Form I 944 PDF

What is the Form I-944 PDF

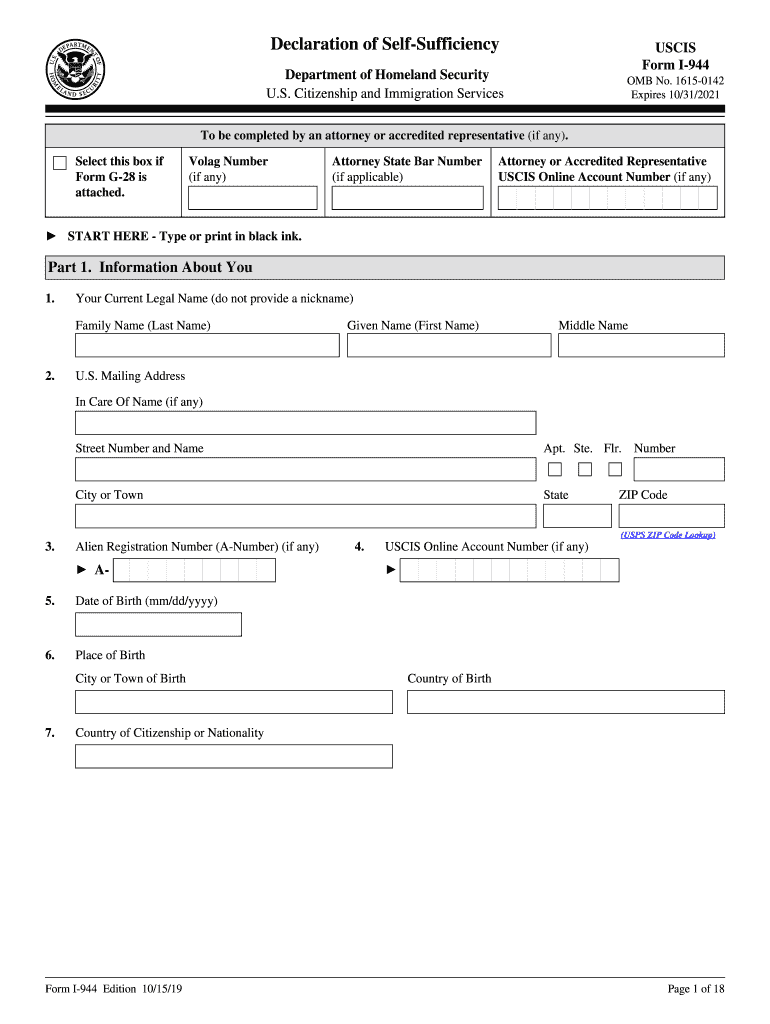

The Form I-944, officially known as the Declaration of Self-Sufficiency, is a document used by the U.S. Citizenship and Immigration Services (USCIS) to assess whether an individual is likely to become a public charge. This form is particularly relevant for individuals applying for adjustment of status or certain immigration benefits. The I-944 form requires applicants to provide information about their financial situation, including income, assets, and liabilities, as well as their education and skills. This assessment helps USCIS determine if the applicant can support themselves without relying on government assistance.

Steps to Complete the Form I-944 PDF

Completing the Form I-944 involves several key steps to ensure accuracy and compliance with USCIS requirements. Begin by downloading the most recent version of the form from the USCIS website. Next, gather necessary documentation, including proof of income, bank statements, and any other financial records. As you fill out the form, provide detailed information about your financial resources, education, and employment history. It is important to answer all questions truthfully and thoroughly, as incomplete or inaccurate information can lead to delays or denials. Once completed, review the form for any errors before submission.

Legal Use of the Form I-944 PDF

The Form I-944 must be used in accordance with U.S. immigration laws and regulations. It is legally binding, meaning that the information provided must be accurate and truthful. Failure to comply with the requirements of the form can result in penalties, including denial of the immigration application or removal proceedings. It is crucial for applicants to understand that the form is a critical part of the immigration process, and any misrepresentation or omission can have serious legal consequences.

Required Documents for the Form I-944 PDF

When submitting the Form I-944, applicants must provide various supporting documents to substantiate the information included in the form. Required documents typically include:

- Proof of income, such as pay stubs or tax returns.

- Bank statements to demonstrate financial stability.

- Documentation of any assets, including property deeds or investment statements.

- Evidence of education and skills, such as diplomas or certificates.

Having these documents prepared and organized will facilitate a smoother application process and help ensure compliance with USCIS requirements.

How to Obtain the Form I-944 PDF

The Form I-944 can be obtained directly from the USCIS website. It is important to ensure that you are downloading the most current version of the form, as USCIS periodically updates its forms and instructions. After accessing the website, navigate to the forms section and search for the I-944. The form is available in PDF format, allowing for easy download and printing. Ensure that you have the necessary software to view and fill out the PDF document correctly.

Form Submission Methods for the I-944 PDF

Applicants can submit the Form I-944 through various methods, depending on their specific circumstances and preferences. The primary submission methods include:

- Online submission through the USCIS website, if applicable for your case.

- Mailing the completed form to the appropriate USCIS address, as specified in the form instructions.

- In-person submission at a USCIS office, if required or recommended for your situation.

Choosing the correct submission method is essential for ensuring that your application is processed efficiently.

Quick guide on how to complete form i 944 pdf

Effortlessly Complete Form I 944 Pdf on Any Device

The management of documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without any delays. Manage Form I 944 Pdf on any device using the airSlate SignNow apps available for Android or iOS, streamlining your document-related tasks today.

The Easiest Way to Modify and Electronically Sign Form I 944 Pdf

- Obtain Form I 944 Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing additional copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form I 944 Pdf and ensure effective communication at any stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form i 944 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the i 944 form and why is it important?

The i 944 form is a critical document used by U.S. Citizenship and Immigration Services to determine an applicant's financial status and eligibility for a green card. Completing this form accurately is essential to support your immigration case and avoid delays.

-

How can airSlate SignNow help with completing the i 944 form?

airSlate SignNow simplifies the process of filling out the i 944 form by providing an intuitive interface for electronic signatures and document management. You can easily upload, sign, and send your completed forms securely, streamlining your immigration process.

-

What features does airSlate SignNow offer for the i 944 form?

Our platform offers features such as document templates, real-time collaboration, and secure storage for your i 944 form. Additionally, built-in compliance tools ensure that your documents meet necessary legal standards, making your submission hassle-free.

-

Is airSlate SignNow cost-effective for submitting the i 944 form?

Yes, airSlate SignNow provides a cost-effective solution for managing your i 944 form and other documents. With flexible pricing plans, businesses and individuals can choose an option that fits their budget while benefiting from premium features.

-

Can I integrate airSlate SignNow with other tools for the i 944 form?

Absolutely! airSlate SignNow offers integrations with various third-party applications such as Google Drive and Dropbox, making it easy to import and export your i 944 form and other files seamlessly. This enhances your workflow and document management processes.

-

What are the benefits of using airSlate SignNow for the i 944 form?

Using airSlate SignNow for the i 944 form provides numerous benefits, including increased efficiency, reduced paper clutter, and enhanced security for your sensitive documents. Our platform empowers users to manage signed documents easily and ensures compliance with immigration requirements.

-

How secure is airSlate SignNow when handling the i 944 form?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your i 944 form and other documents. Our compliance with industry standards guarantees that your information remains confidential and secure throughout the signing process.

Get more for Form I 944 Pdf

Find out other Form I 944 Pdf

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe