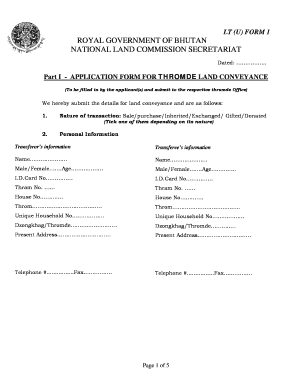

Online Land Transaction Bhutan Form

What is the online land transaction form?

The online land transaction form is a digital document used for the transfer of land ownership in Bhutan. This form facilitates the legal process of buying, selling, or transferring land rights without the need for physical paperwork. By utilizing an electronic format, users can complete the necessary steps for land transactions more efficiently and securely. The online land transaction form is designed to comply with local regulations, ensuring that all legal requirements are met during the transfer process.

Steps to complete the online land transaction form

Completing the online land transaction form involves several key steps to ensure accuracy and compliance. First, gather all required information, including details about the property, the buyer, and the seller. Next, access the online platform where the form is hosted. Fill in the necessary fields with accurate information, ensuring that all data aligns with legal documents. After completing the form, review all entries for correctness. Finally, submit the form electronically, ensuring you receive confirmation of submission for your records.

Legal use of the online land transaction form

The online land transaction form is legally recognized when it meets specific criteria set forth by Bhutanese law. To be valid, the form must include the signatures of all parties involved, which can be accomplished through electronic signature solutions. Additionally, compliance with local regulations, such as those governing land ownership and transfer, is essential. By using a trusted platform that adheres to these legal standards, users can ensure that their transactions are valid and enforceable.

Required documents for the online land transaction form

To successfully complete the online land transaction form, certain documents are typically required. These may include:

- Proof of identity for both the buyer and seller

- Title deed or ownership certificate of the property

- Tax clearance certificates

- Any relevant agreements or contracts related to the transaction

Having these documents ready will streamline the process and help avoid delays in the transaction.

Key elements of the online land transaction form

Several key elements must be included in the online land transaction form to ensure its effectiveness and legal standing. These elements typically consist of:

- Identification details of the buyer and seller

- Description of the property being transferred

- Terms and conditions of the transaction

- Signatures of all parties involved

Incorporating these elements accurately is crucial for the form's acceptance by relevant authorities.

Examples of using the online land transaction form

Examples of scenarios where the online land transaction form can be utilized include:

- A family selling their inherited land to a developer

- An individual purchasing a plot for residential construction

- A business acquiring land for commercial use

These examples illustrate the versatility of the online land transaction form in various real estate situations, making it a valuable tool for all parties involved.

Quick guide on how to complete online land transaction bhutan

Complete Online Land Transaction Bhutan seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and efficiently. Manage Online Land Transaction Bhutan on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to edit and eSign Online Land Transaction Bhutan with minimal effort

- Locate Online Land Transaction Bhutan and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method of delivering your form, via email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Online Land Transaction Bhutan and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the online land transaction bhutan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a land transaction form?

A land transaction form is a legal document used in real estate transactions that facilitates the transfer of ownership of land between parties. With airSlate SignNow, you can easily create, send, and eSign land transaction forms, making the process efficient and straightforward.

-

How does airSlate SignNow help with land transaction forms?

airSlate SignNow streamlines the process of handling land transaction forms by allowing users to create customizable templates and securely eSign documents online. This reduces the need for physical paperwork and speeds up the transaction process signNowly.

-

Is there a cost associated with using airSlate SignNow for land transaction forms?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. Each plan includes features designed to manage land transaction forms effectively, providing a cost-effective solution for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for managing land transaction forms?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications and software, allowing you to manage your land transaction forms efficiently. This ensures you can maintain your workflow and keep your documents organized.

-

What features does airSlate SignNow offer for land transaction forms?

airSlate SignNow provides a range of features for land transaction forms, including custom templates, document tracking, and advanced eSigning options. These features help ensure that every transaction is managed smoothly and securely.

-

How can I ensure the security of my land transaction forms with airSlate SignNow?

Security is a top priority for airSlate SignNow. All land transaction forms are encrypted, and the platform complies with industry standards to ensure your documents are safe from unauthorized access and bsignNowes.

-

What are the benefits of using airSlate SignNow for land transaction forms?

Using airSlate SignNow for land transaction forms offers numerous benefits, including reduced processing time, enhanced collaboration, and improved accuracy in documentation. This leads to more efficient transactions and satisfied clients.

Get more for Online Land Transaction Bhutan

Find out other Online Land Transaction Bhutan

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document