Et 4310 Form

What is the ET 4310?

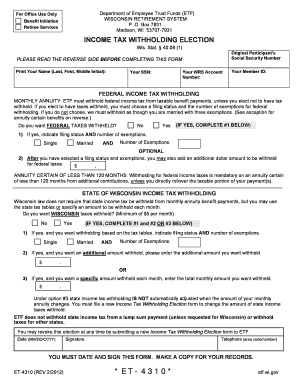

The ET 4310 is a Wisconsin tax form used for reporting various tax-related information. This form is essential for individuals and businesses in the state who need to comply with specific tax obligations. It is particularly relevant for those involved in electronic funds transfers, as it helps streamline the reporting process. Understanding the purpose of the ET 4310 is crucial for ensuring accurate tax filings and maintaining compliance with state regulations.

Steps to Complete the ET 4310

Completing the ET 4310 involves a series of straightforward steps. First, gather all necessary information, including personal identification details and financial data relevant to the reporting period. Next, accurately fill out each section of the form, ensuring that all entries are correct and complete. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, whether online or via mail.

Legal Use of the ET 4310

The ET 4310 is legally recognized as a valid document when completed and submitted in accordance with Wisconsin tax laws. To ensure its legal standing, it is important to adhere to the requirements set forth by the state, including proper signatures and compliance with electronic signature regulations. Utilizing a reliable eSignature solution can enhance the legal validity of the form, providing a secure and compliant way to sign and submit the document.

How to Obtain the ET 4310

Obtaining the ET 4310 is a simple process. The form can be accessed through the official Wisconsin Department of Revenue website or other authorized state resources. It is available in both digital and printable formats, allowing users to choose their preferred method of completion. Ensure that you are using the most current version of the form to avoid any issues during submission.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is critical for compliance with tax regulations. For the ET 4310, specific deadlines may vary based on the reporting period and the taxpayer's circumstances. It is advisable to check the Wisconsin Department of Revenue's official announcements for the latest information on due dates to ensure timely submission and avoid potential penalties.

Form Submission Methods

The ET 4310 can be submitted through various methods, providing flexibility for taxpayers. Options typically include online submission via the Wisconsin Department of Revenue's e-filing system, mailing a printed version of the form, or submitting it in person at designated state offices. Each method has its own set of guidelines, so it is important to follow the instructions carefully to ensure successful filing.

Key Elements of the ET 4310

Understanding the key elements of the ET 4310 is essential for accurate completion. The form typically includes sections for personal information, tax identification numbers, and specific financial data relevant to the reporting requirements. Each section must be filled out with precise information to ensure compliance and facilitate the processing of the form by the state tax authorities.

Quick guide on how to complete et 4310

Effortlessly prepare Et 4310 on any device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage Et 4310 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to adjust and eSign Et 4310 with ease

- Locate Et 4310 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Modify and eSign Et 4310 to guarantee outstanding communication throughout all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the et 4310

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the et 4310 and how does it relate to airSlate SignNow?

The et 4310 is a vital feature within airSlate SignNow that streamlines the electronic signing process. By utilizing the et 4310, businesses can ensure compliant and efficient document management, reducing turnaround times signNowly while maintaining security.

-

How much does airSlate SignNow with the et 4310 feature cost?

airSlate SignNow offers competitive pricing plans that include the valuable et 4310 feature. These plans are designed to cater to various business needs, ensuring that you receive the best possible value for an efficient eSigning experience.

-

What are the key features of the et 4310 in airSlate SignNow?

The et 4310 includes essential features such as customizable templates, secure document storage, and real-time tracking. These functionalities empower users to manage their eSignatures seamlessly within airSlate SignNow, enhancing productivity.

-

Can I integrate airSlate SignNow with other software while using the et 4310 feature?

Yes, airSlate SignNow supports numerous integrations, enabling users to connect the et 4310 feature with their favorite applications. These integrations facilitate a smoother workflow, allowing you to manage documents across platforms easily.

-

What benefits does the et 4310 provide for small businesses?

For small businesses, the et 4310 feature in airSlate SignNow offers cost-effective solutions to streamline operations. The automated eSigning process not only saves time but also helps maintain professional interactions with clients.

-

Is the et 4310 easy to use for individuals new to eSigning?

Absolutely! The et 4310 in airSlate SignNow is designed with user-friendliness in mind, making it accessible even for individuals who are new to eSigning. The intuitive interface ensures that users can easily navigate and complete their signing tasks.

-

What types of documents can I sign using the et 4310?

The et 4310 within airSlate SignNow allows you to sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes it an essential tool for businesses across different industries.

Get more for Et 4310

Find out other Et 4310

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement