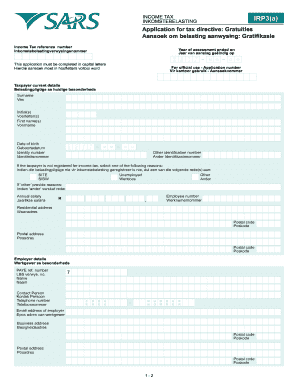

Irp3 a Form

What is the IRP3A Form

The IRP3A form is a tax document used in the United States, primarily for reporting income and tax information for employees. This form is essential for employers to accurately report payments made to employees and ensure compliance with federal tax regulations. The IRP3A form serves as a summary of earnings and tax withholdings, providing both the employer and employee with a clear record of income for the tax year.

How to Use the IRP3A Form

Using the IRP3A form involves several key steps. First, employers need to gather all relevant income data for their employees, including wages, bonuses, and any other compensations. Once the necessary information is compiled, it should be accurately entered into the IRP3A form. After completing the form, employers must distribute copies to their employees and submit the original to the appropriate tax authority by the specified deadlines.

Steps to Complete the IRP3A Form

Completing the IRP3A form requires careful attention to detail. Follow these steps for accuracy:

- Gather employee information, including names, Social Security numbers, and total earnings.

- Input total wages, bonuses, and other compensations in the designated fields.

- Calculate and enter the total tax withholdings for each employee.

- Review the form for any errors or omissions before finalizing.

- Distribute copies to employees and submit the original to the tax authority.

Legal Use of the IRP3A Form

The IRP3A form is legally recognized as a valid means of reporting income and tax withholdings. To ensure its legal standing, it must be filled out accurately and submitted on time. Compliance with IRS regulations is crucial, as failure to do so can result in penalties for both employers and employees. The form must also be retained for record-keeping purposes, as it may be requested during audits or tax reviews.

Key Elements of the IRP3A Form

Key elements of the IRP3A form include:

- Employee identification details, such as name and Social Security number.

- Total earnings for the reporting period.

- Details of any bonuses or additional compensation.

- Total tax withholdings, including federal, state, and local taxes.

- Employer identification information.

Filing Deadlines / Important Dates

Filing deadlines for the IRP3A form are critical for compliance. Employers must submit the form by the designated date, typically at the end of the tax year. It is essential to stay informed about any changes in deadlines, as these can vary year by year. Employees should also be aware of when they can expect to receive their copies for personal tax filing purposes.

Quick guide on how to complete irp3 a form

Complete Irp3 A Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Irp3 A Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Irp3 A Form without hassle

- Obtain Irp3 A Form and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Irp3 A Form and ensure excellent communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irp3 a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the irp3a form and why is it important?

The irp3a form is a crucial document used in tax reporting, particularly for South African businesses. It summarizes the annual earnings and tax withheld for employees, making it important for both compliance and accurate tax submissions.

-

How can airSlate SignNow help with the irp3a form?

airSlate SignNow streamlines the process of sending and eSigning the irp3a form, making it easier for businesses to manage their tax documentation. With our platform, you can quickly collect signatures and ensure the form is filled out correctly and legally.

-

Is there a cost associated with using airSlate SignNow for the irp3a form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that suits your volume of transactions, ensuring that managing the irp3a form remains cost-effective.

-

What features does airSlate SignNow offer for the irp3a form?

airSlate SignNow provides features such as customizable templates, in-app editing, and secure cloud storage for the irp3a form. These features enhance efficiency and ensure the documents are easily accessible whenever needed.

-

Can I integrate airSlate SignNow with my existing systems for the irp3a form?

Yes, airSlate SignNow offers integrations with various CRM and accounting software. This flexibility allows you to incorporate the irp3a form into your existing workflow seamlessly.

-

What are the benefits of using airSlate SignNow for the irp3a form?

Using airSlate SignNow for the irp3a form enhances your business's productivity by saving time on document management. It ensures secure, legally binding signatures, reducing the risk of errors and compliance issues.

-

Is it safe to use airSlate SignNow for sensitive documents like the irp3a form?

Absolutely! airSlate SignNow is equipped with advanced encryption and security protocols to protect sensitive documents like the irp3a form. Your data's confidentiality is our top priority.

Get more for Irp3 A Form

- Table captain form 2011 sfcdenver

- Duke energy guarantor form

- Musc wellness center form

- 2 operational checklist aerobic treatment unit atu septic umn form

- Baseball lineup sheets pdf form

- Busing registration parental consent and release form

- Incumbency certificate form

- Expense reimbursement form version 05 02 13 projecthealingwatersdenver

Find out other Irp3 A Form

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation