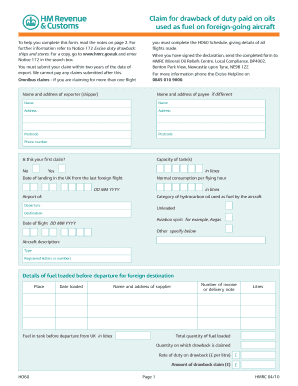

Ho60 Form

What is the HO60?

The HO60 form is an important document used for various legal and tax purposes in the United States. It serves as a request for information from the HMRC (Her Majesty's Revenue and Customs) regarding tax matters. Understanding the purpose of this form is crucial for individuals and businesses alike, as it can impact tax filings and compliance.

How to use the HO60

Using the HO60 form involves several steps to ensure that the information requested is accurate and complete. First, gather all necessary documentation related to your tax situation. This may include previous tax returns, financial statements, and any other relevant records. Next, fill out the form carefully, ensuring that all fields are completed. Once the form is filled out, submit it through the appropriate channels, which may include online submission, mailing, or in-person delivery, depending on the specific requirements.

Steps to complete the HO60

Completing the HO60 form requires attention to detail. Follow these steps for a smooth process:

- Review the form instructions thoroughly to understand the requirements.

- Collect all necessary documents to support your request.

- Fill out the form, ensuring accuracy in all entries.

- Double-check the form for any errors or omissions.

- Choose your submission method: online, by mail, or in person.

- Keep a copy of the completed form for your records.

Legal use of the HO60

The legal use of the HO60 form is governed by specific regulations and guidelines. It is essential to ensure that the form is filled out correctly to maintain its validity. The form must be submitted within the established deadlines to avoid penalties. Additionally, compliance with federal and state laws regarding tax information requests is crucial to ensure that the submitted form is legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the HO60 form can vary depending on the specific circumstances of the request. It is important to be aware of these dates to avoid any potential penalties or issues with tax compliance. Generally, forms should be submitted well in advance of any relevant tax deadlines to allow for processing time. Checking the official IRS guidelines or consulting a tax professional can provide clarity on specific deadlines.

Form Submission Methods

The HO60 form can be submitted through various methods, including online, by mail, or in person. Online submission is often the fastest and most efficient method, allowing for immediate processing. If submitting by mail, ensure that you send the form to the correct address and allow sufficient time for delivery. In-person submissions may be required in certain situations, such as when additional documentation is needed.

Quick guide on how to complete ho60

Effortlessly prepare Ho60 on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage Ho60 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest way to edit and eSign Ho60 effortlessly

- Locate Ho60 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Ho60 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ho60

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are HMRC forms online, and how can they be completed using airSlate SignNow?

HMRC forms online are official documents required for tax reporting and other compliance purposes. With airSlate SignNow, you can easily complete and eSign these forms securely, ensuring compliance and accuracy with every submission.

-

How much does it cost to use airSlate SignNow for HMRC forms online?

airSlate SignNow offers various pricing plans tailored to different business needs, starting from affordable options for small enterprises. Each plan provides access to tools that streamline the process of filling out HMRC forms online efficiently.

-

What features does airSlate SignNow offer for handling HMRC forms online?

airSlate SignNow comes equipped with features such as document templates, advanced eSignature capabilities, and real-time tracking. These tools are designed to make the submission of HMRC forms online not only quick but also hassle-free.

-

Can I integrate airSlate SignNow with other applications for managing HMRC forms online?

Yes, airSlate SignNow supports integration with various applications like Google Drive, CRM systems, and cloud storage solutions. This flexibility ensures that you can manage your HMRC forms online seamlessly within your preferred workflow.

-

Is airSlate SignNow secure for submitting HMRC forms online?

Absolutely. airSlate SignNow uses industry-leading encryption and security protocols to protect your data. When you submit HMRC forms online, you can rest assured that your information is safe and kept private.

-

How do I get started with filling out HMRC forms online using airSlate SignNow?

Getting started is simple! Just sign up for an airSlate SignNow account, choose your desired plan, and access our library of templates for HMRC forms online. Follow the intuitive interface to complete and eSign your documents in minutes.

-

Can airSlate SignNow help ensure compliance when filing HMRC forms online?

Yes, airSlate SignNow guides users through required fields and provides tools to help ensure that all necessary information is included. This greatly reduces the risk of errors and helps maintain compliance when submitting HMRC forms online.

Get more for Ho60

Find out other Ho60

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online