France Individual Dt Form

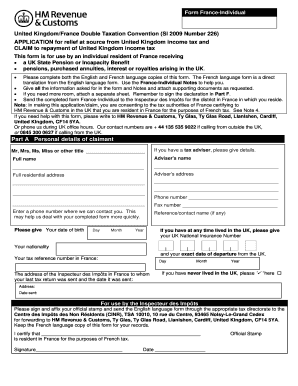

What is the France Individual Dt Form

The France Individual Dt Form is a tax document used for reporting income and claiming benefits under the double taxation agreement between France and the United States. This form is essential for individuals who have financial ties to both countries, ensuring that they do not pay taxes on the same income in both jurisdictions. The form facilitates proper tax reporting and compliance with international tax laws, making it a critical tool for expatriates and international workers.

How to use the France Individual Dt Form

Using the France Individual Dt Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and proof of residency in both countries. Next, fill out the form with accurate information regarding your income sources and any applicable deductions. It is important to review the completed form for accuracy before submission to avoid potential penalties. Finally, submit the form according to the specified guidelines, either online or via traditional mail.

Steps to complete the France Individual Dt Form

Completing the France Individual Dt Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as W-2s, 1099s, and any foreign income statements.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Report your income from all sources, ensuring to include any foreign income that may be subject to taxation.

- Claim any deductions or credits available under the double taxation treaty.

- Review the form for accuracy and completeness before submission.

Legal use of the France Individual Dt Form

The France Individual Dt Form is legally binding when completed and submitted according to the regulations set forth by both the French and U.S. tax authorities. It must be signed and dated by the taxpayer to confirm the accuracy of the information provided. Compliance with the legal requirements ensures that the form is recognized for tax purposes, protecting the taxpayer from potential legal issues related to double taxation.

Filing Deadlines / Important Dates

Filing deadlines for the France Individual Dt Form are crucial for compliance. Typically, the form must be submitted by April 15 of the tax year following the income earned. However, if you are residing outside the United States, you may qualify for an automatic extension until June 15. It is essential to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or updates from tax authorities.

Required Documents

To complete the France Individual Dt Form, several documents are required. These typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation of any foreign income earned.

- Residency certificates from both France and the United States.

- Any relevant tax documents that support deductions or credits claimed.

Form Submission Methods (Online / Mail / In-Person)

Submitting the France Individual Dt Form can be done through various methods. Taxpayers can choose to file online using designated tax software that supports international forms. Alternatively, the form can be printed and mailed to the appropriate tax authority. In some cases, in-person submission may be possible at local tax offices. Each method has its own guidelines, so it is important to follow the instructions provided for the chosen submission method.

Quick guide on how to complete france individual dt form

Effortlessly Prepare France Individual Dt Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage France Individual Dt Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Edit and eSign France Individual Dt Form with Ease

- Obtain France Individual Dt Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and eSign France Individual Dt Form to ensure excellent communication during every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the france individual dt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the France individual DT form?

The France individual DT form is a document utilized for tax declaration purposes by individuals residing in France. It outlines income and other relevant financial details for accurate tax assessment. Completing this form accurately is essential for compliance with French tax regulations.

-

How can airSlate SignNow assist with the France individual DT form?

airSlate SignNow provides a streamlined platform to create, send, and electronically sign the France individual DT form. Our user-friendly interface ensures that you can manage your documents efficiently. With airSlate SignNow, you can also track the status of your documents in real-time.

-

Is there a cost associated with using airSlate SignNow for the France individual DT form?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs when it comes to the France individual DT form. Basic plans start at an affordable monthly rate, with additional features available in higher tiers. This flexibility allows you to choose a package that best suits your requirements.

-

What features does airSlate SignNow offer for managing the France individual DT form?

AirSlate SignNow offers features like cloud storage, collaboration tools, and automated workflows to simplify the management of the France individual DT form. You can easily create templates, customize fields, and send reminders. This enhances efficiency and reduces errors during the signing process.

-

Can I integrate airSlate SignNow with other applications for the France individual DT form?

Absolutely! airSlate SignNow supports integrations with popular applications that you may already be using, such as Google Drive and Microsoft Office. This seamless integration allows for better document management and makes it easier to handle the France individual DT form within your existing workflows.

-

How secure is airSlate SignNow when handling the France individual DT form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect sensitive information associated with the France individual DT form. Additionally, our compliance with industry standards ensures that your data remains safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for the France individual DT form?

Using airSlate SignNow for the France individual DT form offers numerous benefits including time savings, improved accuracy, and enhanced convenience. You can expedite the document signing process while ensuring compliance with French regulations. This ultimately helps you focus on your core business activities.

Get more for France Individual Dt Form

- Ssa 821 work activity report soar works form

- Forms schools and libraries program usacorg

- Ps form 2181 d disclosure and authorization for usps

- United states postal service postage statement nonprofit form

- Fillable form ssa 521free printable pdf sampleformswift

- Proppraprocurementrequest for proposalfree 30 day form

- Form ssa 2 information you need to apply for social security

- Conveyance inspection guidance colorado form

Find out other France Individual Dt Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document