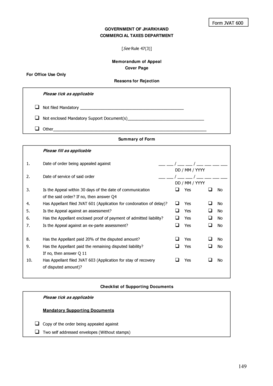

Form JVAT 600

What is the Form JVAT 600

The Form JVAT 600 is a specific document used primarily for tax purposes in the United States. It serves as a declaration for various tax-related activities, including reporting income and claiming deductions. This form is essential for individuals and businesses to ensure compliance with state tax regulations. Understanding its purpose is crucial for accurate tax reporting and to avoid potential penalties.

How to obtain the Form JVAT 600

Obtaining the Form JVAT 600 is straightforward. The form can typically be accessed through the official state tax authority's website or office. Many states provide downloadable versions of the form, allowing users to print and fill it out at their convenience. Additionally, physical copies may be available at local tax offices or government buildings. Ensuring you have the correct version for your state is important, as requirements may vary.

Steps to complete the Form JVAT 600

Completing the Form JVAT 600 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay close attention to any specific instructions provided with the form. Once completed, review the form for any errors before submitting it to the appropriate tax authority.

Legal use of the Form JVAT 600

The legal use of the Form JVAT 600 is governed by state tax laws. To be considered valid, the form must be filled out accurately and submitted within the designated deadlines. It is important to understand that any false information or failure to comply with submission guidelines can result in penalties. Utilizing this form correctly ensures that taxpayers fulfill their legal obligations and maintain good standing with tax authorities.

Key elements of the Form JVAT 600

Key elements of the Form JVAT 600 include personal identification information, income details, and any deductions or credits being claimed. The form typically requires the taxpayer's name, address, Social Security number, and other relevant financial information. Understanding these elements is essential for accurately reporting income and ensuring that all applicable deductions are claimed. Each section of the form plays a critical role in the overall tax filing process.

Form Submission Methods (Online / Mail / In-Person)

The Form JVAT 600 can be submitted through various methods, depending on state regulations. Common submission methods include online filing through the state tax authority's website, mailing a physical copy of the form, or delivering it in person to a local tax office. Each method has its own advantages, such as the speed of online submission or the personal assurance of in-person delivery. It is important to choose the method that best suits your needs and adheres to state guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Form JVAT 600 vary by state and can depend on the type of taxpayer. Generally, individual taxpayers must submit their forms by April 15 of each year, while businesses may have different deadlines. It is crucial to stay informed about these dates to avoid late penalties. Keeping a calendar of important tax dates can help ensure timely submissions and maintain compliance with tax regulations.

Quick guide on how to complete form jvat 600

Effortlessly Create [SKS] on Any Device

Online document administration has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Alter and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Choose how you wish to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form JVAT 600

Create this form in 5 minutes!

How to create an eSignature for the form jvat 600

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form JVAT 600 and how is it used?

Form JVAT 600 is an essential document used for tax reporting purposes. It plays a critical role for businesses in ensuring compliance with tax regulations. By using airSlate SignNow, you can easily create, send, and eSign Form JVAT 600, streamlining your workflow and reducing paperwork.

-

How does airSlate SignNow simplify the process of completing Form JVAT 600?

airSlate SignNow offers user-friendly templates and tools that make filling out Form JVAT 600 straightforward. With its intuitive interface, users can quickly enter the required information and utilize electronic signatures for faster processing. This signNowly cuts down the time taken to manage tax documents.

-

Is there a cost associated with using airSlate SignNow for Form JVAT 600?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. Subscribing to their services provides access to features that facilitate the completion of Form JVAT 600 and other essential documents. You can easily evaluate pricing based on your company's specific requirements.

-

What are the primary benefits of using airSlate SignNow for Form JVAT 600?

Using airSlate SignNow for Form JVAT 600 provides multiple benefits, including time savings, enhanced security, and better document management. The electronic signing process eliminates the hassle of paper forms, ensuring that your tax documentation is always secure and easily accessible. Additionally, you can track the status of your documents in real-time.

-

What integrations does airSlate SignNow support for managing Form JVAT 600?

airSlate SignNow seamlessly integrates with various other applications such as CRM systems and cloud storage services. This allows users to streamline the workflow for Form JVAT 600, making it easier to pull in relevant data and store completed documents. These integrations help create a more efficient document management process.

-

Can I collaborate with my team on Form JVAT 600 using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on Form JVAT 600 in real time. Team members can review, edit, and sign the document together, enhancing collaboration and ensuring that everyone is aligned before submitting tax documents. This feature helps improve accuracy and teamwork.

-

Is airSlate SignNow compliant with legal standards for Form JVAT 600?

Yes, airSlate SignNow is designed to comply with legal and regulatory standards governing electronic signatures and document management. By using airSlate SignNow for Form JVAT 600, businesses can confidently ensure that their tax documents are legally binding and valid under applicable laws.

Get more for Form JVAT 600

Find out other Form JVAT 600

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile