Minister Housing Allowance Worksheet Form

What is the Minister Housing Allowance Worksheet

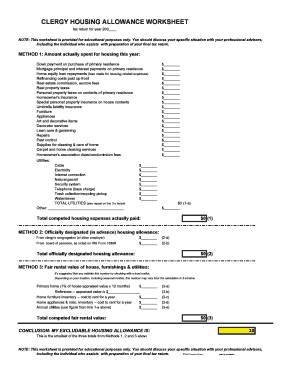

The Minister Housing Allowance Worksheet is a crucial document for clergy members in the United States. It helps pastors calculate their housing allowance, which is a tax benefit that allows them to exclude certain housing-related expenses from their taxable income. This worksheet outlines the eligible expenses, including rent, mortgage payments, utilities, and maintenance costs. By accurately completing this worksheet, ministers can ensure they maximize their tax benefits while remaining compliant with IRS regulations.

How to use the Minister Housing Allowance Worksheet

Using the Minister Housing Allowance Worksheet involves several steps. First, gather all necessary documentation related to housing expenses. This may include lease agreements, mortgage statements, and utility bills. Next, fill out the worksheet by entering your total housing expenses and any applicable deductions. It is essential to keep accurate records, as the IRS may require proof of these expenses during an audit. Once completed, the worksheet can be submitted alongside your tax return to claim the housing allowance deduction.

Steps to complete the Minister Housing Allowance Worksheet

Completing the Minister Housing Allowance Worksheet requires careful attention to detail. Start by listing all eligible housing expenses, such as rent or mortgage payments. Then, calculate the total amount spent on these expenses for the year. Next, determine the portion of your income that qualifies for the housing allowance. Finally, review the completed worksheet for accuracy before submitting it with your tax return. It is advisable to consult a tax professional if you have questions about specific entries or calculations.

Legal use of the Minister Housing Allowance Worksheet

The legal use of the Minister Housing Allowance Worksheet is governed by IRS guidelines. To qualify for the housing allowance, the expenses claimed must be reasonable and necessary for the minister's role. The worksheet serves as documentation to support the claims made on tax returns. It is important to adhere to IRS regulations to avoid potential penalties or audits. Ministers should ensure that their housing allowance is properly documented and justified to maintain compliance with tax laws.

IRS Guidelines

The IRS provides specific guidelines regarding the housing allowance for ministers. According to IRS regulations, the housing allowance must be designated in advance by the church or religious organization. Additionally, the amount claimed cannot exceed the fair rental value of the home plus utilities. Ministers should familiarize themselves with IRS Publication 517, which outlines the tax treatment of clergy and provides detailed information on housing allowances. Adhering to these guidelines ensures that ministers can take full advantage of their housing benefits while remaining compliant with tax laws.

Eligibility Criteria

To be eligible for the housing allowance, a minister must meet certain criteria set forth by the IRS. The individual must be a duly ordained, commissioned, or licensed minister of a church. Additionally, the housing allowance must be designated by the employing church or organization before the payment is made. The minister must also use the allowance for housing-related expenses, such as rent or mortgage payments. Understanding these eligibility criteria is essential for clergy members to ensure they can claim the housing allowance on their tax returns.

Quick guide on how to complete minister housing allowance worksheet

Effortlessly Prepare Minister Housing Allowance Worksheet on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you require to create, alter, and eSign your documents swiftly without delays. Manage Minister Housing Allowance Worksheet on any platform with the airSlate SignNow mobile apps for Android or iOS and enhance any document-related process today.

The easiest method to edit and eSign Minister Housing Allowance Worksheet with ease

- Obtain Minister Housing Allowance Worksheet and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Minister Housing Allowance Worksheet and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minister housing allowance worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a clergy tax deductions worksheet?

A clergy tax deductions worksheet is a tool designed specifically for ministers and clergy members to track and calculate tax deductions related to their ministry expenses. This worksheet helps ensure that you maximize your eligible deductions while maintaining compliance with tax regulations.

-

How can I use airSlate SignNow for my clergy tax deductions worksheet?

With airSlate SignNow, you can easily create, fill out, and eSign your clergy tax deductions worksheet online. Our intuitive platform allows for secure document sharing and storage, streamlining your tax preparation process and ensuring that your deductions are accurate.

-

Is airSlate SignNow suitable for individuals with no legal background when working on tax deductions?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing individuals without legal experience to effectively manage their clergy tax deductions worksheet. The platform provides templates and guidance to help users navigate the tax form requirements with ease.

-

Are there any costs associated with using airSlate SignNow for clergy tax deductions worksheet preparation?

Yes, airSlate SignNow offers various pricing plans to accommodate your needs. You can choose from options that provide flexibility and value, ensuring you have access to the features necessary for managing your clergy tax deductions worksheet without overspending.

-

What features does airSlate SignNow offer for managing tax deduction documents?

airSlate SignNow includes features such as eSigning, document templates, and automated reminders that simplify the management of your clergy tax deductions worksheet. These tools help keep your paperwork organized, ensuring you can focus on what really matters—your ministry.

-

How does airSlate SignNow ensure the security of my clergy tax deductions worksheet?

Security is a priority at airSlate SignNow. We utilize advanced encryption technology and secure cloud storage to protect your clergy tax deductions worksheet from unauthorized access, giving you peace of mind as you work on sensitive financial documents.

-

Can I integrate airSlate SignNow with other accounting software for ease of use?

Yes, airSlate SignNow offers integrations with various popular accounting software, allowing you to seamlessly connect your clergy tax deductions worksheet data. This ensures that your financial information is streamlined and accessible across your platforms for easier management.

Get more for Minister Housing Allowance Worksheet

Find out other Minister Housing Allowance Worksheet

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement