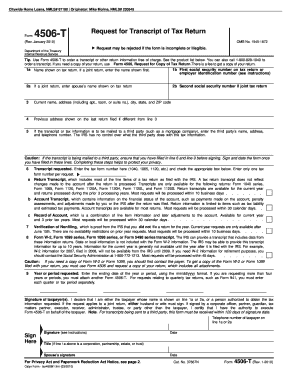

IRS Form 4506 T

What is the IRS Form 4506 T

The IRS Form 4506 T, also known as the Request for Transcript of Tax Return, is a document used by taxpayers to request a transcript of their tax return information from the Internal Revenue Service. This form is essential for individuals and businesses who need to verify income, especially when applying for loans, mortgages, or other financial assistance. The form allows taxpayers to obtain various types of tax return transcripts, including those for individual income tax returns, business tax returns, and other specific tax documents.

How to use the IRS Form 4506 T

Using the IRS Form 4506 T involves a straightforward process. First, taxpayers need to fill out the form with their personal information, including name, address, and Social Security number. Next, they should specify the type of transcript required and the tax years for which they need the information. After completing the form, it can be submitted to the IRS either by mail or electronically, depending on the method chosen. It is important to ensure that all information is accurate to avoid delays in processing.

Steps to complete the IRS Form 4506 T

Completing the IRS Form 4506 T requires careful attention to detail. Here are the key steps:

- Download the form from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Select the type of transcript you need and specify the tax years.

- Provide any third-party information if you wish to authorize someone else to receive the transcript.

- Sign and date the form to validate your request.

- Submit the completed form to the IRS by mail or electronically, as applicable.

Legal use of the IRS Form 4506 T

The IRS Form 4506 T is legally recognized as a valid request for tax information. When filled out correctly, it serves as a formal request for the IRS to release your tax transcripts. It is crucial to understand that submitting this form without proper authorization or for fraudulent purposes can lead to legal repercussions. Therefore, it is essential to use the form responsibly and ensure that all provided information is accurate and truthful.

Key elements of the IRS Form 4506 T

Several key elements are essential to understand when dealing with the IRS Form 4506 T:

- Personal Information: Accurate details about the taxpayer must be provided.

- Transcript Type: The form allows requests for different types of transcripts, such as tax return transcripts and account transcripts.

- Tax Years: Specify the years for which the transcripts are requested.

- Signature: The form must be signed by the taxpayer or an authorized representative.

Form Submission Methods

The IRS Form 4506 T can be submitted through various methods. Taxpayers can choose to mail the completed form to the appropriate IRS address based on their location. Alternatively, the form can also be submitted electronically through certain tax software platforms that support e-filing. It is important to follow the instructions carefully to ensure that the submission method aligns with the taxpayer's needs and preferences.

Quick guide on how to complete irs form 4506 t

Complete IRS Form 4506 T effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a suitable environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage IRS Form 4506 T on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to edit and eSign IRS Form 4506 T without any hassle

- Obtain IRS Form 4506 T and then select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign IRS Form 4506 T and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 4506 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 4506 T, and how can airSlate SignNow help?

The IRS Form 4506 T is a request form for tax return transcripts, which individuals and businesses can use for various financial needs. airSlate SignNow simplifies the process by enabling users to electronically sign and send this form securely, ensuring quick processing and reduced turnaround times.

-

How much does airSlate SignNow cost for using IRS Form 4506 T?

airSlate SignNow offers various pricing plans to suit different user needs, including a plan specifically tailored for frequent users of IRS Form 4506 T. The subscription options provide excellent value with features designed to streamline document management and eSigning at competitive rates.

-

What are the key features of airSlate SignNow when dealing with IRS Form 4506 T?

With airSlate SignNow, users can effortlessly create, sign, and send the IRS Form 4506 T. Key features include customizable templates, automated workflows, and secure cloud storage, which enhance efficiency and organization when managing this important tax document.

-

How does airSlate SignNow ensure the security of IRS Form 4506 T submissions?

airSlate SignNow takes security seriously, utilizing advanced encryption protocols to protect sensitive information contained in the IRS Form 4506 T. Additionally, the platform complies with industry regulations, ensuring that all transmissions are secure and confidential.

-

Can I integrate airSlate SignNow with other tools for managing IRS Form 4506 T?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing the experience of managing the IRS Form 4506 T. Users can integrate with popular CRM and accounting tools to streamline their workflow and reduce manual data entry.

-

What is the benefit of using airSlate SignNow for the IRS Form 4506 T?

Using airSlate SignNow for the IRS Form 4506 T offers numerous benefits, including time savings, improved accuracy, and a completely paperless process. The platform allows users to manage their forms more efficiently, reducing stress during the tax return process.

-

Is there customer support available for questions about IRS Form 4506 T on airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive customer support to address any questions about using the IRS Form 4506 T. Users can access live chat, email support, and extensive online resources to ensure they get the help they need.

Get more for IRS Form 4506 T

- Personal income tax employee business expense affidavit rev 775 form

- Credit for military service in a combat zone form

- 2017 nj 1065 instructions for njpartnership return 2017 nj 1065 instructions for njpartnership return form

- 2015 nj 2017 2019 form

- Submitter form nj efw2 s 2018 2019

- Tax compliance certification oregon form

- 8879 k kentucky individual income tax declaration for electronic revenue ky form

- Ol ez2017v1 form

Find out other IRS Form 4506 T

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors