D15 Form 1977-2026

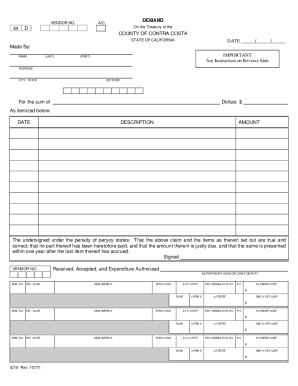

What is the D15 Form

The D15 form is a specific document used primarily for tax purposes in the United States. It serves as a declaration of certain financial information required by the Internal Revenue Service (IRS). This form is essential for individuals or businesses that need to report specific income, deductions, or credits. Understanding the purpose of the D15 form is crucial for ensuring compliance with tax regulations and for accurate reporting of financial data.

How to use the D15 Form

Using the D15 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, such as income statements and receipts for deductions. Next, carefully fill out the form by entering the required information in the designated fields. It is important to double-check all entries for accuracy before submission. Once completed, the D15 form can be submitted electronically or via mail, depending on the specific requirements set by the IRS.

Steps to complete the D15 Form

Completing the D15 form requires attention to detail. Follow these steps for successful completion:

- Collect all necessary financial documents.

- Read the instructions provided with the form to understand each section.

- Fill in your personal information, including name, address, and Social Security number.

- Report all income accurately, ensuring to include all sources.

- List any deductions or credits you are eligible for, following the guidelines.

- Review the form for any errors or omissions.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the D15 Form

The D15 form is legally binding when filled out and submitted in accordance with IRS regulations. To ensure its legal standing, it is essential to provide accurate and truthful information. Additionally, the form must be signed and dated by the individual or authorized representative. Compliance with all applicable tax laws and regulations is necessary to avoid penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the D15 form are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April fifteenth for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing statuses. It is advisable to check the IRS website or consult a tax professional for the most current deadlines related to the D15 form.

Form Submission Methods (Online / Mail / In-Person)

The D15 form can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to submit the form electronically through the IRS e-file system.

- Mail: The completed form can be printed and mailed to the appropriate IRS address as indicated in the instructions.

- In-Person: Some taxpayers may choose to deliver the form in person at designated IRS offices, though this option may vary by location.

Quick guide on how to complete d15 form

Complete D15 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage D15 Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign D15 Form with ease

- Locate D15 Form and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize key areas of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal value as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign D15 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d15 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a d15 form and how can airSlate SignNow help with it?

A d15 form is a commonly used document for various business purposes, including compliance and reporting. airSlate SignNow streamlines the process of creating, sending, and eSigning your d15 form, making it easy to manage your documents efficiently.

-

Is airSlate SignNow a cost-effective solution for handling d15 forms?

Yes, airSlate SignNow offers competitive pricing plans tailored to fit different business sizes and needs. With our cost-effective solution, you can manage your d15 forms without breaking the bank while still enjoying a user-friendly experience.

-

What features does airSlate SignNow offer for managing d15 forms?

airSlate SignNow provides features such as eSignature capabilities, templates for creating d15 forms, and document sharing options. These features help simplify your workflow and ensure that your d15 forms are processed quickly and securely.

-

Can I integrate airSlate SignNow with other tools for handling d15 forms?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and CRMs. This allows you to manage and send your d15 forms directly from the tools you already use, enhancing productivity.

-

How does airSlate SignNow ensure the security of my d15 forms?

Security is a top priority at airSlate SignNow. We use advanced encryption and compliance measures to ensure that all your d15 forms and sensitive data remain secure throughout the signing and storage process.

-

Can I track the status of my d15 forms using airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your d15 forms in real-time. This way, you can easily see when documents are viewed, signed, or completed, enhancing your document management process.

-

Is it easy to customize a d15 form with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily customize your d15 form by adding fields, checkboxes, and logos to fit your brand. Our intuitive interface makes it straightforward to create the perfect version of your d15 form.

Get more for D15 Form

- In the superior court for the state of alaska at in the matter of the hospitalization of respondent form

- Dr 460 and dr 465 findings of fact and conclusions of law custody decree of custody and judgment 4 10 custody form

- Cr 771 nome request for calendar setting 312 pdf fill in criminal forms

- Pg 605 instructions for minor guardianship petition non indian child 8 15 probate gaurdianship forms

- P 315 request to start informal probate and appoint a personal representative when there is a will 4 15 fill in probate forms

- Partial satisfaction of judgment alaska form

- Civ 525 form

- Mc 120 petition for 180 day commitment 12 87 fill in form

Find out other D15 Form

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement