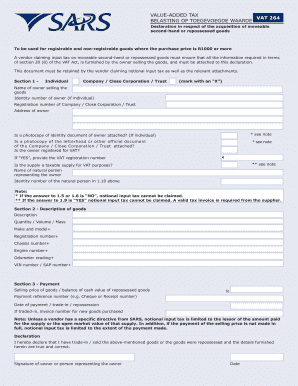

Vat 264 Form

What is the VAT 264?

The VAT 264 form is an essential document used in the United States for reporting and claiming refunds on Value Added Tax (VAT) paid on goods and services. This form is primarily utilized by businesses that are registered for VAT and have incurred VAT expenses in the course of their operations. The VAT 264 allows these businesses to reclaim the VAT they have paid, ensuring they are not financially burdened by taxes on their purchases. Understanding the purpose and function of the VAT 264 is crucial for businesses aiming to manage their tax obligations effectively.

How to Use the VAT 264

Using the VAT 264 form involves a systematic approach to ensure accurate reporting and compliance with tax regulations. First, businesses must gather all relevant invoices and receipts that detail the VAT paid on purchases. Next, they should complete the VAT 264 by entering the necessary information, including the total amount of VAT claimed and the corresponding purchase details. Once the form is filled out, it can be submitted to the appropriate tax authority for processing. It is important to keep copies of the submitted form and supporting documents for record-keeping and potential audits.

Steps to Complete the VAT 264

Completing the VAT 264 form requires careful attention to detail. Here are the steps to follow:

- Collect all invoices and receipts that show the VAT paid on purchases.

- Fill in the business's name, address, and VAT registration number at the top of the form.

- List each purchase, including the date, supplier information, and the amount of VAT paid.

- Calculate the total VAT amount to be reclaimed and enter it in the designated section.

- Review the completed form for accuracy and completeness.

- Submit the form to the relevant tax authority, either online or by mail.

Legal Use of the VAT 264

The legal use of the VAT 264 form is governed by specific regulations that ensure compliance with tax laws. When properly filled out and submitted, the VAT 264 serves as a legal document that allows businesses to reclaim VAT. It is essential for businesses to adhere to the guidelines set forth by the Internal Revenue Service (IRS) and other regulatory bodies to avoid penalties. Proper documentation and accurate reporting are vital to uphold the legal validity of the claims made on the VAT 264.

Required Documents

To successfully complete the VAT 264 form, businesses must provide certain supporting documents. These typically include:

- Invoices that detail the VAT paid on purchases.

- Receipts from suppliers that confirm the transactions.

- Any additional documentation that may be required by the tax authority for verification purposes.

Having these documents readily available will facilitate a smoother process when filling out and submitting the VAT 264.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 264 form can vary based on the business's tax year and specific regulations set by the IRS. It is crucial for businesses to be aware of these deadlines to avoid late submissions, which could result in penalties. Generally, businesses should mark their calendars for the end of each tax quarter, as this is often when VAT claims need to be submitted. Staying informed about important dates ensures timely compliance with tax obligations.

Quick guide on how to complete vat 264 250543986

Complete Vat 264 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without hassle. Manage Vat 264 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign Vat 264 with no effort

- Locate Vat 264 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Vat 264 and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 264 250543986

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VAT 264 form and why is it important?

The VAT 264 form is a crucial document for businesses that are registered for VAT in the UK, allowing them to reclaim VAT on certain purchases. Understanding the VAT 264 form is important because it ensures accurate compliance with tax regulations and maximizes potential VAT recovery. airSlate SignNow simplifies the eSigning process for the VAT 264 form, making it easier for businesses to manage their tax documents efficiently.

-

How can airSlate SignNow help with the completion of the VAT 264 form?

airSlate SignNow provides an intuitive platform that enables businesses to easily fill out and eSign the VAT 264 form. With user-friendly features, you can quickly complete the form and send it securely to your accountant or tax advisor. This streamlined process helps minimize errors and ensures that your VAT claims are handled promptly.

-

Is there a cost associated with using airSlate SignNow for the VAT 264 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. You can choose a plan that suits your requirements and budget, all while gaining access to features that simplify the completion and eSigning of the VAT 264 form. Check our website for the latest pricing and plan options.

-

What features does airSlate SignNow offer for processing the VAT 264 form?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage, which are all designed to facilitate the processing of the VAT 264 form. Additionally, our platform allows for real-time collaboration, enabling multiple parties to review and sign the form simultaneously. These features enhance efficiency and ensure compliance with VAT regulations.

-

Can I integrate airSlate SignNow with other software for handling the VAT 264 form?

Yes, airSlate SignNow supports integrations with various accounting and tax software, making it easy to streamline the handling of the VAT 264 form. This connectivity allows you to automatically send and receive information related to VAT claims, ensuring your documentation remains organized and accessible. Explore our integration options to see how we can enhance your workflow.

-

How secure is the process of signing the VAT 264 form with airSlate SignNow?

The security of your data is a top priority at airSlate SignNow. We implement industry-standard encryption and comply with global data protection regulations to ensure that your information related to the VAT 264 form is safe and secure. You can confidently eSign and share your documents knowing that they are protected.

-

Can airSlate SignNow assist in tracking the status of my VAT 264 form?

Absolutely! With airSlate SignNow, you can effortlessly track the status of your VAT 264 form after it has been sent for eSigning. Our platform provides notifications and updates on document progress, ensuring you stay informed on when signatures are completed. This feature adds an extra layer of convenience when managing your VAT documentation.

Get more for Vat 264

- Important notice this application form is not required if you apply in person at a service canada point

- General power of attorney form 2016 2019

- Customer support 18664759184 reference max approved form

- Concluding report form ab 4 forms

- Skills investment bursary application part time study forms

- Rc1 fillable 2011 form

- Form t661 2015 2019

- Form 2employees compensation ordinance 2017 2019

Find out other Vat 264

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form