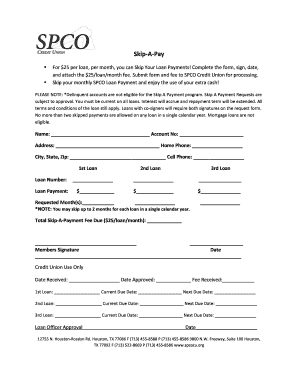

Scott Credit Union Skip a Payment Form

What is the Scott Credit Union Skip A Payment

The Scott Credit Union Skip A Payment program allows members to temporarily defer a scheduled loan payment. This option can be beneficial for members facing financial difficulties or unexpected expenses. By participating in this program, members can maintain their financial stability while managing their loan obligations more effectively.

How to use the Scott Credit Union Skip A Payment

To utilize the Skip A Payment feature, members must first verify their eligibility by reviewing the terms and conditions provided by Scott Credit Union. Once confirmed, members can request to skip a payment through their online banking portal or by contacting customer service. It is essential to submit the request before the payment due date to ensure proper processing.

Steps to complete the Scott Credit Union Skip A Payment

Completing the Skip A Payment process involves several straightforward steps:

- Log in to your Scott Credit Union online account.

- Navigate to the loan section and locate the Skip A Payment option.

- Review the eligibility criteria and terms associated with the program.

- Submit your request to skip the payment, ensuring all required information is accurate.

- Confirm your request and check for any notifications regarding approval.

Key elements of the Scott Credit Union Skip A Payment

Understanding the key elements of the Skip A Payment program is crucial for effective use. Members should be aware of:

- The maximum number of payments that can be skipped in a year.

- Any associated fees or interest implications for skipping a payment.

- The impact on loan repayment terms and overall balance.

- Eligibility requirements, including the types of loans covered under this program.

Eligibility Criteria

Eligibility for the Scott Credit Union Skip A Payment program typically includes several factors. Members must have an active loan in good standing, meaning no recent delinquencies or defaults. Additionally, the program may be limited to specific loan types, such as auto loans or personal loans. Members are encouraged to review the specific eligibility criteria outlined by Scott Credit Union.

Legal use of the Scott Credit Union Skip A Payment

Utilizing the Skip A Payment program is legal and compliant with financial regulations, provided that members adhere to the established guidelines. It is important for members to understand that skipping a payment may have implications for their credit score and loan terms. Members should carefully consider these factors before proceeding with the request.

Quick guide on how to complete scott credit union skip a payment

Prepare Scott Credit Union Skip A Payment effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Scott Credit Union Skip A Payment on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Scott Credit Union Skip A Payment effortlessly

- Locate Scott Credit Union Skip A Payment and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Edit and eSign Scott Credit Union Skip A Payment and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the scott credit union skip a payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the scott credit union desktop login process?

To access your account, visit the Scott Credit Union website and click on the desktop login button. Enter your username and password, then click 'Log In' to access your account securely. If you're having issues, you can reset your password using the link provided on the login page.

-

Are there any fees associated with using the Scott Credit Union desktop login?

The Scott Credit Union desktop login itself is free of charge. However, certain account services may incur fees, which can be found on the credit union's website. It's always a good practice to review these details to avoid unexpected charges.

-

What features are available after logging into Scott Credit Union desktop?

After completing your Scott Credit Union desktop login, you can manage your accounts, pay bills, transfer funds, and access various digital banking tools. The platform is designed to provide a comprehensive banking experience conveniently from your desktop.

-

Can I use airSlate SignNow with my Scott Credit Union desktop login?

Yes, airSlate SignNow can be integrated with your Scott Credit Union desktop login to facilitate document signing and transfer of important financial documents securely. This integration enhances usability and streamlines your banking processes like never before.

-

What are the benefits of using the Scott Credit Union desktop login?

The primary benefit of the Scott Credit Union desktop login is the convenience it provides for accessing account information at any time. Users can monitor their accounts, manage transactions, and utilize various banking services efficiently from their desktops.

-

Is the Scott Credit Union desktop login secure?

Absolutely, the Scott Credit Union desktop login is designed with security in mind. It employs advanced encryption and multifactor authentication to protect your personal and financial information, ensuring safe access to your accounts.

-

What should I do if I forget my Scott Credit Union desktop login credentials?

If you forget your Scott Credit Union desktop login credentials, simply click on the 'Forgot Username or Password?' link on the login page. Follow the prompts to reset your password or retrieve your username securely.

Get more for Scott Credit Union Skip A Payment

Find out other Scott Credit Union Skip A Payment

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online