PPP Loan Forgiveness Application Released by SBA the 2020

What is the PPP Loan Forgiveness Application Released By SBA The

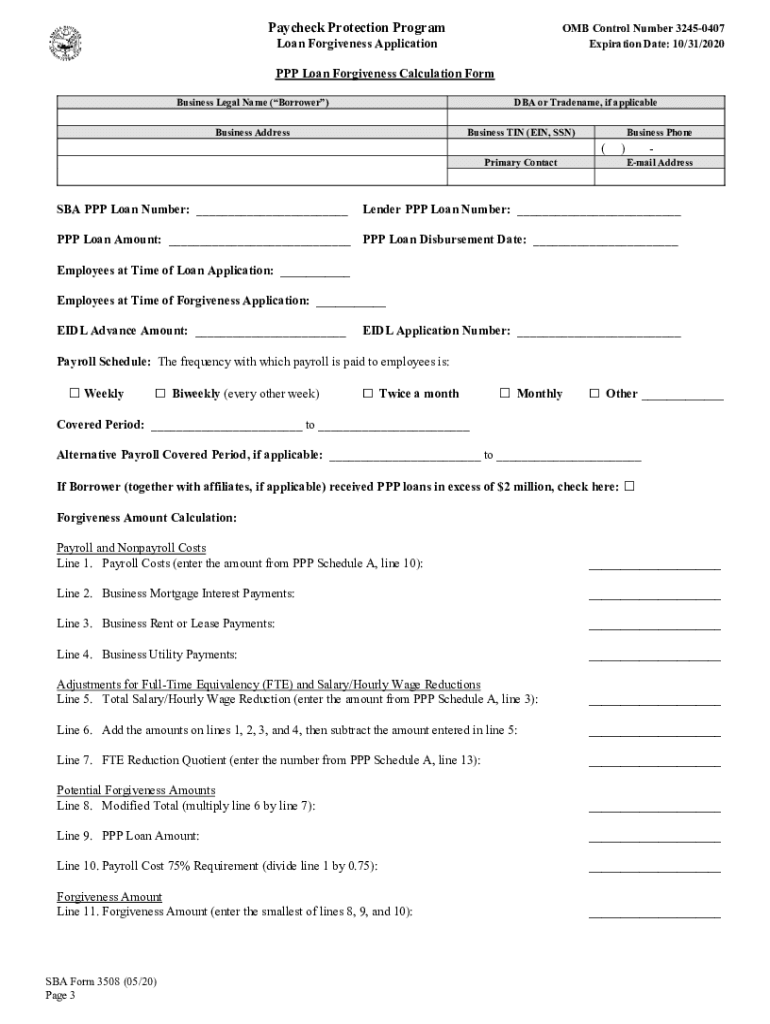

The PPP Loan Forgiveness Application released by the SBA is a critical document for businesses that received funding through the Paycheck Protection Program (PPP). This application allows borrowers to request forgiveness for the loans they received, which were intended to help cover payroll costs, rent, utilities, and other eligible expenses during the COVID-19 pandemic. The form outlines the necessary information that businesses must provide to demonstrate that they have used the funds in accordance with the program's requirements.

Steps to complete the PPP Loan Forgiveness Application Released By SBA The

Completing the PPP Loan Forgiveness Application involves several key steps. First, businesses must gather all relevant documentation, including payroll records, tax filings, and receipts for eligible expenses. Next, they should fill out the application form accurately, ensuring all required fields are completed. It is essential to calculate the total amount of loan forgiveness requested based on eligible expenses incurred during the covered period. Finally, businesses must submit the completed application to their lender, along with all supporting documents, to initiate the forgiveness process.

Required Documents

To successfully complete the PPP Loan Forgiveness Application, borrowers need to provide several key documents. These typically include:

- Payroll documentation, such as bank statements or payroll reports.

- Tax forms, including IRS Form 941 and state payroll tax filings.

- Receipts or invoices for rent, utilities, and other eligible non-payroll expenses.

- Records of any salary reductions or changes in employee headcount.

Having these documents ready will facilitate a smoother application process and help ensure that the request for forgiveness is justified.

Eligibility Criteria

Eligibility for loan forgiveness under the PPP is contingent upon meeting specific criteria set forth by the SBA. Borrowers must have used the loan proceeds for eligible expenses, which include payroll costs, rent, utilities, and certain other expenses. Additionally, businesses must maintain their employee headcount and salary levels during the covered period to qualify for full forgiveness. Understanding these criteria is essential for businesses to maximize their chances of receiving loan forgiveness.

Form Submission Methods (Online / Mail / In-Person)

The PPP Loan Forgiveness Application can be submitted through various methods, depending on the lender's requirements. Most lenders allow borrowers to submit the application online through their portals, which is often the quickest and most efficient method. Some lenders may also accept applications via mail or in-person submissions. It is important for borrowers to verify their lender's preferred submission method to ensure timely processing of their forgiveness request.

Application Process & Approval Time

The application process for the PPP Loan Forgiveness involves submitting the completed form and supporting documentation to the lender. Once submitted, the lender has a specific timeframe to review the application and make a decision. Typically, lenders must respond within sixty days of receiving the application. If approved, the lender will notify the SBA, which will then provide the final decision regarding forgiveness. Understanding this timeline can help businesses plan accordingly and manage their finances effectively.

Quick guide on how to complete ppp loan forgiveness application released by sba the

Effortlessly Prepare PPP Loan Forgiveness Application Released By SBA The on Any Device

Managing documents online has become increasingly preferred by businesses and individuals alike. It offers a fantastic eco-friendly alternative to conventional printed and signed paperwork, as you can locate the right form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents promptly without delays. Handle PPP Loan Forgiveness Application Released By SBA The on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

How to Alter and eSign PPP Loan Forgiveness Application Released By SBA The with Ease

- Locate PPP Loan Forgiveness Application Released By SBA The and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign PPP Loan Forgiveness Application Released By SBA The and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ppp loan forgiveness application released by sba the

Create this form in 5 minutes!

How to create an eSignature for the ppp loan forgiveness application released by sba the

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the PPP Loan Forgiveness Application Released By SBA The?

The PPP Loan Forgiveness Application Released By SBA The is a standardized form issued by the Small Business Administration to streamline the process for businesses seeking loan forgiveness under the Paycheck Protection Program. This application outlines the necessary documentation and criteria for qualifying expenses to ensure businesses can maximize their forgiveness eligibility.

-

How can airSlate SignNow assist with the PPP Loan Forgiveness Application Released By SBA The?

airSlate SignNow is designed to simplify the signing and submission process for the PPP Loan Forgiveness Application Released By SBA The. With its user-friendly eSignature features, businesses can quickly fill out their applications, obtain necessary signatures, and securely send their documents, all within one platform.

-

Is airSlate SignNow cost-effective for managing the PPP Loan Forgiveness Application Released By SBA The?

Yes, airSlate SignNow offers a cost-effective solution for managing the PPP Loan Forgiveness Application Released By SBA The. With its competitive pricing plans, users can access advanced features that make document handling and eSigning affordable without compromising on quality and security.

-

What features of airSlate SignNow support the submission of the PPP Loan Forgiveness Application Released By SBA The?

airSlate SignNow provides a variety of features that enhance the submission process for the PPP Loan Forgiveness Application Released By SBA The. Key features include customizable templates, in-app document editing, secure eSignature capabilities, and real-time tracking of document status to ensure seamless and efficient submissions.

-

Can I integrate airSlate SignNow with other applications to manage the PPP Loan Forgiveness Application Released By SBA The?

Absolutely! airSlate SignNow easily integrates with numerous applications, enabling businesses to streamline their workflows related to the PPP Loan Forgiveness Application Released By SBA The. This integration capability enhances productivity by allowing you to connect your favorite tools and manage all document processes in one place.

-

What are the benefits of using airSlate SignNow for the PPP Loan Forgiveness Application Released By SBA The?

Using airSlate SignNow for the PPP Loan Forgiveness Application Released By SBA The offers numerous benefits, including signNow time savings, enhanced accuracy, and improved compliance with SBA requirements. The platform's intuitive design ensures that businesses can navigate through their loan forgiveness application without hassle.

-

Is airSlate SignNow secure for handling the PPP Loan Forgiveness Application Released By SBA The?

Yes, security is a top priority for airSlate SignNow. The platform complies with industry standards and utilizes advanced encryption measures to protect sensitive information throughout the process of handling the PPP Loan Forgiveness Application Released By SBA The, ensuring your data remains secure and confidential.

Get more for PPP Loan Forgiveness Application Released By SBA The

- Patented form

- Agreement condominium form

- Agreement between lender borrower form

- Condominium unit form

- Wphospital org medical release form

- Financial policy for physicians office form

- Authorization release insurance information

- Identification of insurance for college or university and authorization form

Find out other PPP Loan Forgiveness Application Released By SBA The

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free