First Time Maryland Homebuyer Transfer and Recordation Tax Addendum PDF Form

What is the First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

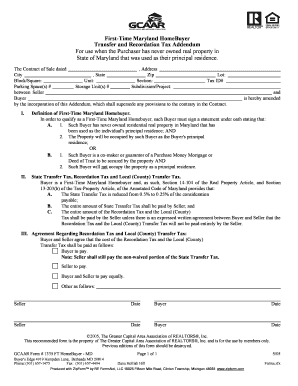

The First Time Maryland Homebuyer Transfer and Recordation Tax Addendum is a crucial document for individuals purchasing their first home in Maryland. This addendum allows eligible first-time homebuyers to apply for a reduction in transfer and recordation taxes, which can significantly lower the overall cost of purchasing a property. The form outlines the specific eligibility criteria and provides the necessary information to ensure compliance with Maryland state regulations. It is important for buyers to understand the implications of this addendum, as it can influence both the financial aspects of the home purchase and the legal obligations associated with property ownership.

How to Use the First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

Using the First Time Maryland Homebuyer Transfer and Recordation Tax Addendum involves several key steps. First, download the PDF form from a trusted source. Next, fill out the required fields, ensuring that all information is accurate and complete. This includes providing personal details, property information, and confirming eligibility as a first-time homebuyer. After completing the form, it must be signed and dated by all parties involved in the transaction. Finally, submit the addendum along with other required documents to the appropriate local government office or during the closing process of the home purchase.

Steps to Complete the First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

Completing the First Time Maryland Homebuyer Transfer and Recordation Tax Addendum requires careful attention to detail. Follow these steps for successful completion:

- Download the PDF form from a reliable source.

- Fill in your full name, address, and contact information.

- Provide details about the property being purchased, including the address and purchase price.

- Confirm your eligibility by checking the appropriate boxes regarding first-time homebuyer status.

- Sign and date the form, ensuring all parties involved do the same.

- Submit the completed form with your closing documents.

Key Elements of the First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

The First Time Maryland Homebuyer Transfer and Recordation Tax Addendum includes several key elements that are essential for its validity. These elements consist of:

- Identification of the buyer and seller.

- Property details, including the address and tax identification number.

- Confirmation of first-time homebuyer status.

- Signature lines for all parties involved.

- Instructions for submission and any additional documentation required.

Legal Use of the First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

The legal use of the First Time Maryland Homebuyer Transfer and Recordation Tax Addendum is governed by Maryland state law. To ensure the addendum is legally binding, it must be completed accurately and submitted in accordance with local regulations. The form serves as an official request for tax reduction, and failure to adhere to the guidelines may result in non-compliance. It is advisable for homebuyers to consult with a real estate attorney or a qualified professional to ensure that all legal requirements are met during the home buying process.

Eligibility Criteria for the First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

To qualify for the benefits outlined in the First Time Maryland Homebuyer Transfer and Recordation Tax Addendum, buyers must meet specific eligibility criteria. These criteria typically include:

- The buyer must be a first-time homebuyer, defined as someone who has not owned a home in the past three years.

- The property must be located in Maryland and used as the buyer's primary residence.

- The purchase price of the home must fall within the limits set by the state.

- The buyer must provide necessary documentation proving eligibility, such as income verification and prior homeownership history.

Quick guide on how to complete first time maryland homebuyer transfer and recordation tax addendum pdf

Complete First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your papers quickly without delays. Manage First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf effortlessly

- Obtain First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would prefer to send your form, by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device you choose. Revise and eSign First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the first time maryland homebuyer transfer and recordation tax addendum pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the first time Maryland homebuyer transfer and recordation tax addendum PDF?

The first time Maryland homebuyer transfer and recordation tax addendum PDF is a document designed to assist first-time homebuyers in Maryland. It outlines the terms and conditions related to the transfer and recordation tax exemptions available to eligible homeowners, ensuring they can take advantage of potential savings during the home buying process.

-

How can I access the first time Maryland homebuyer transfer and recordation tax addendum PDF?

You can easily access the first time Maryland homebuyer transfer and recordation tax addendum PDF through airSlate SignNow. Our platform allows you to download, fill out, and eSign the document conveniently, streamlining your homebuying paperwork.

-

Are there any fees associated with using the first time Maryland homebuyer transfer and recordation tax addendum PDF through airSlate SignNow?

While the first time Maryland homebuyer transfer and recordation tax addendum PDF itself is free, airSlate SignNow offers subscription plans that enable cost-effective eSigning and document management features. These plans are designed to fit varying budgets while ensuring you can prepare essential documents without hassle.

-

What features does airSlate SignNow offer for eSigning the first time Maryland homebuyer transfer and recordation tax addendum PDF?

AirSlate SignNow provides intuitive eSigning features for the first time Maryland homebuyer transfer and recordation tax addendum PDF, including a user-friendly interface and secure signing options. You can sign documents electronically from any device, making it easy to complete your paperwork anytime, anywhere.

-

What benefits do I get from using airSlate SignNow for the first time Maryland homebuyer transfer and recordation tax addendum PDF?

Using airSlate SignNow for the first time Maryland homebuyer transfer and recordation tax addendum PDF offers numerous benefits, including increased efficiency, real-time tracking of document status, and reduced processing time. Our platform helps simplify the homebuying process, allowing you to focus on finding your new home.

-

Can airSlate SignNow integrate with other tools for managing real estate documents?

Yes, airSlate SignNow integrates seamlessly with various real estate management tools, making it easier to manage documents like the first time Maryland homebuyer transfer and recordation tax addendum PDF. This integration enhances your workflow, allowing you to keep all your important documents organized in one place.

-

Is the first time Maryland homebuyer transfer and recordation tax addendum PDF applicable for all Maryland homebuyers?

The first time Maryland homebuyer transfer and recordation tax addendum PDF is specifically tailored for first-time homebuyers in Maryland who meet certain eligibility criteria. It's important to review your qualifications to ensure you can benefit from the tax exemptions outlined in the document.

Get more for First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

Find out other First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer