Sc Form 401i

What is the SC Form 401i

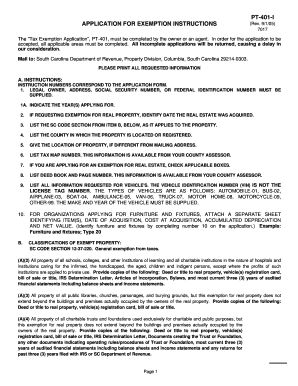

The SC Form 401i is a specific document used in the state of South Carolina, primarily for tax purposes. This form is utilized to report income and calculate the associated tax obligations for individuals and businesses within the state. It is essential for ensuring compliance with state tax laws and accurately reflecting income for tax assessment. Understanding the form's purpose and requirements is crucial for taxpayers to avoid potential penalties.

How to Obtain the SC Form 401i

To obtain the SC Form 401i, taxpayers can visit the South Carolina Department of Revenue's official website, where the form is available for download. Additionally, physical copies may be requested from local tax offices or through designated state government offices. Ensuring that you have the most recent version of the form is important, as tax regulations can change annually.

Steps to Complete the SC Form 401i

Completing the SC Form 401i involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Fill out the personal information section, ensuring accuracy in names and identification numbers.

- Report all sources of income, including wages, dividends, and other earnings.

- Calculate deductions and credits applicable to your situation, following the guidelines provided with the form.

- Review the completed form for accuracy before submission.

Legal Use of the SC Form 401i

The SC Form 401i is legally binding when completed and submitted according to state regulations. It must be signed by the taxpayer or an authorized representative to be considered valid. Compliance with the relevant tax laws ensures that the form serves its intended purpose in reporting income and fulfilling tax obligations, thereby avoiding potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the SC Form 401i typically align with the federal tax filing deadlines. Generally, individual taxpayers must submit their forms by April fifteenth of each year. However, it is advisable to check for any specific state extensions or changes that may apply. Staying informed about these dates is essential for timely compliance and avoiding late fees.

Form Submission Methods

The SC Form 401i can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online through the South Carolina Department of Revenue's e-filing system, which offers a secure and efficient way to submit tax forms. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is important to select the one that best suits your needs.

Quick guide on how to complete sc form 401i

Prepare Sc Form 401i effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It offers an ideal sustainable substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without issues. Manage Sc Form 401i on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign Sc Form 401i with ease

- Locate Sc Form 401i and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Sc Form 401i and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc form 401i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SC Form 401i and how does airSlate SignNow help with it?

SC Form 401i is a crucial document used for various administrative purposes. airSlate SignNow streamlines the process of sending, signing, and managing SC Form 401i, making it easier for businesses to handle their paperwork efficiently.

-

What features does airSlate SignNow offer for SC Form 401i?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time tracking specifically designed for SC Form 401i. These features enhance the user experience and ensure that all necessary signatures are captured promptly.

-

Is there a cost associated with using airSlate SignNow for SC Form 401i?

Yes, airSlate SignNow offers competitive pricing plans tailored for various business needs, including SC Form 401i management. You can choose from different subscription levels, ensuring you find a cost-effective solution that fits your budget.

-

How can airSlate SignNow benefit my business when handling SC Form 401i?

Using airSlate SignNow for SC Form 401i simplifies your document workflow, reducing processing time and minimizing errors. This efficiency not only saves money but also enhances overall productivity by allowing your team to focus on more strategic tasks.

-

Can I integrate airSlate SignNow with other software for SC Form 401i?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, making it easy to incorporate SC Form 401i into your existing workflows. This flexibility ensures that you can maintain your preferred tools while benefiting from eSignature capabilities.

-

Is airSlate SignNow secure for handling sensitive SC Form 401i data?

Yes, security is a top priority for airSlate SignNow. When managing SC Form 401i, your data is protected with advanced encryption and compliance with industry standards, ensuring that sensitive information remains safe throughout the signing process.

-

What support options are available when using airSlate SignNow for SC Form 401i?

airSlate SignNow provides comprehensive support options, including live chat, email support, and an extensive knowledge base tailored for SC Form 401i users. This ensures you have access to the assistance you need whenever you encounter challenges.

Get more for Sc Form 401i

- Transfer credit evaluation form

- 4 small business tax mistakes and how to solve them wave form

- Lecture based regularly scheduled series ama category 1 form

- Corporate credit card simmons internal simmons university form

- Goldmoney verification form

- Private wealth scholarshipsfirst merchants bank form

- Change epayment enrollment authorization form

- Download financial assistance application pdf uw medicine form

Find out other Sc Form 401i

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe