WORK AREA TRAFFIC CONTROL ADDENDUM City of Boulder 2009-2026

Understanding the work area traffic control addendum in Boulder

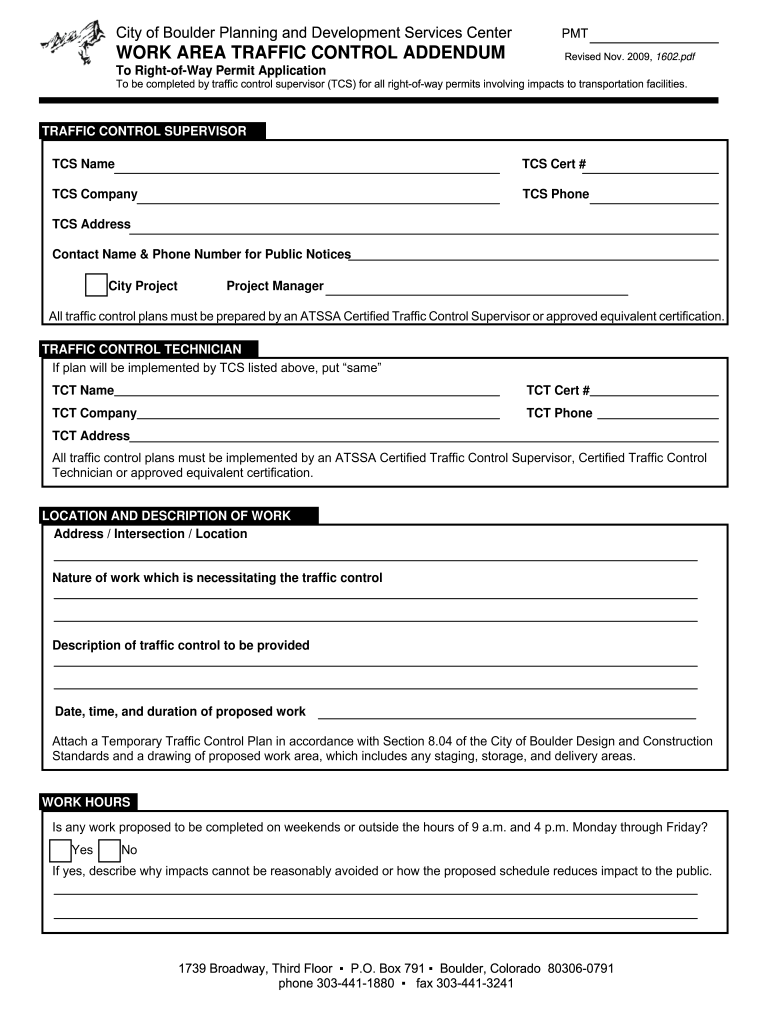

The work area traffic control addendum is a critical document for managing traffic flow during construction or maintenance activities in Boulder. This addendum outlines the necessary measures to ensure public safety and minimize disruptions. It includes specific guidelines on signage, barriers, and traffic patterns that must be adhered to while work is ongoing. Understanding this document is essential for contractors and businesses to comply with local regulations and maintain safety standards.

Steps to complete the work area traffic control addendum

Completing the work area traffic control addendum involves several key steps:

- Gather necessary project details, including location, duration, and type of work.

- Review Boulder’s traffic control requirements to ensure compliance.

- Draft the addendum, clearly outlining the planned traffic control measures.

- Submit the addendum to the appropriate city department for review.

- Incorporate any feedback received from city officials before finalizing the document.

How to obtain the work area traffic control addendum

Obtaining the work area traffic control addendum involves contacting the City of Boulder’s transportation department. They provide the necessary forms and guidelines for completing the addendum. Typically, these documents can be accessed online or through direct communication with city officials. It is advisable to check for any specific requirements or updates on the city’s website before submission.

Key elements of the work area traffic control addendum

The work area traffic control addendum should include several key elements to ensure clarity and compliance:

- Project description: A brief overview of the work being performed.

- Traffic control plan: Detailed measures for managing traffic, including signage and detours.

- Duration of work: Specific dates and times when the work will occur.

- Contact information: Details for the project manager or contractor responsible for the work.

Legal use of the work area traffic control addendum

The legal use of the work area traffic control addendum is essential for ensuring that all traffic management practices are compliant with local laws. This document must be properly filled out and submitted to the City of Boulder to obtain the necessary approvals. Failure to comply with the regulations outlined in the addendum can result in penalties or delays in project completion. It is important to keep a copy of the approved addendum on-site during the project.

Examples of using the work area traffic control addendum

There are various scenarios where the work area traffic control addendum is utilized:

- Road repairs requiring lane closures and detours.

- Utility work that impacts traffic flow in residential areas.

- Construction projects that necessitate temporary traffic signals or signage.

In each case, the addendum serves to communicate the planned traffic control measures to the public and ensure safety during the work period.

Quick guide on how to complete work area traffic control addendum city of boulder

Complete WORK AREA TRAFFIC CONTROL ADDENDUM City Of Boulder effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without hindrances. Handle WORK AREA TRAFFIC CONTROL ADDENDUM City Of Boulder on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign WORK AREA TRAFFIC CONTROL ADDENDUM City Of Boulder without difficulty

- Find WORK AREA TRAFFIC CONTROL ADDENDUM City Of Boulder and click Get Form to commence.

- Use the tools we provide to complete your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign WORK AREA TRAFFIC CONTROL ADDENDUM City Of Boulder and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

-

I am a working software professional in the Bay Area and looking to switch jobs. I can't openly write in my LinkedIn profile about the same. How do I approach recruiters/companies? Is there an easier way than filling out 4 - 5 page forms in the career website of the company?

I'd say that you should just seek out the jobs that interest you and apply for them. Many don't have such onerous application forms. Some even allow you to apply through LinkedIn. And if you target a small set of companies that really interest you, then it's worth the extra effort to customize each application. Many recruiters and hiring managers, myself included, give more weight to candidates who seem specifically interested in an opportunity, as compared to those who seem to be taking a shotgun approach to the job seeking process.

Create this form in 5 minutes!

How to create an eSignature for the work area traffic control addendum city of boulder

How to create an electronic signature for the Work Area Traffic Control Addendum City Of Boulder in the online mode

How to generate an eSignature for the Work Area Traffic Control Addendum City Of Boulder in Chrome

How to generate an electronic signature for putting it on the Work Area Traffic Control Addendum City Of Boulder in Gmail

How to create an eSignature for the Work Area Traffic Control Addendum City Of Boulder right from your smart phone

How to make an electronic signature for the Work Area Traffic Control Addendum City Of Boulder on iOS devices

How to create an eSignature for the Work Area Traffic Control Addendum City Of Boulder on Android OS

People also ask

-

What is colorado traffic control, and how does it relate to airSlate SignNow?

Colorado traffic control refers to the methods and systems used to manage and direct traffic within Colorado. airSlate SignNow provides a streamlined solution for traffic control companies to manage documentation, contracts, and compliance efficiently with an easy-to-use eSigning platform.

-

How much does airSlate SignNow cost for colorado traffic control businesses?

The pricing for airSlate SignNow varies based on the features and number of users needed. For colorado traffic control businesses, we offer competitive pricing plans that can fit different budgets, ensuring you get the best value for your eSigning needs.

-

What features does airSlate SignNow offer for colorado traffic control workflows?

airSlate SignNow includes features like custom templates, bulk sending, and advanced tracking, which are essential for colorado traffic control operations. These features help streamline document management, making it easier to handle contracts and permits in a timely manner.

-

Can airSlate SignNow integrate with other tools used in colorado traffic control?

Yes, airSlate SignNow offers seamless integrations with various software and tools commonly used in colorado traffic control. This allows organizations to consolidate their workflows and maintain efficiency across different platforms.

-

What are the benefits of using airSlate SignNow for colorado traffic control documents?

Using airSlate SignNow for colorado traffic control documents provides numerous benefits, including faster turnaround times, improved accuracy, and enhanced security. By digitizing the signing process, businesses can expect increased productivity and a reduction in paper-related errors.

-

Is airSlate SignNow compliant with the regulations for colorado traffic control?

Yes, airSlate SignNow is compliant with all relevant eSigning regulations, ensuring that documents related to colorado traffic control are legally binding and secure. Our platform is designed to meet and exceed compliance standards for various industries and states.

-

How can colorado traffic control companies ensure document security with airSlate SignNow?

AirSlate SignNow incorporates advanced security features, such as encryption and secure cloud storage, to protect documents for colorado traffic control companies. These security measures safeguard sensitive information, ensuring that your records are always safe and accessible.

Get more for WORK AREA TRAFFIC CONTROL ADDENDUM City Of Boulder

Find out other WORK AREA TRAFFIC CONTROL ADDENDUM City Of Boulder

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer