Mo Ifta Forms

What is the Mo Ifta Forms

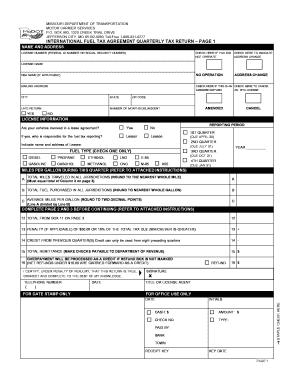

The Mo Ifta forms are essential documents used for reporting and paying fuel taxes in the state of Missouri. Specifically, these forms are designed for businesses that operate commercial vehicles and are subject to the International Fuel Tax Agreement (IFTA). The Mo Ifta forms help ensure compliance with fuel tax regulations, allowing for accurate tracking of fuel use across state lines. This is crucial for maintaining legal compliance and avoiding penalties associated with fuel tax discrepancies.

How to use the Mo Ifta Forms

Using the Mo Ifta forms involves several steps to ensure that all required information is accurately reported. First, gather all relevant data regarding fuel purchases and mileage traveled in each state. This includes receipts for fuel and odometer readings. Next, complete the Mo Ifta application by filling out the necessary fields, which typically include vehicle information, fuel usage, and travel details. Once the form is completed, review it for accuracy before submission. Utilizing digital tools can streamline this process, allowing for easier data entry and management.

Steps to complete the Mo Ifta Forms

Completing the Mo Ifta forms requires careful attention to detail. Follow these steps:

- Collect all fuel purchase receipts and mileage logs for the reporting period.

- Access the Mo Ifta forms, either in print or digitally.

- Fill in the required fields, ensuring all information is accurate and complete.

- Calculate the total fuel consumed and the total miles traveled in each jurisdiction.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline.

Legal use of the Mo Ifta Forms

The legal use of the Mo Ifta forms is governed by state and federal regulations. These forms must be completed accurately to ensure compliance with the International Fuel Tax Agreement, which is designed to simplify the reporting of fuel taxes for interstate commercial vehicle operators. Failing to use the forms correctly can result in legal penalties, including fines and audits. It is important to maintain records of all submitted forms and supporting documents to substantiate claims made on the forms.

Filing Deadlines / Important Dates

Filing deadlines for the Mo Ifta forms are crucial for compliance. Typically, these forms must be submitted quarterly, with specific due dates set by the Missouri Department of Revenue. It is essential to be aware of these dates to avoid late fees or penalties. Mark your calendar for the filing deadlines, which usually fall at the end of the month following the close of each quarter. Staying informed about these important dates helps ensure timely submissions and compliance with state regulations.

Required Documents

To complete the Mo Ifta forms, certain documents are required. These include:

- Fuel purchase receipts for the reporting period.

- Mileage logs detailing the distances traveled in each jurisdiction.

- Vehicle identification information, including VIN and license plate numbers.

- Any previous IFTA returns for reference.

Having these documents ready will facilitate the completion of the forms and help ensure accuracy in reporting.

Quick guide on how to complete mo ifta forms

Complete Mo Ifta Forms seamlessly on any device

Online document management has become favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Mo Ifta Forms on any device using airSlate SignNow Android or iOS applications and streamline any document-based task today.

How to modify and eSign Mo Ifta Forms effortlessly

- Find Mo Ifta Forms and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Mo Ifta Forms and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo ifta forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mo ifta and how does it relate to airSlate SignNow?

Mo ifta refers to the specific document framework that airSlate SignNow supports for facilitating electronic signing. By using airSlate SignNow, businesses can ensure their mo ifta documents are signed efficiently and securely, streamlining the entire process.

-

What features does airSlate SignNow offer for handling mo ifta documents?

AirSlate SignNow provides robust features for managing mo ifta documents, including customizable templates, automated workflows, and multi-signature options. These features enable users to efficiently prepare, send, and track their mo ifta documents from any device.

-

Is airSlate SignNow cost-effective for managing mo ifta documentation?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing mo ifta documentation. With various pricing plans available, businesses can choose an option that fits their budget while still enjoying comprehensive eSigning features.

-

Can airSlate SignNow integrate with other software for mo ifta workflows?

Absolutely! AirSlate SignNow offers seamless integrations with a variety of business applications to enhance mo ifta workflows. This allows businesses to connect their existing systems for easier document management and improved efficiency.

-

What are the benefits of using airSlate SignNow for mo ifta documents?

Using airSlate SignNow for mo ifta documents brings numerous benefits, including faster turnaround times, improved compliance, and reduced paper waste. By digitizing your mo ifta processes, you can save time and resources while maintaining legal standards.

-

How secure is airSlate SignNow for sending mo ifta documents?

AirSlate SignNow prioritizes security for all documents, including mo ifta. The platform employs robust encryption, two-factor authentication, and secure cloud storage to ensure that your sensitive information remains protected.

-

Is training available for using airSlate SignNow with mo ifta?

Yes, airSlate SignNow offers training resources and customer support to help users effectively manage mo ifta documents. Whether through tutorials, webinars, or dedicated support, businesses can learn how to maximize the benefits of the platform.

Get more for Mo Ifta Forms

- Red bank register digifind itcom form

- St johns county jail 2014 form

- Case number civil action summons b plaintiffs vs form

- State champs prepare to be noticed lyricsazlyricscom form

- Surrogate court morris county nj form

- Pleading format sample

- Petition for expungement kansas form

- Kansas judicial council kansasjudicialcouncil form

Find out other Mo Ifta Forms

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free