Individual Credit Application Kentucky Form

What is the Individual Credit Application Kentucky

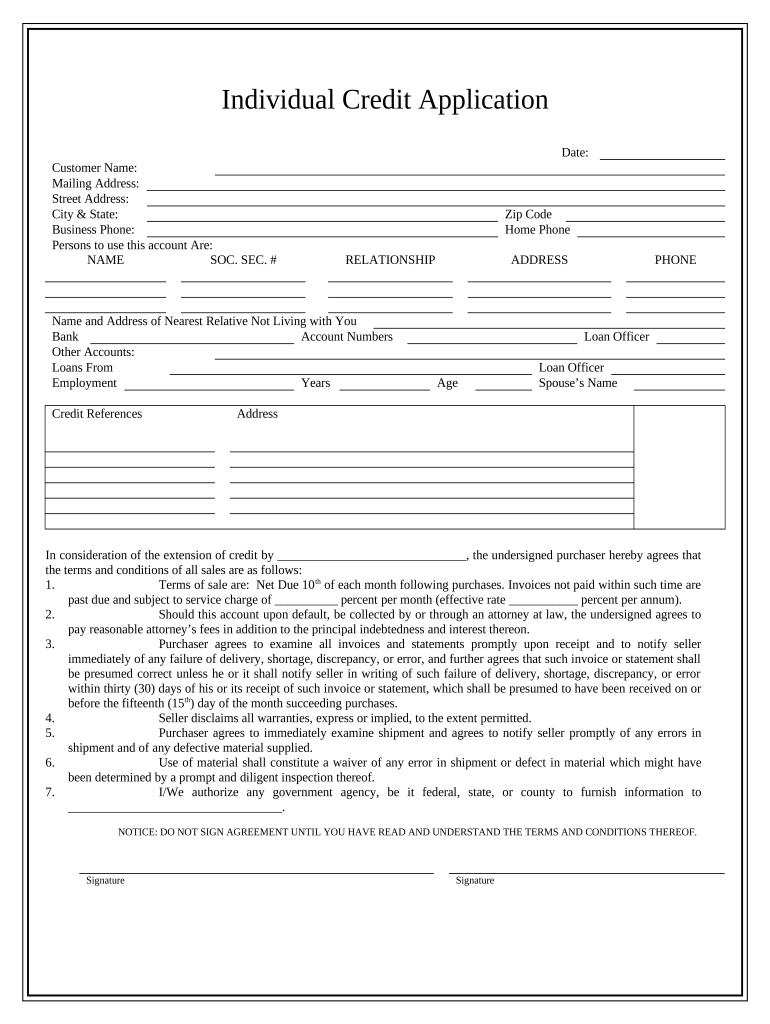

The Individual Credit Application Kentucky is a formal document used by individuals seeking to apply for credit within the state. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically includes details such as the applicant's name, address, social security number, employment information, and income. By providing this information, lenders can evaluate the risk of extending credit and determine the terms of the loan or credit line.

How to use the Individual Credit Application Kentucky

Using the Individual Credit Application Kentucky involves several straightforward steps. First, obtain the application from a lender or financial institution. Next, fill out the form accurately, ensuring all required fields are completed. After filling out the application, review it for any errors or omissions. Once confirmed, submit the application as instructed, either online, by mail, or in person. It is important to keep a copy of the submitted application for your records.

Steps to complete the Individual Credit Application Kentucky

Completing the Individual Credit Application Kentucky requires attention to detail. Follow these steps for a successful submission:

- Gather necessary documentation, such as proof of income and identification.

- Provide accurate personal information, including your full name, address, and social security number.

- Disclose your employment details and income sources.

- Review the application for accuracy and completeness.

- Submit the application according to the lender's specified method.

Key elements of the Individual Credit Application Kentucky

Key elements of the Individual Credit Application Kentucky include personal identification information, financial history, and employment details. Applicants must provide their full name, address, and social security number to verify identity. Additionally, the application typically requires information about current employment, monthly income, and any existing debts. This information helps lenders assess the applicant's financial stability and ability to repay the borrowed amount.

Legal use of the Individual Credit Application Kentucky

The legal use of the Individual Credit Application Kentucky is governed by federal and state regulations that protect consumer rights. It is essential for the application to be completed truthfully, as providing false information can lead to legal consequences. Furthermore, lenders must comply with the Fair Credit Reporting Act, ensuring that any credit checks performed adhere to legal standards. This protects both the applicant and the lender during the credit evaluation process.

Eligibility Criteria

Eligibility criteria for the Individual Credit Application Kentucky generally include being a legal resident of Kentucky, having a valid social security number, and being of legal age, typically eighteen years or older. Lenders may also consider the applicant's credit history, income level, and existing debt obligations when determining eligibility. Meeting these criteria is crucial for a successful credit application.

Quick guide on how to complete individual credit application kentucky

Complete Individual Credit Application Kentucky effortlessly on any device

Virtual document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can access the proper form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Individual Credit Application Kentucky on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Individual Credit Application Kentucky with ease

- Access Individual Credit Application Kentucky and click on Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mismanaged documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Individual Credit Application Kentucky to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Individual Credit Application Kentucky and how does it work?

The Individual Credit Application Kentucky is a streamlined form designed to collect necessary personal and financial information for credit evaluations. By using airSlate SignNow, users can easily send and eSign this application, ensuring a secure and efficient application process.

-

How much does it cost to use the Individual Credit Application Kentucky with airSlate SignNow?

Using airSlate SignNow to manage your Individual Credit Application Kentucky is cost-effective, with flexible pricing plans to suit businesses of all sizes. The pricing depends on the features and the number of users you require, making it an affordable option for easily handling credit applications.

-

What features are included in the Individual Credit Application Kentucky solution?

The Individual Credit Application Kentucky solution includes features such as customizable templates, electronic signatures, secure data storage, and easy document sharing. These features ensure that your application process runs smoothly while maintaining compliance and security.

-

How does airSlate SignNow benefit the Individual Credit Application Kentucky process?

airSlate SignNow benefits the Individual Credit Application Kentucky process by simplifying the way applications are sent and signed. The platform enhances productivity, reduces paper use, and offers real-time tracking, making it easier for businesses to manage their credit intake.

-

Is the Individual Credit Application Kentucky customizable?

Yes, the Individual Credit Application Kentucky can be easily customized to fit your specific requirements. With airSlate SignNow, you can modify templates to include the exact information fields you need, ensuring a tailored application process that meets your business's needs.

-

Can I integrate airSlate SignNow with other software for the Individual Credit Application Kentucky?

Absolutely! airSlate SignNow can be integrated with a variety of software applications, allowing for seamless data transfer and process automation. This ability enhances the functionality of the Individual Credit Application Kentucky, making it easier to manage applications alongside your existing systems.

-

How secure is the data for the Individual Credit Application Kentucky on airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs encryption and robust security protocols to protect sensitive data associated with the Individual Credit Application Kentucky, ensuring that all information remains safe and confidential throughout the signing process.

Get more for Individual Credit Application Kentucky

- Lifewireless form

- Honey jar labels printable form

- Bsc exam form

- In service attendance form

- Developing skills all in one practice vol 1 form

- Imo crew effects declaration form

- 5013 r t1 general income tax benefit return for non residents and deemed residents of canada non residents of canada form

- New jersey earned income tax credit nj gov form

Find out other Individual Credit Application Kentucky

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online