Michigan Pension Schedule 4884 Michigan Form

What is the Michigan Pension Schedule 4884 Michigan

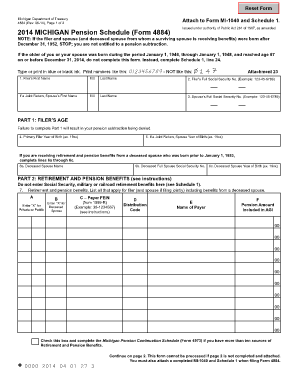

The Michigan Pension Schedule 4884 is a tax form used by residents of Michigan to report pension and retirement distributions. This form is essential for individuals receiving pension income, as it helps determine the taxable amount of these distributions under Michigan state tax law. It is specifically designed for taxpayers who need to disclose their pension-related income to the state, ensuring compliance with state tax regulations.

How to use the Michigan Pension Schedule 4884 Michigan

To effectively use the Michigan Pension Schedule 4884, taxpayers should first gather all relevant documentation regarding their pension distributions. This includes any 1099 forms received from pension providers. Once the necessary information is collected, individuals can fill out the form by entering their pension income, any applicable deductions, and other required details. It is important to follow the instructions carefully to ensure accurate reporting and to avoid potential issues with the Michigan Department of Treasury.

Steps to complete the Michigan Pension Schedule 4884 Michigan

Completing the Michigan Pension Schedule 4884 involves several key steps:

- Gather all relevant documents, including 1099 forms and any other records of pension income.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill in the form with your personal information, including your name, address, and Social Security number.

- Report your total pension income as indicated on your 1099 forms.

- Calculate any deductions or exemptions applicable to your situation.

- Review the completed form for accuracy before submission.

Legal use of the Michigan Pension Schedule 4884 Michigan

The Michigan Pension Schedule 4884 is legally binding when completed accurately and submitted in accordance with state regulations. To ensure its legal standing, taxpayers must comply with all instructions and provide truthful information. Additionally, the form must be signed and dated to validate the submission. Failure to adhere to these requirements may result in penalties or disputes with the Michigan Department of Treasury.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Michigan Pension Schedule 4884. Typically, the form is due on April fifteenth of each year, aligning with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file the form on time to avoid late fees and penalties.

Who Issues the Form

The Michigan Pension Schedule 4884 is issued by the Michigan Department of Treasury. This state agency is responsible for tax administration and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the Michigan Department of Treasury's website or through authorized tax preparation services.

Quick guide on how to complete michigan pension schedule 4884 michigan

Effortlessly Prepare Michigan Pension Schedule 4884 Michigan on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, enabling you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Michigan Pension Schedule 4884 Michigan on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Modify and eSign Michigan Pension Schedule 4884 Michigan with Ease

- Find Michigan Pension Schedule 4884 Michigan and click on Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or missing documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Michigan Pension Schedule 4884 Michigan and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan pension schedule 4884 michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Pension Schedule 4884 Michigan used for?

The Michigan Pension Schedule 4884 Michigan is used to report pension and retirement benefit payments. It helps ensure that recipients accurately declare their retirement income and comply with state tax regulations, making it an essential document for financial planning.

-

How can airSlate SignNow assist with the Michigan Pension Schedule 4884 Michigan?

airSlate SignNow allows users to easily prepare, send, and eSign the Michigan Pension Schedule 4884 Michigan. Our platform's streamlined process helps reduce the time spent on paperwork, ensuring you can focus more on managing your retirement benefits.

-

What are the pricing options for using airSlate SignNow for the Michigan Pension Schedule 4884 Michigan?

airSlate SignNow offers competitive pricing plans suitable for individuals and businesses wanting to manage the Michigan Pension Schedule 4884 Michigan efficiently. We provide a range of subscription options that fit various needs, ensuring you get the best value for your document management.

-

Are there any features in airSlate SignNow specifically for the Michigan Pension Schedule 4884 Michigan?

Yes, airSlate SignNow offers features tailored for managing the Michigan Pension Schedule 4884 Michigan, such as customizable templates and secure eSigning. These functionalities simplify the entire process, making it quicker and more reliable for users to handle their pension documents.

-

What are the benefits of using airSlate SignNow for pension documentation?

Using airSlate SignNow for your pension documentation, like the Michigan Pension Schedule 4884 Michigan, provides numerous benefits, including enhanced security, reduced processing time, and user-friendly tools. Our platform ensures that your documents are handled efficiently while maintaining compliance with legal requirements.

-

Can I integrate airSlate SignNow with other software for handling the Michigan Pension Schedule 4884 Michigan?

Absolutely! airSlate SignNow offers integrations with various software tools, making it convenient to manage the Michigan Pension Schedule 4884 Michigan alongside your existing workflows. This compatibility helps users streamline their document processes and improve overall productivity.

-

Is airSlate SignNow compliant with Michigan state regulations for pension documents?

Yes, airSlate SignNow is designed to comply with Michigan state regulations, including those related to the Michigan Pension Schedule 4884 Michigan. Our platform regularly updates its security and compliance features to ensure users are meeting all necessary legal requirements effectively.

Get more for Michigan Pension Schedule 4884 Michigan

- Request transcripts from chancellor university form

- Lassen community college transcripts form

- Siue application fee waiver form

- Non custodial parents fom international parents fom international form

- Pt hrs verification formdocx fresnostate

- Documentation of a psychiatric or psychological disability form slc

- Rhinoplasty form

- Sevis i 20 application form

Find out other Michigan Pension Schedule 4884 Michigan

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online