Subcontractor Information Form

What is the Subcontractor Information Form

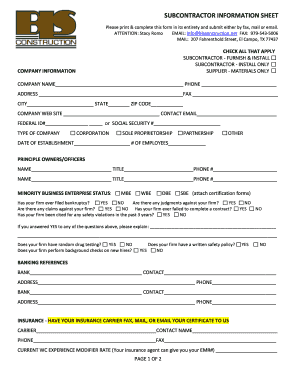

The subcontractor information form is a crucial document used by businesses to collect essential details from subcontractors. This form typically includes information such as the subcontractor's name, address, contact information, tax identification number, and business structure. It serves as a foundational tool for ensuring compliance with tax regulations and facilitates proper record-keeping for both the contractor and the subcontractor. By gathering this information, businesses can streamline their operations and maintain accurate financial records.

Steps to complete the Subcontractor Information Form

Completing the subcontractor information form involves several straightforward steps. First, gather all necessary information about the subcontractor, including their legal name, business address, and contact details. Next, ensure you have the subcontractor's tax identification number, which is essential for tax reporting purposes. After filling in the required fields, review the form for accuracy to avoid any potential issues. Finally, the subcontractor should sign the form, either electronically or in print, to validate the information provided.

Legal use of the Subcontractor Information Form

The subcontractor information form is legally binding when it meets specific criteria. It must be completed accurately and signed by the subcontractor to ensure compliance with federal and state regulations. The form serves as a record of the subcontractor's agreement to provide services and includes necessary tax information, which is vital for reporting to the IRS. Using a reliable digital platform, such as signNow, can enhance the legal standing of the form by ensuring secure signatures and compliance with eSignature laws.

Key elements of the Subcontractor Information Form

Several key elements should be included in the subcontractor information form to ensure its effectiveness. These elements typically consist of:

- Subcontractor's full legal name: Essential for identification and legal purposes.

- Business address: Necessary for correspondence and contractual obligations.

- Contact information: Includes phone numbers and email addresses for communication.

- Tax identification number: Required for tax reporting to the IRS.

- Business structure: Indicates whether the subcontractor is a sole proprietor, LLC, corporation, etc.

How to use the Subcontractor Information Form

Using the subcontractor information form effectively involves a few simple practices. Begin by providing the form to the subcontractor at the start of your working relationship. Ensure they understand the importance of completing the form accurately. After the subcontractor fills out the form, review it for completeness and correctness. Store the completed form securely, whether in digital format or as a physical copy, to ensure easy access for future reference and compliance audits.

Form Submission Methods (Online / Mail / In-Person)

The subcontractor information form can be submitted through various methods, depending on the preferences of the parties involved. Common submission methods include:

- Online submission: Many businesses opt for digital platforms that allow for quick and secure submission.

- Mail: The form can be printed and sent via postal service for those who prefer traditional methods.

- In-person submission: Subcontractors may also deliver the form directly to the contractor's office for immediate processing.

Quick guide on how to complete subcontractor information form

Effortlessly Prepare Subcontractor Information Form on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Subcontractor Information Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Subcontractor Information Form with Ease

- Locate Subcontractor Information Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Edit and eSign Subcontractor Information Form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the subcontractor information form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a subcontractor information form and how is it used?

A subcontractor information form is a document that collects essential details about subcontractors, such as their qualifications, experience, and compliance status. This form helps businesses streamline the onboarding process by ensuring they have all necessary information to evaluate subcontractors effectively. Using airSlate SignNow, you can easily create and send this form for eSignature, enhancing efficiency.

-

How does airSlate SignNow facilitate the use of subcontractor information forms?

airSlate SignNow allows businesses to create customizable subcontractor information forms that can be sent for electronic signatures quickly. This platform simplifies the process of collecting and managing subcontractor information, allowing users to track submissions and maintain organized records. The user-friendly interface ensures that everyone involved can complete and sign forms without technical challenges.

-

Are there any costs associated with using the subcontractor information form feature?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans include features for creating and managing subcontractor information forms, among other document-related functionalities. Be sure to review the pricing options to find the plan that works best for your business requirements and budget.

-

What benefits does using airSlate SignNow provide for subcontractor information forms?

Utilizing airSlate SignNow for subcontractor information forms brings increased efficiency and reduced paperwork. The platform enables quicker turnaround times for collecting necessary information and allows for better compliance tracking. Additionally, the eSignature feature ensures legal validity and secure document handling.

-

Can I integrate airSlate SignNow with other tools for managing subcontractor information forms?

Absolutely! airSlate SignNow offers integrations with various tools and platforms, enhancing your ability to manage subcontractor information forms. You can connect with project management systems, CRM software, and other applications to streamline workflows and ensure seamless data transfer across different systems.

-

Is it easy to customize subcontractor information forms with airSlate SignNow?

Yes, customizing subcontractor information forms in airSlate SignNow is straightforward. The platform provides a user-friendly editor that allows you to add fields, change layouts, and adjust content to meet your specific needs. This ensures that your form gathers all the relevant information efficiently.

-

How does airSlate SignNow ensure the security of subcontractor information forms?

airSlate SignNow prioritizes the security of your documents, including subcontractor information forms. The platform uses strong encryption protocols, ensuring that all data transmitted and stored remains confidential and secure. This provides peace of mind for businesses handling sensitive subcontractor information.

Get more for Subcontractor Information Form

Find out other Subcontractor Information Form

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile