Tfn No of Oman Form

What is the Tfn No Of Oman Form

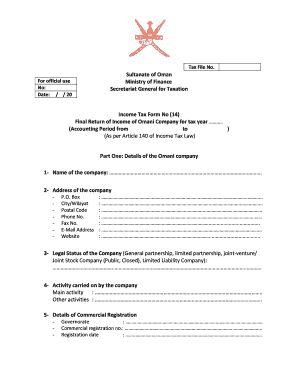

The Tfn No of Oman form is a specific document required for individuals and businesses operating in Oman to obtain a Tax File Number (TFN). This number is essential for tax identification purposes, allowing the government to track tax obligations and ensure compliance with local tax laws. The form collects personal and business information, including the applicant's name, address, and details related to their tax status. Understanding this form is crucial for anyone engaging in financial activities in Oman.

How to use the Tfn No Of Oman Form

Using the Tfn No of Oman form involves several straightforward steps. First, gather all necessary personal and business information. Next, complete the form accurately, ensuring that all fields are filled out correctly to avoid delays. After completing the form, submit it to the appropriate tax authority in Oman. This submission can often be done electronically, making the process more efficient. It is important to keep a copy of the submitted form for your records.

Steps to complete the Tfn No Of Oman Form

Completing the Tfn No of Oman form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary documentation, including identification and proof of address.

- Fill out the form with your personal and business information.

- Double-check all entries for accuracy, ensuring there are no typos or omissions.

- Sign and date the form as required.

- Submit the form via the designated method, whether online or by mail.

Legal use of the Tfn No Of Oman Form

The legal use of the Tfn No of Oman form is governed by tax regulations in Oman. This form serves as a formal request for a Tax File Number, which is legally required for tax compliance. Failure to obtain a TFN can result in penalties or complications with tax authorities. It is essential to ensure that the form is filled out correctly and submitted in accordance with local laws to avoid any legal issues.

Required Documents

When completing the Tfn No of Oman form, certain documents are typically required. These may include:

- A valid form of identification, such as a passport or national ID.

- Proof of residence, such as a utility bill or lease agreement.

- Business registration documents, if applicable.

Having these documents ready will facilitate a smoother application process.

Form Submission Methods

The Tfn No of Oman form can be submitted through various methods, depending on the preferences of the applicant and the regulations in place. Common submission methods include:

- Online submission through the official tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices.

Choosing the right method can help expedite the processing of your application.

Quick guide on how to complete tfn no of oman form

Complete Tfn No Of Oman Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without procrastination. Manage Tfn No Of Oman Form on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest method to alter and eSign Tfn No Of Oman Form seamlessly

- Obtain Tfn No Of Oman Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to deliver your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Tfn No Of Oman Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tfn no of oman form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tfn No Of Oman Form?

The Tfn No Of Oman Form is a document required for individuals and businesses in Oman to obtain their tax file number. This form ensures compliance with Omani tax regulations and allows for proper tax assessment. Filling it out correctly is essential for efficient tax processing.

-

Why should I use airSlate SignNow for the Tfn No Of Oman Form?

Using airSlate SignNow for the Tfn No Of Oman Form streamlines the signing and submission process. Our platform offers an intuitive interface, ensuring that users can easily fill out and eSign their forms. Additionally, our secure cloud storage keeps your documents safe and accessible.

-

Is there a cost associated with using the Tfn No Of Oman Form on airSlate SignNow?

Pricing for using the Tfn No Of Oman Form on airSlate SignNow depends on the subscription plan chosen. We offer various plans tailored to different needs, ensuring cost-effectiveness for both individuals and businesses. You can check our website for detailed pricing options.

-

Are there any additional features available for the Tfn No Of Oman Form on airSlate SignNow?

Yes, airSlate SignNow provides various features for the Tfn No Of Oman Form, including customizable templates, workflow automation, and real-time tracking of document status. These features enhance productivity and simplify the process of managing your documents online.

-

Can I integrate airSlate SignNow with other applications for the Tfn No Of Oman Form?

Absolutely! airSlate SignNow offers seamless integrations with several popular applications, allowing you to manage the Tfn No Of Oman Form alongside your existing tools. This integration capability enhances efficiency and centralizes your document workflows.

-

How long does it take to complete the Tfn No Of Oman Form using airSlate SignNow?

Completing the Tfn No Of Oman Form using airSlate SignNow is quick and straightforward, typically taking just a few minutes. The user-friendly interface guides you through each step, ensuring that you can fill out and submit your form with ease.

-

What kind of customer support is available for the Tfn No Of Oman Form?

airSlate SignNow offers robust customer support for all users working with the Tfn No Of Oman Form. You can access our help center, live chat, or contact our support team via email for any queries or assistance needed during the process.

Get more for Tfn No Of Oman Form

- Colorado mesa university transcripts form

- Exempt form kettering university kettering

- Monthly log sheet form

- Nazarene church matching form point loma nazarene university pointloma

- Osmosis virtual lab form

- Application for teas test at csu long beach california state csulb form

- Neisd travel request form

- Mgscms online form

Find out other Tfn No Of Oman Form

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed