Naperville Transfer Stamps Form

What is the Naperville Transfer Stamps

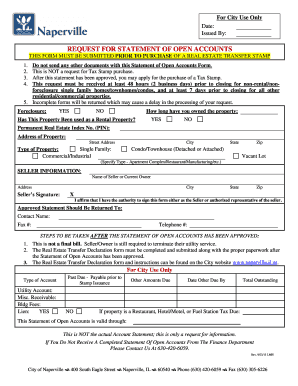

The Naperville transfer stamps are official documents required for real estate transactions within the city of Naperville, Illinois. These stamps serve as proof that the transfer tax has been paid when property changes hands. The city imposes this tax on the sale of real estate to generate revenue for local services and infrastructure. Understanding the purpose and requirements of these stamps is essential for both buyers and sellers involved in property transactions.

How to Obtain the Naperville Transfer Stamps

To obtain the Naperville transfer stamps, individuals must apply through the city’s finance department. The application process typically involves submitting a completed form along with payment for the transfer tax. Payments can be made via check or electronic methods, depending on the city’s regulations. It is important to ensure that all required information is accurate to avoid delays in processing.

Steps to Complete the Naperville Transfer Stamps

Completing the Naperville transfer stamps involves several key steps:

- Gather necessary documentation, including the property deed and proof of payment for the transfer tax.

- Fill out the required application form accurately, providing all requested details.

- Submit the form along with payment to the city’s finance department, either online or in person.

- Receive the transfer stamps, which must be affixed to the property deed before finalizing the sale.

Legal Use of the Naperville Transfer Stamps

The Naperville transfer stamps hold legal significance in property transactions. They confirm that the transfer tax has been paid, which is a requirement for the recording of the property deed. Without these stamps, the deed may not be accepted by the county recorder’s office, potentially leading to legal complications for the buyer and seller. It is crucial to ensure compliance with all local regulations regarding the use of these stamps.

Key Elements of the Naperville Transfer Stamps

Key elements of the Naperville transfer stamps include:

- The stamp itself, which is typically a physical label or digital confirmation that indicates payment of the transfer tax.

- Information regarding the property, including the address and legal description.

- The names of the buyer and seller involved in the transaction.

- The date of the transaction, which is important for record-keeping and compliance.

Required Documents for Naperville Transfer Stamps

When applying for the Naperville transfer stamps, several documents are typically required:

- Completed application form for the transfer stamps.

- Copy of the property deed or sales contract.

- Proof of payment for the transfer tax, which may include receipts or bank statements.

- Identification of the parties involved in the transaction, such as driver’s licenses or business identification numbers.

Quick guide on how to complete statement of open accounts naperville

Complete statement of open accounts naperville seamlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents quickly without hindrance. Manage naperville transfer stamps on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign naperville statement of open accounts effortlessly

- Find naperville transfer tax and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, exhaustive form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign naperville exempt stamp to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to statement of open accounts

Create this form in 5 minutes!

How to create an eSignature for the city of naperville request for open accounts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask city of naperville statement of accounts

-

What are Naperville transfer stamps?

Naperville transfer stamps are official stamps required for property transfers within Naperville. These stamps signify that the transfer taxes have been paid, facilitating a smoother real estate transaction process.

-

How can airSlate SignNow help with Naperville transfer stamps?

With airSlate SignNow, you can easily prepare and eSign the necessary documents for obtaining Naperville transfer stamps. Our platform streamlines the paperwork involved, making sure all requirements are met efficiently.

-

What is the cost of obtaining Naperville transfer stamps?

The cost of Naperville transfer stamps varies based on the property value. It’s essential to consult with local authorities or our customer support to understand the current pricing associated with these stamps.

-

Do I need Naperville transfer stamps for all property sales?

Yes, Naperville transfer stamps are typically required for all property sales within the city. They are crucial for finalizing transactions and ensuring compliance with local regulations.

-

How long does it take to get Naperville transfer stamps?

The processing time for Naperville transfer stamps can vary, but it usually takes a few days once the application is submitted. Using airSlate SignNow can help expedite document preparation to ensure timely submissions.

-

Are there any penalties for not obtaining Naperville transfer stamps?

Yes, failing to obtain Naperville transfer stamps can lead to penalties or additional taxes when selling a property. It's advisable to secure these stamps to avoid complications during property transfers.

-

Can airSlate SignNow integrate with other software for Naperville transfer stamps?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, making it easier to manage your documents related to Naperville transfer stamps. This integration facilitates a more efficient workflow.

Get more for naperville il statement of open accounts

Find out other naperville request for statement of open accounts

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template