St Clair County Tax Assessor Form

What is the St Clair County Tax Assessor?

The St Clair County Tax Assessor is an official responsible for determining the value of properties within St Clair County, Illinois. This office plays a crucial role in the local taxation system by assessing property values to ensure fair taxation. The assessed values are used to calculate property taxes, which fund essential public services such as schools, roads, and emergency services. Understanding the function of the tax assessor helps property owners navigate their tax obligations and potential exemptions.

How to use the St Clair County Tax Assessor

Utilizing the St Clair County Tax Assessor's services involves accessing property information through their official channels. Property owners can search for their property details, including assessed values, tax rates, and payment history. This information is typically available online through the county's official website. Users can enter their property address or parcel number to retrieve relevant data. Familiarizing oneself with this process can simplify tax planning and ensure accurate assessments.

Steps to complete the St Clair County Tax Assessor

Completing the St Clair County Tax Assessor process involves several key steps:

- Gather necessary property information, including the address and parcel number.

- Visit the St Clair County Tax Assessor's website or office.

- Use the property search tool to access your property details.

- Review the assessed value and ensure it aligns with your expectations.

- If discrepancies exist, follow the procedures for appealing the assessment.

By following these steps, property owners can effectively manage their tax responsibilities and ensure they are being taxed fairly.

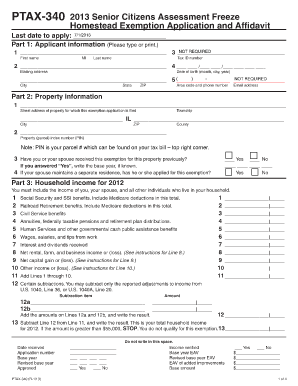

Eligibility Criteria for Tax Exemptions

St Clair County offers various tax exemptions that property owners may qualify for, such as exemptions for seniors, veterans, and those with disabilities. To be eligible for these exemptions, applicants must meet specific criteria, including age, income limits, and residency requirements. It is essential to review the eligibility guidelines provided by the St Clair County Tax Assessor's office to determine if you qualify for any available benefits, which can significantly reduce property tax liabilities.

Legal use of the St Clair County Tax Assessor

The legal use of the St Clair County Tax Assessor's services ensures that property assessments comply with state and local laws. Property owners have the right to access their assessment information and challenge any discrepancies through formal appeal processes. Understanding the legal framework governing property assessments is vital for ensuring compliance and protecting one's rights as a taxpayer. The assessor's office adheres to regulations that dictate how properties are valued and taxed, providing transparency and accountability in the assessment process.

Form Submission Methods

Property owners can submit forms related to the St Clair County Tax Assessor through various methods. These include:

- Online: Many forms can be completed and submitted electronically via the St Clair County Tax Assessor's website.

- Mail: Completed forms can be printed, signed, and mailed to the assessor's office.

- In-Person: Property owners may also visit the assessor's office to submit forms directly and receive assistance.

Choosing the appropriate submission method can streamline the process and ensure timely handling of requests.

Quick guide on how to complete st clair county tax assessor

Easily Prepare St Clair County Tax Assessor on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed paperwork, as you can access the right template and securely store it digitally. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle St Clair County Tax Assessor on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign St Clair County Tax Assessor Effortlessly

- Locate St Clair County Tax Assessor and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign St Clair County Tax Assessor to maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st clair county tax assessor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st clair county il tax assessor property search?

The st clair county il tax assessor property search is an online tool that allows residents to access property assessments, ownership details, and tax information for properties within St. Clair County, Illinois. This resource is essential for homeowners and prospective buyers to understand property values and associated taxes.

-

How can I perform a st clair county il tax assessor property search?

To perform a st clair county il tax assessor property search, visit the official St. Clair County Assessor's website. From there, you can enter property details like the address or parcel number to retrieve comprehensive information about assessments, taxes, and ownership.

-

Are there any fees associated with the st clair county il tax assessor property search?

No, accessing the st clair county il tax assessor property search is free for all users. You can obtain property information without incurring any charges, making it a cost-effective solution for homeowners and interested buyers.

-

What features are available in the st clair county il tax assessor property search?

The st clair county il tax assessor property search offers features such as property valuations, tax history, land use details, and ownership information. These tools help users make informed decisions based on current and historical data about properties.

-

How does the st clair county il tax assessor property search benefit homeowners?

Homeowners can benefit from the st clair county il tax assessor property search by gaining insights into their property's assessed value and tax obligations. This information empowers them to contest assessments or properly budget for tax payments.

-

Is the st clair county il tax assessor property search mobile-friendly?

Yes, the st clair county il tax assessor property search is designed to be mobile-friendly. Users can easily access property information from their smartphones or tablets, ensuring convenience and accessibility on the go.

-

Can I integrate the st clair county il tax assessor property search with other tools?

While the st clair county il tax assessor property search is primarily a standalone tool, many users choose to combine it with real estate apps or financial planning software for a comprehensive approach to property management. Check with specific tools for suitable integrations.

Get more for St Clair County Tax Assessor

- Vehicles and vessels how to request a use tax clearance form

- Fillable online online contact us form city of carson california fax

- 2019 form ct 706709 connecticut estate and gift tax

- For estates of decedents dying during calendar year 2019 read instructions before completing this form

- W 2g electronic filing form

- Affidavit and agreement for issuance of duplicate warrant 06 form

- Ia 1040 schedule a iowagov form

- Form 35 002a iowa contractors statement templaterollercom

Find out other St Clair County Tax Assessor

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself