Iht407 2008-2026

What is the Iht407

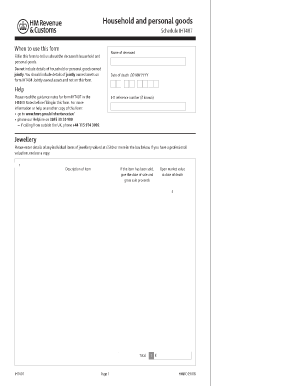

The Iht407 form, also known as the Inheritance Tax (IHT) Return, is a critical document used in the United States for reporting the value of an estate when someone passes away. This form is essential for calculating any inheritance tax that may be due. It provides a comprehensive overview of the deceased's assets, liabilities, and any exemptions that may apply. Understanding the Iht407 is vital for executors and beneficiaries to ensure compliance with tax obligations and to facilitate the proper distribution of the estate.

How to use the Iht407

Using the Iht407 form involves several key steps. First, gather all necessary documentation related to the deceased's estate, including property deeds, bank statements, and any relevant financial records. Next, accurately complete the form by listing all assets and liabilities. It is important to provide precise valuations and ensure that all information is truthful and complete. Once the form is filled out, it must be submitted to the appropriate tax authority. Utilizing digital tools can streamline this process, making it easier to manage and submit the Iht407 electronically.

Steps to complete the Iht407

Completing the Iht407 form requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, including bank statements, property valuations, and any debts owed by the deceased.

- Begin filling out the form by entering personal details of the deceased, including their full name, date of birth, and date of death.

- List all assets, such as real estate, bank accounts, investments, and personal belongings, providing accurate valuations for each.

- Document any liabilities, including outstanding debts and funeral expenses, to determine the net value of the estate.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Iht407

The legal use of the Iht407 form is governed by various tax laws and regulations. It is crucial that the form is filled out correctly to ensure compliance with inheritance tax requirements. An improperly completed form can lead to penalties or delays in the estate settlement process. The Iht407 serves as an official record that can be used in legal proceedings if necessary, making it essential for executors to understand the legal implications of the information provided.

Required Documents

To complete the Iht407 form accurately, several documents are required. These include:

- Death certificate of the deceased.

- Proof of ownership for all assets, such as titles and deeds.

- Financial statements from banks and investment accounts.

- Documentation of any debts or liabilities, including loans and credit card statements.

- Records of any gifts made by the deceased within a specified time frame prior to their death.

Form Submission Methods

The Iht407 form can be submitted through various methods to ensure compliance and maintain records. Options for submission include:

- Online submission: Many jurisdictions allow for electronic filing of the Iht407, providing a quick and efficient way to submit the form.

- Mail: The completed form can be printed and mailed to the appropriate tax authority. Ensure that it is sent via a trackable method for confirmation of receipt.

- In-person: Some individuals may choose to submit the form in person at their local tax office, allowing for immediate confirmation and assistance if needed.

Quick guide on how to complete iht407

Complete Iht407 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Iht407 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to alter and eSign Iht407 without breaking a sweat

- Find Iht407 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your preferred device. Edit and eSign Iht407 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht407

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the iht407 and how can it benefit my business?

The iht407 is a unique document management solution offered by airSlate SignNow that simplifies the process of sending and eSigning documents. By leveraging the iht407 capabilities, businesses can enhance their workflow efficiency, reduce turnaround time, and improve overall document security, making it a valuable tool for any organization.

-

How does the pricing for iht407 work?

The pricing for the iht407 is competitive and tailored to meet the needs of various business sizes. airSlate SignNow offers flexible subscription plans that allow you to choose the features that best suit your requirements. You can visit our pricing page to get detailed information on the ih407 pricing structure and choose the plan that fits your budget.

-

What features does the iht407 offer for document management?

The iht407 includes a wide array of features such as customizable templates, bulk sending options, and advanced security measures. Additionally, it allows users to track the status of documents in real-time and provides robust audit trails, ensuring that all actions taken on documents are recorded for compliance purposes.

-

Can I integrate the iht407 with other software my business uses?

Yes, the iht407 can seamlessly integrate with various business applications, including CRM systems, cloud storage services, and productivity tools. This integration capability helps maintain a smooth workflow and allows teams to manage their document signing processes without disrupting their existing operations.

-

Is the iht407 suitable for remote teams?

Absolutely! The iht407 is designed with remote teams in mind, enabling them to collaborate and sign documents from anywhere in the world. Its user-friendly interface and cloud-based nature ensure that all team members can access and execute necessary documents without being tied to a specific location.

-

How secure is the iht407 for handling sensitive documents?

The iht407 prioritizes security by using industry-standard encryption protocols and secure cloud storage. Additionally, airSlate SignNow implements advanced authentication methods to protect sensitive information, ensuring that your documents remain safe from unauthorized access.

-

What type of customer support is available for iht407 users?

Customers using the iht407 have access to comprehensive support services, including live chat, email, and telephone assistance. Additionally, airSlate SignNow provides detailed documentation and online resources to help users navigate the platform efficiently.

Get more for Iht407

Find out other Iht407

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed