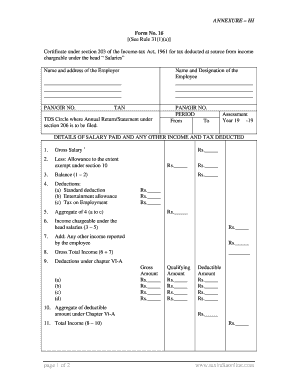

Form No 16

What is the R16 Form?

The R16 form, also known as Form No 16, is a tax-related document used primarily in the United States. It serves as a statement of earnings and tax deductions for employees, typically provided by employers at the end of the tax year. This form outlines the total income earned by an employee and the amount of federal, state, and local taxes withheld. Understanding the details of the R16 form is crucial for accurate tax filing and compliance with IRS regulations.

How to Use the R16 Form

To effectively use the R16 form, individuals should first ensure they receive it from their employer. The information contained in the form is essential for preparing tax returns. Taxpayers can utilize the data to report their income accurately and claim any deductions or credits they may be eligible for. It is important to keep the form on hand when filing taxes, as it provides necessary details that help in calculating tax liabilities.

Steps to Complete the R16 Form

Completing the R16 form involves several key steps:

- Gather necessary personal information, including your Social Security number and employment details.

- Review your earnings for the year as reported by your employer.

- Check the tax withholding amounts listed on the form to ensure accuracy.

- Use the information from the R16 form to fill out your tax return, ensuring all figures align.

- Keep a copy of the completed form for your records.

Legal Use of the R16 Form

The R16 form holds legal significance as it is used to report taxable income to the IRS. It must be filled out accurately to avoid penalties or issues during tax audits. The form complies with federal regulations, ensuring that the information provided is valid for tax purposes. Proper use of the R16 form helps maintain transparency in financial reporting and supports compliance with tax laws.

Key Elements of the R16 Form

Several key elements are essential to understand when dealing with the R16 form:

- Employee Information: This includes the employee's name, address, and Social Security number.

- Employer Information: Details about the employer, including name, address, and Employer Identification Number (EIN).

- Income Details: Total wages, tips, and other compensation received during the tax year.

- Tax Withholdings: Amounts withheld for federal, state, and local taxes.

- Other Deductions: Any additional deductions that may affect taxable income.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the R16 form is crucial for compliance. Generally, employers must provide the R16 form to employees by January thirty-first of the following year. Taxpayers should aim to file their tax returns by April fifteenth to avoid penalties. Staying aware of these dates helps ensure timely submission of tax documents and adherence to IRS guidelines.

Quick guide on how to complete form no 16 37923266

Complete Form No 16 seamlessly on any device

Digital document management has gained traction among enterprises and individuals. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Form No 16 on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Form No 16 effortlessly

- Locate Form No 16 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes only moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form No 16 and guarantee exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 16 37923266

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form no 16 and why is it important?

Form no 16 is a tax document issued by employers to their employees, summarizing the TDS (Tax Deducted at Source) deducted on salary. It is essential for filing income tax returns as it provides detailed information about the taxable income and tax paid. Understanding form no 16 helps ensure accurate tax filing and can save potential penalties.

-

How can airSlate SignNow help with form no 16 management?

airSlate SignNow streamlines the process of sending and eSigning form no 16 by providing a user-friendly platform that eliminates paperwork. With features like templates and secure electronic signatures, organizations can efficiently manage their form no 16 documents throughout the tax season. This saves time and enhances compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow for form no 16?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes, making it accessible for managing form no 16 efficiently. Each plan includes features like unlimited templates and customizable workflows, ensuring you get the best value for your investment. Plus, there’s a free trial available to help you explore its benefits.

-

Is airSlate SignNow compliant with legal requirements for form no 16?

Yes, airSlate SignNow is designed to comply with the legal requirements associated with form no 16 and electronic signatures. The platform ensures that all signed documents are legally binding and secure. This means you can confidently send and manage your form no 16 documents without worrying about compliance issues.

-

What integrations are available with airSlate SignNow for handling form no 16?

airSlate SignNow integrates seamlessly with numerous tools and applications, allowing for streamlined management of form no 16. You can connect it with popular software such as Salesforce, Google Drive, and others to enhance document workflows. These integrations help simplify processes and improve overall productivity.

-

Can airSlate SignNow assist with the automated sending of form no 16 to employees?

Absolutely! airSlate SignNow provides automation features that enable the bulk sending of form no 16 to employees quickly and efficiently. You can set up automated workflows to ensure timely distribution, minimizing manual tasks and reducing the risk of errors. This makes managing your employees' tax documents hassle-free.

-

What features of airSlate SignNow make it ideal for form no 16 processing?

airSlate SignNow offers several features beneficial for form no 16 processing, including customizable templates and an intuitive signing process. Additionally, it provides a secure platform for document storage and tracking, ensuring you have access to all necessary forms anytime. These features make it an ideal solution for efficient tax document management.

Get more for Form No 16

- Enrollment verification academy of art university my academyart form

- Access your grades ampampamp transcripts at shawnee state university form

- From napa valley college to a campus in either the california state university csu or the university of california uc system form

- Chapter 14 section 1 guided reading and review the growth of presidential power answer key form

- University of louisville replacement diploma form

- Form cuw9 111710xls university of colorado denver ucdenver

- Personal information pdf

- Hs healthcenterform 11x1716indd

Find out other Form No 16

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe