business's documentation needs.

-

How much does airSlate SignNow cost?

AirSlate SignNow offers various pricing plans to fit different business needs, starting from a free trial for individuals and teams. Knowing how to get a P45 at an affordable price is easy with our platform, which streamlines the paperwork processes without breaking the bank.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers convenience, security, and speed. With our platform, you can easily eSign documents, which enhances your understanding of how to get a P45 quickly and securely. This not only saves time but also minimizes errors.

-

Does airSlate SignNow integrate with other tools?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and others. This means you can manage your documents, including how to get a P45, alongside other essential tools you already use, enhancing your overall workflow.

Get more for P45

- Certificate of medical necessity cms 484 oxygen form

- Custodian of recordsstate of california department of form

- If filing a complaint against a vehicle dealership please complete form de 002c dealer licensing ampampamp audit

- Use this form to apply for or change your existing for hire intrastate operating authority

- Notification for underground storage tanks form to complete for owners of underground storage tanks

- Form 3 final icje

- Form 8844 rev march 2020 internal revenue service

- Backup withholding b programinternal revenue service form

Find out other P45

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy