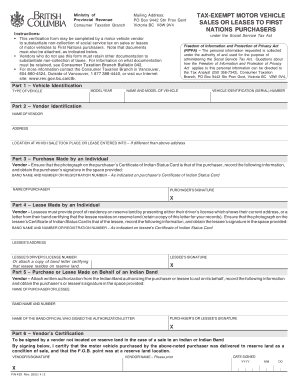

Tax Exempt Motor Vehicle Sales or Leases to First Nations Purchasers Form

Understanding the Tax Exempt Motor Vehicle Sales or Leases to First Nations Purchasers

The tax exempt motor vehicle sales or leases to First Nations purchasers is a program designed to provide financial relief for eligible individuals. This exemption allows qualifying First Nations members to purchase or lease motor vehicles without incurring state sales tax. The program aims to support economic development and mobility within First Nations communities. To qualify, individuals must demonstrate their status as members of a recognized First Nation and meet specific criteria outlined by state regulations.

Steps to Complete the Tax Exempt Motor Vehicle Sales or Leases to First Nations Purchasers

Completing the tax exempt motor vehicle sales or leases to First Nations purchasers involves several key steps:

- Gather necessary documentation, including proof of First Nations status.

- Obtain the appropriate tax exemption form from the relevant state agency.

- Fill out the form accurately, ensuring all required information is provided.

- Submit the completed form along with any supporting documents to the vehicle dealer or leasing company.

- Retain copies of all submitted documents for your records.

Required Documents for the Tax Exempt Motor Vehicle Sales or Leases to First Nations Purchasers

To successfully apply for the tax exemption, applicants need to provide specific documentation, which generally includes:

- Proof of First Nations membership, such as a registration card or letter from the band.

- A completed tax exemption form, which can vary by state.

- Identification, such as a driver's license or state ID.

- Any additional documents requested by the vehicle dealer or leasing company.

Eligibility Criteria for the Tax Exempt Motor Vehicle Sales or Leases to First Nations Purchasers

Eligibility for the tax exempt motor vehicle sales or leases to First Nations purchasers typically requires the following:

- The applicant must be a registered member of a recognized First Nation.

- The vehicle must be for personal use and not for commercial purposes.

- Applicants must comply with any additional state-specific requirements.

Legal Use of the Tax Exempt Motor Vehicle Sales or Leases to First Nations Purchasers

The legal use of the tax exempt motor vehicle sales or leases to First Nations purchasers is governed by state laws and regulations. It is essential to ensure compliance with these laws to avoid potential penalties. The exemption is intended to facilitate access to transportation for First Nations individuals, but misuse of the exemption can lead to legal repercussions. Understanding the legal framework surrounding this exemption is crucial for both purchasers and dealers.

Form Submission Methods for the Tax Exempt Motor Vehicle Sales or Leases to First Nations Purchasers

Submitting the tax exemption form can typically be done through various methods, including:

- Online submission via the state agency's website.

- Mailing the completed form to the designated office.

- In-person submission at the vehicle dealer or leasing company.

Quick guide on how to complete tax exempt motor vehicle sales or leases to first nations purchasers

Prepare Tax Exempt Motor Vehicle Sales Or Leases To First Nations Purchasers effortlessly on any device

Online document administration has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Tax Exempt Motor Vehicle Sales Or Leases To First Nations Purchasers on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Tax Exempt Motor Vehicle Sales Or Leases To First Nations Purchasers effortlessly

- Find Tax Exempt Motor Vehicle Sales Or Leases To First Nations Purchasers and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Craft your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Adjust and eSign Tax Exempt Motor Vehicle Sales Or Leases To First Nations Purchasers to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt motor vehicle sales or leases to first nations purchasers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ICBC tax exemption form?

The ICBC tax exemption form is a document used in British Columbia, Canada, to claim tax exemptions for eligible vehicles. This form is essential for individuals and businesses to ensure compliance with tax regulations while maximizing savings on vehicles used for specific purposes.

-

How can airSlate SignNow help with the ICBC tax exemption form?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the ICBC tax exemption form. With our user-friendly interface, you can prepare the document and manage the signing process seamlessly, ensuring a quick and secure workflow.

-

Is there a cost to use airSlate SignNow for the ICBC tax exemption form?

Yes, airSlate SignNow offers flexible pricing plans to suit various business needs. Each plan includes the necessary features for efficiently processing the ICBC tax exemption form, ensuring that you receive excellent value as you streamline your document management.

-

What features does airSlate SignNow offer for managing the ICBC tax exemption form?

airSlate SignNow includes features such as customizable templates, electronic signatures, and real-time tracking for the ICBC tax exemption form. These functionalities help you automate your workflows and keep all stakeholders informed about the document's status.

-

Can I integrate airSlate SignNow with other applications for the ICBC tax exemption form?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to import data and automate processes related to the ICBC tax exemption form. This creates a seamless experience, enhancing your productivity and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for the ICBC tax exemption form?

Using airSlate SignNow for the ICBC tax exemption form brings numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. With electronic signatures, you can process the exemption quickly and with guaranteed compliance.

-

Is airSlate SignNow compliant with data protection regulations when handling the ICBC tax exemption form?

Yes, airSlate SignNow takes data security seriously and complies with industry standards such as GDPR and CCPA. When handling the ICBC tax exemption form, you can trust that your data is protected and managed in accordance with all applicable regulations.

Get more for Tax Exempt Motor Vehicle Sales Or Leases To First Nations Purchasers

- 1609 pr editable form

- The bucks county childrens museum field trip registration form

- 1609 sll form

- Facility use request form 2016 2017 central bucks school district cbsd

- Facility use form central bucks school district

- 2020 2021 health forms

- Fillable online print entire health form fax email print pdffiller

- Inclement weather hotline 267 893 4020 option 5 form

Find out other Tax Exempt Motor Vehicle Sales Or Leases To First Nations Purchasers

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple