Deed of Sale by Business Entity Personal Representative to Joint Tenants UCBC Form 10 5 7 Minnesota

What is the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota

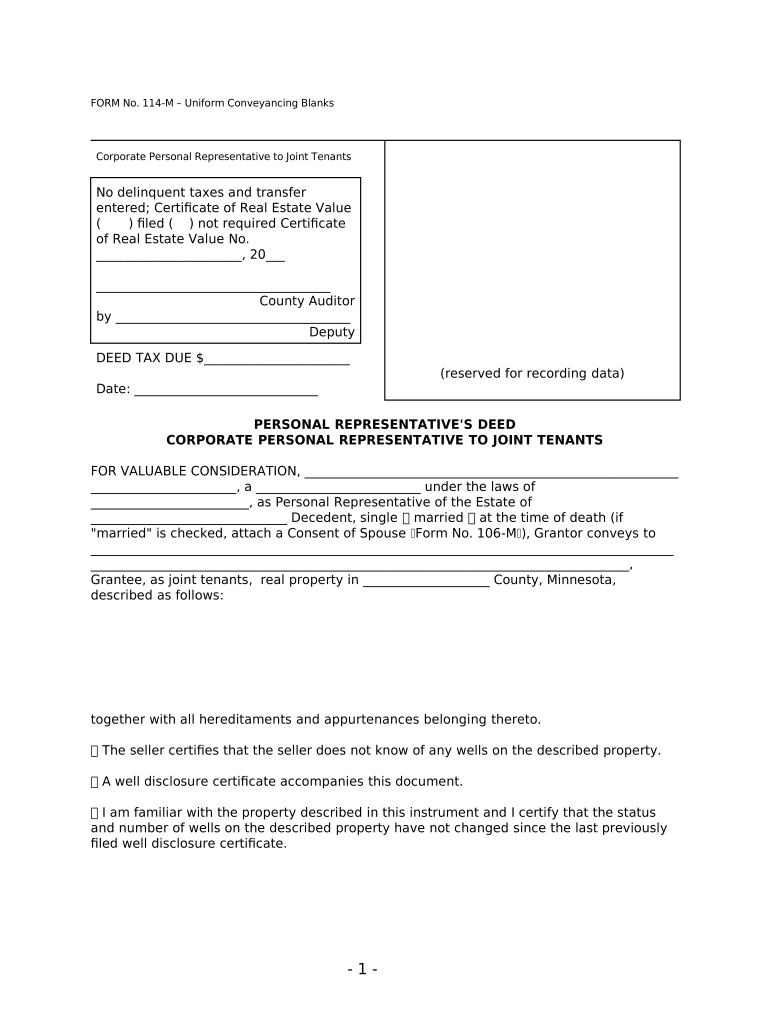

The Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota is a legal document used to transfer property ownership from a business entity, represented by a personal representative, to joint tenants. This form is essential in real estate transactions where multiple parties hold ownership rights to a property. The form outlines the terms of the sale, identifies the parties involved, and ensures that the transfer complies with Minnesota state laws.

Steps to Complete the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota

Completing the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota involves several key steps:

- Gather necessary information: Collect details about the property, including its legal description, the names of the joint tenants, and the business entity's information.

- Fill out the form: Accurately complete all sections of the form, ensuring that all parties' names and addresses are correct.

- Obtain signatures: The personal representative must sign the form in the presence of a notary public, who will also provide their signature and seal.

- File the form: Submit the completed form to the appropriate county recorder's office in Minnesota for official recording.

Legal Use of the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota

This deed serves as a legally binding document that facilitates the transfer of property ownership. It must adhere to specific legal requirements to be valid, including proper execution and notarization. The form provides clarity on the rights and responsibilities of the joint tenants, ensuring that all parties understand their ownership stakes. Additionally, it protects the interests of the business entity by documenting the transaction formally.

Key Elements of the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota

Several critical components must be included in the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota:

- Identification of parties: Names and addresses of the business entity and joint tenants.

- Property description: A detailed legal description of the property being sold.

- Sale terms: The purchase price and any relevant payment terms.

- Signatures: Signatures of the personal representative and notary public.

How to Use the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota

To use the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota, follow these guidelines:

- Review the form: Ensure you have the correct version of the form and understand its requirements.

- Complete the form: Fill in all required information accurately, paying attention to detail.

- Sign and notarize: Have the personal representative sign the form in front of a notary public.

- Submit for recording: File the completed and notarized form with the county recorder's office to make the transfer official.

State-Specific Rules for the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota

In Minnesota, specific rules govern the use of the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7. These include:

- Notarization requirement: The personal representative's signature must be notarized for the deed to be valid.

- Recording: The completed form must be recorded with the county recorder's office to effectuate the transfer of ownership.

- Legal descriptions: The property must be described accurately to avoid disputes regarding ownership.

Quick guide on how to complete deed of sale by business entity personal representative to joint tenants ucbc form 1057 minnesota

Effortlessly prepare Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the right form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Handle Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota smoothly

- Locate Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature via the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to finalize your changes.

- Choose how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate issues related to lost or misplaced documents, bothersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota to maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota?

The Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota is a legal document that facilitates the transfer of property from a business entity's personal representative to joint tenants. This form ensures that all legal requirements are met for the sale and ownership transition in Minnesota. By using this form, you can ensure a smooth and compliant transfer process.

-

How can airSlate SignNow assist with the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota?

airSlate SignNow simplifies the process of handling the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota by providing a digital platform for eSignature and document management. With its user-friendly interface, you can easily prepare, sign, and store your documents securely. This efficient solution streamlines your workflow and enhances document accessibility.

-

Is there a fee to use airSlate SignNow for filing the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those specifically for managing the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota. While there is a fee associated with using the platform, it provides cost-effective solutions when compared to traditional methods of document handling. Check their website for the most accurate and updated pricing details.

-

What features does airSlate SignNow offer for the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota?

airSlate SignNow offers a variety of features specific to the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota, including customizable templates, electronic signatures, and secure document storage. Additionally, it provides tracking capabilities and reminders to ensure that all parties stay informed throughout the signing process. These features make your document management much more efficient.

-

Can I integrate airSlate SignNow with other tools for managing the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota?

Yes, airSlate SignNow supports integrations with various applications which can enhance the management of the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota. This includes CRM systems, cloud storage solutions, and other productivity tools. These integrations help create a seamless workflow by allowing for easy sharing and collaboration on your important documents.

-

How secure is the process of signing the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive documents like the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota. The platform employs robust encryption and complies with industry standards to ensure that all signed documents are secure and confidential. You can confidently manage your transactions knowing that your data is protected.

-

What are the benefits of using airSlate SignNow for the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota?

Using airSlate SignNow for the Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota offers numerous benefits such as faster processing times, reduced paper use, and comprehensive document tracking. Additionally, it enhances collaboration among involved parties, making it easier to handle revisions and approvals. Ultimately, this leads to a more efficient and eco-friendly process.

Get more for Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota

- Field trip permission and release this section to be form

- Preoperative checklist ppt form

- Navsup 1220 2 form

- Ntcar commercial contract of sale form

- Probability models worksheet form

- Mc 051 form

- Affidavit concerning smoke and carbon monoxide detectors form

- Schedule c premachined door schedule algoma hardwoods form

Find out other Deed Of Sale By Business Entity Personal Representative To Joint Tenants UCBC Form 10 5 7 Minnesota

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe