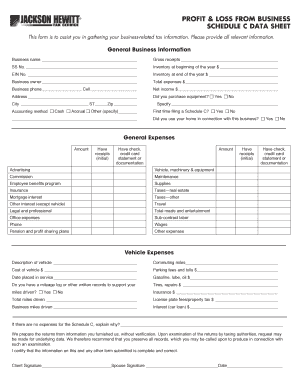

PROFIT & LOSS from BUSINESS SCHEDULE C DATA SHEET Form

Understanding the profit loss business sheet

The profit loss business sheet, often referred to as the Schedule C profit and loss form, is a crucial document for self-employed individuals and small business owners in the United States. This form details income and expenses, allowing business owners to calculate their net profit or loss for the year. It is essential for tax reporting and can significantly impact the amount of tax owed or refunded. The Schedule C is filed with the IRS as part of the individual tax return, ensuring that all business activities are accurately reported.

Steps to complete the profit loss business sheet

Filling out the profit loss business sheet involves several key steps:

- Gather financial records: Collect all income statements, receipts, and expense records for the tax year.

- Report income: Enter total income from all business activities, including sales and services.

- List expenses: Categorize and list all business expenses, such as supplies, utilities, and wages.

- Calculate net profit or loss: Subtract total expenses from total income to determine your net profit or loss.

- Review for accuracy: Ensure all information is complete and accurate to avoid issues with the IRS.

Legal use of the profit loss business sheet

The profit loss business sheet is legally binding when completed accurately and submitted to the IRS. It must adhere to specific guidelines to ensure compliance with tax laws. This includes maintaining accurate records, providing truthful information, and filing by the designated deadlines. The use of electronic signatures on this document is also legally recognized, provided the signing process meets the requirements set forth by regulations such as ESIGN and UETA.

Key elements of the profit loss business sheet

Understanding the key elements of the profit loss business sheet is vital for effective completion. The main components include:

- Business Information: Name, address, and type of business.

- Income: Total gross receipts or sales.

- Expenses: Detailed breakdown of all business-related expenses.

- Net Profit or Loss: The final calculation that determines the financial outcome of the business for the year.

IRS guidelines for the profit loss business sheet

The IRS provides specific guidelines for completing the profit loss business sheet. It is important to follow these guidelines to ensure compliance and avoid penalties. Key points include:

- Use the correct tax year for reporting.

- Ensure all income and expenses are reported accurately.

- Retain supporting documents for at least three years in case of an audit.

Filing deadlines for the profit loss business sheet

Filing deadlines for the profit loss business sheet are crucial for compliance. Typically, the deadline aligns with the individual tax return deadline, which is usually April 15th of each year. If additional time is needed, an extension can be requested, but it is important to understand that any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete profit ampamp loss from business schedule c data sheet

Effortlessly Prepare PROFIT & LOSS FROM BUSINESS SCHEDULE C DATA SHEET on Any Device

Online document management has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow offers you all the resources required to create, edit, and eSign your documents promptly without delays. Manage PROFIT & LOSS FROM BUSINESS SCHEDULE C DATA SHEET on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign PROFIT & LOSS FROM BUSINESS SCHEDULE C DATA SHEET Effortlessly

- Obtain PROFIT & LOSS FROM BUSINESS SCHEDULE C DATA SHEET and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, frustrating form searches, or errors requiring new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign PROFIT & LOSS FROM BUSINESS SCHEDULE C DATA SHEET to ensure excellent communication at any stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the profit ampamp loss from business schedule c data sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a profit loss business sheet and why is it important?

A profit loss business sheet is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period. It's crucial for understanding the profitability of your business, helping you make informed decisions based on accurate financial data.

-

How can airSlate SignNow enhance my profit loss business sheet process?

airSlate SignNow streamlines the creation, distribution, and signing of your profit loss business sheet by providing an intuitive platform. With electronic signatures and document templates, you can save time and ensure accuracy, allowing you to focus more on your business operations.

-

Is there a trial available for airSlate SignNow, and how does it relate to a profit loss business sheet?

Yes, airSlate SignNow offers a trial period that allows you to explore its features, including tools for creating and managing your profit loss business sheet. This trial enables you to evaluate how the platform can streamline your financial documentation processes without any commitment.

-

What features does airSlate SignNow offer that assist with a profit loss business sheet?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure electronic signatures that aid in the effective management of your profit loss business sheet. These features ensure that your financial documents are professionally handled and efficiently processed.

-

Can I integrate airSlate SignNow with my accounting software to manage my profit loss business sheet?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage and generate your profit loss business sheet directly from your existing tools. This integration enhances workflow efficiency by reducing manual data entry and errors.

-

What are the pricing options for airSlate SignNow for small businesses needing a profit loss business sheet?

airSlate SignNow offers flexible pricing plans that cater to small businesses looking to streamline their profit loss business sheet processes. With options designed to fit different budgets, you can choose a plan that provides the features you need at a competitive price.

-

How does electronic signing benefit my profit loss business sheet preparation?

Electronic signing simplifies the approval process for your profit loss business sheet by eliminating the need for physical signatures. This not only saves time but also enhances security and ensures that your financial documents are legally binding and easily accessible.

Get more for PROFIT & LOSS FROM BUSINESS SCHEDULE C DATA SHEET

Find out other PROFIT & LOSS FROM BUSINESS SCHEDULE C DATA SHEET

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors