Form 68 in Word Format

What is the Form 68 In Word Format

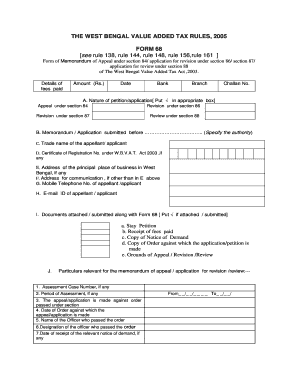

The Form 68 is a specific document used for income tax purposes in the United States. It serves as a declaration for certain tax-related information, enabling taxpayers to report their financial activities accurately. The form is available in a Word format, allowing users to fill it out digitally, which simplifies the process of submission and record-keeping. This format is particularly advantageous for those who prefer to complete their documents electronically, ensuring that they can easily edit and save their information without the need for printing.

How to use the Form 68 In Word Format

Using the Form 68 in Word format is straightforward. First, download the form from a reliable source. Once you have the document, open it in a compatible word processing program. Fill in the required fields with your personal and financial information. Ensure accuracy, as errors can lead to complications with your tax filings. After completing the form, save it securely. You can print it for submission or save it as a PDF for electronic filing, depending on your needs.

Steps to complete the Form 68 In Word Format

Completing the Form 68 in Word format involves several key steps:

- Download the Form 68 in Word format from a trusted source.

- Open the file in a word processing application.

- Carefully read the instructions provided within the form.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the necessary financial details as required by the form.

- Review the form for accuracy and completeness.

- Save the completed form and print it if necessary for submission.

Legal use of the Form 68 In Word Format

The Form 68 in Word format is legally binding when filled out correctly and submitted according to the relevant tax regulations. To ensure its legal validity, it is essential to comply with all applicable laws regarding electronic signatures and document submissions. Utilizing a reliable platform for eSigning can enhance the legitimacy of your completed form. It is advisable to keep a copy of the submitted form for your records, as this may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 68 are critical to ensuring compliance with tax regulations. Typically, the form must be submitted by the annual tax filing deadline, which is usually April 15. However, specific deadlines may vary based on individual circumstances, such as extensions or special considerations for certain taxpayer categories. It is essential to stay informed about these dates to avoid penalties and ensure timely processing of your tax return.

Required Documents

When preparing to complete the Form 68, certain documents are necessary to provide the required information accurately. These may include:

- Previous year’s tax return for reference.

- W-2 forms from employers.

- 1099 forms for any additional income.

- Documentation of deductions or credits you plan to claim.

- Any relevant financial statements or records.

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in your filings.

Quick guide on how to complete form 68 in word format

Complete Form 68 In Word Format effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Form 68 In Word Format on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Form 68 In Word Format with ease

- Locate Form 68 In Word Format and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form browsing, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 68 In Word Format to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 68 in word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 68 and how can airSlate SignNow help with it?

Form 68 is a specific document commonly used in various business processes. airSlate SignNow simplifies the management and signing of Form 68 by providing an intuitive platform that enables users to send, sign, and store the document securely, streamlining workflow and saving time.

-

What features does airSlate SignNow offer for handling Form 68?

With airSlate SignNow, users can easily create, edit, and share Form 68. Our platform includes features like customizable templates, automated workflows, and in-app signing options to enhance efficiency and ensure compliance with legal standards.

-

Are there any costs associated with using airSlate SignNow for Form 68?

airSlate SignNow offers a cost-effective solution for managing Form 68, with various pricing plans to fit different business sizes and needs. You can choose from free trials or monthly subscriptions that offer comprehensive features without the burden of hidden fees.

-

How does airSlate SignNow ensure the security of Form 68?

Security is a priority at airSlate SignNow, especially for sensitive documents like Form 68. Our platform utilizes robust encryption, secure data storage, and compliance with legal standards to protect your information and ensure that all electronic signatures are legally binding.

-

Can I integrate airSlate SignNow with other tools to manage Form 68?

Yes, airSlate SignNow seamlessly integrates with a variety of other applications, enhancing your ability to manage Form 68. This includes popular tools such as Google Drive, Dropbox, and various CRM systems, allowing for easier document handling and workflow automation.

-

What benefits do I gain from using airSlate SignNow for Form 68?

Using airSlate SignNow for Form 68 signNowly enhances productivity and reduces turnaround time. The easy-to-use platform improves collaboration, ensuring that all stakeholders can efficiently access, review, and sign the document from anywhere, at any time.

-

Is it easy to get started with airSlate SignNow for Form 68?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to get started with managing Form 68. Simply create an account, upload your document, and follow the guided prompts to send and sign your form quickly and efficiently.

Get more for Form 68 In Word Format

Find out other Form 68 In Word Format

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form