Quotation of Insurance Form

What is the quotation of insurance?

The quotation of insurance is a formal document provided by an insurance company that outlines the terms, coverage options, and estimated costs associated with a specific insurance policy. This document serves as a preliminary agreement between the insurer and the insured, detailing the potential premium amounts based on the applicant's information and risk factors. It is essential for individuals and businesses seeking to understand their insurance options before committing to a policy.

Key elements of the quotation of insurance

An effective insurance quotation format typically includes several critical components:

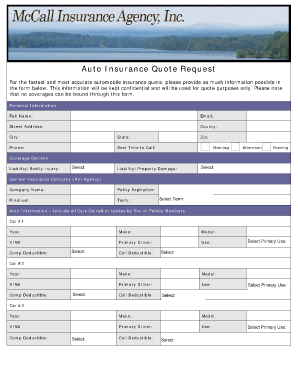

- Personal Information: Details about the applicant, including name, address, and contact information.

- Coverage Details: A breakdown of the types of coverage being offered, such as liability, collision, and comprehensive for car insurance.

- Premium Estimate: The projected cost of the insurance policy, often presented as a monthly or annual figure.

- Deductibles: Information about the deductible amounts for various coverage types, which affect the overall premium.

- Policy Limits: The maximum amount the insurer will pay for claims under the policy.

- Exclusions: Specific situations or conditions that are not covered by the policy.

How to obtain the quotation of insurance

To obtain a quotation of insurance, individuals can follow these steps:

- Identify the type of insurance needed, such as car, home, or health insurance.

- Gather necessary personal and property information, including previous insurance history and any relevant documentation.

- Contact insurance providers directly or use online tools to request quotes. Many companies offer online forms that can streamline this process.

- Compare the quotations received, paying close attention to coverage options, premium estimates, and terms.

Steps to complete the quotation of insurance

Completing the quotation of insurance involves several important steps to ensure accuracy and compliance:

- Fill out the quotation form with accurate personal information and details relevant to the type of insurance.

- Provide any necessary documentation, such as proof of identity or vehicle registration for car insurance.

- Review the terms and conditions outlined in the quotation to ensure understanding of coverage and limitations.

- Submit the completed quotation form to the insurance provider, either online or through other specified methods.

Legal use of the quotation of insurance

The quotation of insurance can serve as a legally binding document under specific circumstances. For it to be valid, the following conditions must be met:

- Both parties must agree to the terms outlined in the quotation.

- The document should include signatures or electronic signatures from both the insurer and the insured, confirming acceptance of the terms.

- The quotation must comply with relevant state regulations and insurance laws to ensure enforceability.

Examples of using the quotation of insurance

Quotations of insurance can be used in various scenarios, including:

- Individuals seeking car insurance may request multiple quotations to find the best coverage at an affordable price.

- Businesses may obtain insurance quotations to assess their liability coverage needs and budget for premiums.

- Homeowners looking to insure their property can use quotations to compare different policies and coverage options.

Quick guide on how to complete quotation of insurance

Streamline Quotation Of Insurance effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the appropriate template and securely keep it online. airSlate SignNow equips you with all the resources necessary to produce, modify, and electronically sign your documents swiftly and without hurdles. Oversee Quotation Of Insurance on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Quotation Of Insurance with ease

- Locate Quotation Of Insurance and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to preserve your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and electronically sign Quotation Of Insurance and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quotation of insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the insurance format supported by airSlate SignNow?

The insurance format supported by airSlate SignNow allows users to create and manage electronic documents specifically designed for the insurance industry. This format ensures compliance with industry regulations while enabling quick and secure eSigning of all insurance-related documents.

-

How does airSlate SignNow handle pricing for insurance format documents?

airSlate SignNow provides competitive pricing options for businesses that frequently work with insurance format documents. Pricing is structured based on the number of users and features required, making it a cost-effective solution for managing insurance documents.

-

Can I integrate airSlate SignNow with other tools for insurance format documents?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms, enhancing the efficiency of handling insurance format documents. This includes integration with popular CRM systems, cloud storage services, and other applications essential for insurance workflows.

-

What are the key benefits of using airSlate SignNow for insurance form management?

Using airSlate SignNow for insurance format management provides several benefits, including improved efficiency, reduced paper usage, and a faster signing process. It helps organizations stay organized and compliant while ensuring all insurance documents are securely managed.

-

Is airSlate SignNow compliant with industry standards for insurance format documents?

Yes, airSlate SignNow is compliant with essential industry standards and regulations, ensuring that all insurance format documents meet legal requirements. This compliance helps businesses maintain the integrity of their documents and protect sensitive information.

-

What features does airSlate SignNow offer for managing insurance format documents?

airSlate SignNow includes features such as customizable templates, real-time tracking, and advanced security measures for managing insurance format documents. These tools are designed to streamline the signing process and ensure a professional workflow.

-

How does airSlate SignNow improve the efficiency of signing insurance format documents?

airSlate SignNow improves efficiency by allowing users to send, manage, and eSign insurance format documents electronically. The platform's intuitive interface and automated workflows signNowly reduce the time spent on processing documents and obtaining signatures.

Get more for Quotation Of Insurance

- Rhodes state college request form

- Scholarship application harrisena community church form

- Diorama book report form

- Student support checklist ms hs high plains ed form

- Surf shack registration form christ united methodist church umcchrist

- Teacher recommendation form

- Idoc non tax filer s statement form

- Naemt instructor candidate monitoring form

Find out other Quotation Of Insurance

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free