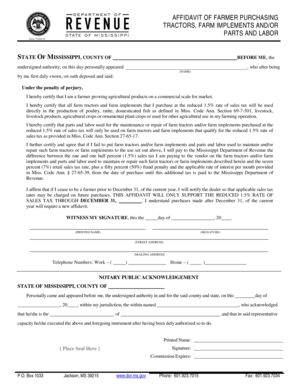

Mississippi Farm Tax Affidavit 2015-2026

What is the Mississippi Farm Tax Affidavit

The Mississippi Farm Tax Affidavit is a legal document that certifies a taxpayer's eligibility for certain tax exemptions related to agricultural activities. It is primarily used by farmers and agricultural producers to affirm their status and ensure compliance with state tax regulations. This affidavit allows individuals to claim exemptions on property taxes for equipment, machinery, and other assets used in farming operations.

How to use the Mississippi Farm Tax Affidavit

To effectively use the Mississippi Farm Tax Affidavit, individuals must complete the form accurately and submit it to the appropriate tax authority. This process typically involves providing detailed information about the farming operation, including the types of crops or livestock produced, the equipment used, and the overall scale of the farming activities. Proper completion ensures that the taxpayer can benefit from the available tax exemptions.

Steps to complete the Mississippi Farm Tax Affidavit

Completing the Mississippi Farm Tax Affidavit involves several key steps:

- Gather necessary information about your farming operation, including income, expenses, and assets.

- Obtain the affidavit form from the Mississippi Department of Revenue or a local tax office.

- Fill out the form, ensuring all sections are completed accurately.

- Sign and date the affidavit to validate the information provided.

- Submit the completed affidavit to your local tax authority by the specified deadline.

Legal use of the Mississippi Farm Tax Affidavit

The Mississippi Farm Tax Affidavit is legally binding and must be used in accordance with state tax laws. It is essential for taxpayers to understand that providing false information on the affidavit can lead to penalties, including fines and loss of tax exemptions. Therefore, it is crucial to ensure that all statements made within the affidavit are truthful and supported by appropriate documentation.

Key elements of the Mississippi Farm Tax Affidavit

Key elements of the Mississippi Farm Tax Affidavit include:

- Taxpayer Information: Name, address, and contact details of the farmer or agricultural producer.

- Farm Operation Details: Description of the farming activities, including types of crops or livestock.

- Asset Information: Details about the equipment and machinery used in the farming operation.

- Signature: A declaration affirming the accuracy of the information provided.

Required Documents

When submitting the Mississippi Farm Tax Affidavit, individuals may need to provide supporting documents, which can include:

- Proof of farming operation, such as sales receipts or invoices.

- Records of equipment purchases and ownership.

- Financial statements that reflect the income and expenses of the farming business.

Quick guide on how to complete mississippi farm tax affidavit

Complete Mississippi Farm Tax Affidavit seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly and without delays. Manage Mississippi Farm Tax Affidavit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Mississippi Farm Tax Affidavit effortlessly

- Locate Mississippi Farm Tax Affidavit and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Mississippi Farm Tax Affidavit to ensure superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mississippi farm tax affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Mississippi farm tax affidavit?

A Mississippi farm tax affidavit is a legal document that verifies the agricultural status of a property for tax exemption purposes. This affidavit helps farmers secure reduced property taxes based on agricultural use. Understanding this affidavit is crucial for ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with Mississippi farm tax affidavit submissions?

airSlate SignNow simplifies the process of submitting Mississippi farm tax affidavits by providing an easy-to-use eSigning platform. Users can securely sign, send, and manage their documents online, ensuring timely submissions and compliance with state requirements. This streamlines the often complicated paperwork associated with tax exemptions.

-

Are there any costs associated with using airSlate SignNow for Mississippi farm tax affidavits?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, making it a cost-effective solution for submitting Mississippi farm tax affidavits. You can choose a plan based on your volume of documents and required features. Pricing is transparent, with no hidden fees, ensuring you get the best value.

-

What features does airSlate SignNow provide for managing Mississippi farm tax affidavits?

airSlate SignNow includes features like document templates, automated workflows, and real-time tracking, all essential for managing Mississippi farm tax affidavits effectively. These tools help users reduce errors, save time, and improve the overall efficiency of the document handling process. Additionally, user-friendly interfaces make navigation simple.

-

Can I integrate airSlate SignNow with other software for Mississippi farm tax affidavits?

Yes, airSlate SignNow offers seamless integrations with various CRM, document management, and accounting software. This allows users to manage Mississippi farm tax affidavits alongside other business processes. Integrating tools can reduce manual entry errors and enhance overall document organization.

-

What are the benefits of using airSlate SignNow for Mississippi farm tax affidavits?

Using airSlate SignNow for Mississippi farm tax affidavits can greatly enhance efficiency and accuracy in document management. The platform allows for quick eSigning, efficient workflows, and easy access to signed copies, ensuring you never miss a deadline. Trusting airSlate SignNow means a streamlined process and peace of mind when filing crucial tax documents.

-

Is it secure to use airSlate SignNow for Mississippi farm tax affidavits?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all Mississippi farm tax affidavits are handled with the utmost care. The platform employs encryption and secure data storage, protecting sensitive information throughout the document signing process. You can confidently manage your legal documents knowing that security is a top priority.

Get more for Mississippi Farm Tax Affidavit

Find out other Mississippi Farm Tax Affidavit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement