Subcontractor Application Form

What is the subcontractor application form?

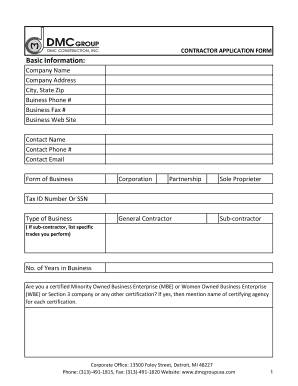

The subcontractor application form is an essential document used by businesses to collect necessary information from subcontractors. This form typically includes details such as the subcontractor's name, contact information, tax identification number, and relevant qualifications. By completing this form, subcontractors provide the information needed for tax reporting and compliance purposes. It serves as a formal agreement that outlines the relationship between the subcontractor and the hiring entity, ensuring clarity in expectations and responsibilities.

Steps to complete the subcontractor application form

Filling out the subcontractor application form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and business credentials. Next, carefully fill out each section of the form, ensuring that all fields are completed accurately. It is crucial to review the form for any errors before submission. Finally, sign and date the form to validate it. Depending on the requirements, you may need to submit the completed form electronically or in paper format.

Legal use of the subcontractor application form

The subcontractor application form is legally binding when completed and signed according to the relevant laws and regulations. To ensure its legal standing, the form must comply with federal and state guidelines regarding subcontractor agreements. This includes adherence to tax regulations and employment laws. Utilizing a reliable digital platform for signing can enhance the form's legality, as it provides a secure method for capturing signatures and maintaining compliance with eSignature laws.

IRS guidelines for subcontractors

Subcontractors must adhere to specific IRS guidelines when completing the subcontractor application form. This includes providing accurate tax identification numbers and ensuring that all income earned is reported correctly. The IRS requires businesses to issue a Form 1099-MISC or 1099-NEC to subcontractors who earn a certain threshold in a tax year. Understanding these guidelines helps subcontractors maintain compliance and avoid potential penalties associated with misreporting income.

Required documents for the subcontractor application form

When filling out the subcontractor application form, several documents may be required to verify the subcontractor's identity and qualifications. Commonly required documents include a valid driver's license or state ID, a Social Security card or Employer Identification Number (EIN), and proof of relevant certifications or licenses. Having these documents ready can streamline the application process and ensure that all necessary information is accurately provided.

Form submission methods

The subcontractor application form can typically be submitted through various methods, depending on the preferences of the hiring entity. Common submission methods include online submission via a secure portal, mailing a physical copy to the appropriate office, or delivering the form in person. Each method has its advantages, such as speed and convenience for online submissions or the ability to ask questions in person when submitting directly.

Eligibility criteria for subcontractors

Eligibility to fill out the subcontractor application form generally includes having the necessary skills, qualifications, and legal status to perform the work required. Subcontractors may need to demonstrate their expertise in a specific field, possess relevant licenses, and comply with local regulations. Additionally, they should provide proof of insurance and any other documentation that may be required by the hiring business to ensure a smooth hiring process.

Quick guide on how to complete subcontractor application form 335979

Complete Subcontractor Application Form effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can acquire the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents quickly without delays. Handle Subcontractor Application Form on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Subcontractor Application Form seamlessly

- Find Subcontractor Application Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document needs in just a few clicks from your preferred device. Adjust and eSign Subcontractor Application Form and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the subcontractor application form 335979

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sub contractor tax form and why is it important?

A sub contractor tax form is a crucial document that outlines payments made to subcontractors, which is essential for accurate tax reporting. Using this form ensures compliance with tax regulations, preventing potential penalties. It's important for businesses to maintain correct records of both income and expenses related to subcontractors.

-

How can airSlate SignNow help me manage sub contractor tax forms?

airSlate SignNow streamlines the process of sending, signing, and storing sub contractor tax forms electronically. Our easy-to-use interface allows you to gather necessary signatures quickly, reducing administrative overhead. This means you can focus more on your business while we handle the paperwork.

-

What are the pricing options for airSlate SignNow regarding sub contractor tax forms?

airSlate SignNow offers various pricing plans to cater to businesses of all sizes. Each plan provides access to essential features required for managing sub contractor tax forms efficiently. This flexibility allows you to choose a plan that best fits your budget and business needs.

-

Are there any integrations available for managing sub contractor tax forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and project management software. This integration makes it easy to sync data relating to sub contractor tax forms between platforms. You can automate workflows and maintain organized records without manual entry.

-

What features does airSlate SignNow offer for sub contractor tax form management?

airSlate SignNow provides advanced features such as templates, bulk sending, and audit trails specifically for sub contractor tax forms. These tools simplify the entire process from creation to secure storage. Plus, you can easily track who has signed which documents in real-time.

-

Can I signNow out for support if I have questions about my sub contractor tax forms?

Absolutely! airSlate SignNow offers dedicated customer support for any inquiries related to sub contractor tax forms. Whether you need help with technical issues or general guidance on using our platform, our team is always ready to assist you.

-

Is it safe to store sub contractor tax forms with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all your sub contractor tax forms are stored safely. We use advanced encryption measures to protect your documents. You can trust that your sensitive information will remain confidential and secure.

Get more for Subcontractor Application Form

- Petitioning with a mc360 and mc 360a form

- How file petition menacing dog california 1990 form

- Pos040 2010 form

- Bmd 003 form

- Completion drug program form

- Form complaint law enforcement form

- Civ 151 application to be relieved as attorney on completion of limited scope representation judicial council forms

- San mateo county superior court recommends adr options form

Find out other Subcontractor Application Form

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form