Sasr Payroll Form

What is the Sasr Payroll

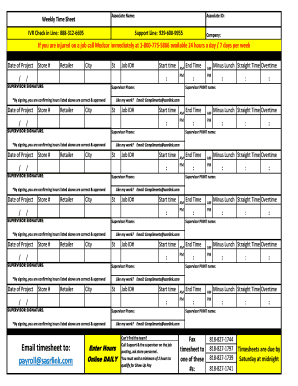

The Sasr Payroll is a specific document used for payroll processing within the SASR (Strategic Allied Services Resources) framework. It serves as a record of employee hours worked, wages earned, and deductions applicable. This form is essential for businesses to maintain accurate payroll records and ensure compliance with federal and state regulations. The Sasr Payroll form is designed to streamline the payroll process, making it easier for employers to manage employee compensation effectively.

How to use the Sasr Payroll

Using the Sasr Payroll involves several steps to ensure accuracy and compliance. First, employers must collect data on employee hours worked, including regular and overtime hours. Next, this information is entered into the Sasr Payroll form, detailing each employee's earnings and deductions. After completing the form, employers should review it for accuracy before submitting it for processing. Utilizing electronic signatures through platforms like signNow can enhance the efficiency of this process, ensuring that all necessary approvals are obtained swiftly.

Steps to complete the Sasr Payroll

Completing the Sasr Payroll requires a systematic approach to ensure all information is accurate and compliant. Here are the essential steps:

- Gather employee time records for the payroll period.

- Calculate total hours worked, including regular and overtime hours.

- Determine gross pay by applying the appropriate wage rates.

- Calculate deductions for taxes, benefits, and other withholdings.

- Fill out the Sasr Payroll form with the calculated figures.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate payroll processing department.

Legal use of the Sasr Payroll

The legal use of the Sasr Payroll is governed by various federal and state regulations. It is crucial for businesses to ensure that the form is completed accurately to avoid potential legal issues. Compliance with the Fair Labor Standards Act (FLSA) and other relevant labor laws is essential. Additionally, maintaining proper records of payroll transactions can protect businesses in case of audits or disputes. Utilizing a trusted eSignature solution can further enhance the legal standing of the Sasr Payroll by providing a secure method for obtaining necessary signatures.

Key elements of the Sasr Payroll

Several key elements are essential for the effective use of the Sasr Payroll. These include:

- Employee Information: Name, identification number, and job title.

- Hours Worked: Total hours for regular and overtime pay.

- Gross Pay: Total earnings before deductions.

- Deductions: Taxes and other withholdings.

- Net Pay: Final amount received by the employee.

Form Submission Methods

The Sasr Payroll can be submitted through various methods, depending on the preferences of the business and the requirements of the payroll processing system. Common submission methods include:

- Online Submission: Utilizing payroll software or platforms like signNow for electronic submission.

- Mail: Sending a hard copy of the completed form to the payroll department.

- In-Person: Delivering the form directly to the payroll office for processing.

Quick guide on how to complete sasr payroll

Effortlessly Prepare Sasr Payroll on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the essential tools to swiftly create, modify, and electronically sign your documents without delays. Handle Sasr Payroll on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and Electronically Sign Sasr Payroll Effortlessly

- Obtain Sasr Payroll and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your amendments.

- Choose how you prefer to share your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Sasr Payroll and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sasr payroll

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary benefit of using airSlate SignNow?

The primary benefit of using airSlate SignNow is that it empowers businesses to streamline their document signing process. By calling 18007755866, you can learn how SignNow provides a user-friendly and cost-effective solution that enhances efficiency and saves time for all document workflows.

-

How does airSlate SignNow handle document security?

airSlate SignNow prioritizes document security by offering advanced encryption and compliance with legal standards. When you signNow out to 18007755866, you can get information on how our platform ensures sensitive information remains protected throughout the eSigning process.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers competitive pricing plans to suit different business needs. For detailed information about plans and any potential promotions, feel free to call us at 18007755866 and our team will assist you.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various software applications such as Salesforce, Google Drive, and Dropbox. Contact us at 18007755866 to discuss specific integrations that can enhance your workflow.

-

Is it difficult to get started with airSlate SignNow?

Not at all! airSlate SignNow is designed to be user-friendly, making it easy for anyone to get started with electronic signatures. If you need help, just call 18007755866 for personalized guidance on setting up your account.

-

What types of documents can be signed using airSlate SignNow?

With airSlate SignNow, you can sign a wide variety of documents, including contracts, NDAs, and forms. For specific use cases or any additional questions, don't hesitate to signNow out to us at 18007755866.

-

Does airSlate SignNow offer a free trial?

Yes, airSlate SignNow provides a free trial for new users to explore its features. To find out more about obtaining your trial and what it includes, simply call 18007755866.

Get more for Sasr Payroll

- 2014 form 3805v net operating loss nol computation and nol and disaster loss limitationsindividuals estates and trusts

- Form nj w4 3 07 r 12 2007

- Cbt 100 new jersey corporation business tax return njgov 33809551 form

- Earned income tax credit njgov form

- Cbt 100 form 2006 nj

- Nj resale certificate form

- Cbt 100 instructions form

Find out other Sasr Payroll

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter