Transmittal of Tax Returns Reported on Magnetic Media Ok 2015-2026

Understanding the Transmittal of Tax Returns Reported on Magnetic Media

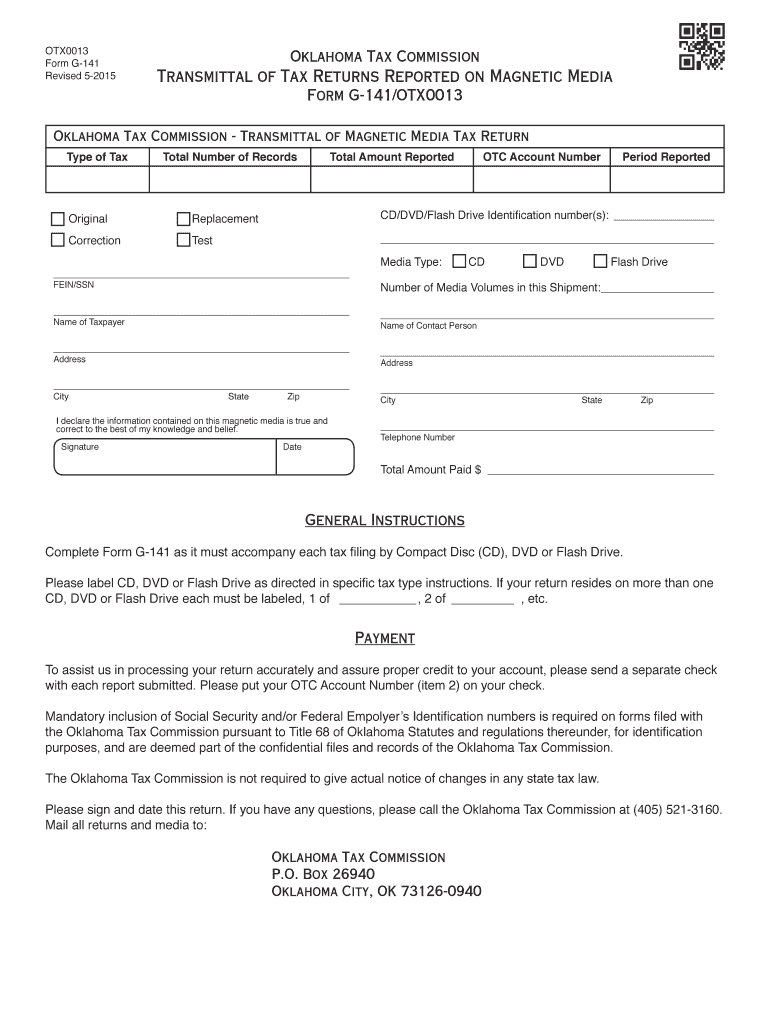

The Transmittal of Tax Returns Reported on Magnetic Media serves as an essential document for taxpayers who file their returns electronically. This form is designed to facilitate the submission of tax information in a digital format, ensuring compliance with federal and state regulations. It is particularly useful for businesses and tax professionals who manage multiple returns, as it streamlines the filing process and reduces the risk of errors associated with paper submissions.

This form typically includes key details such as the taxpayer's identification number, the type of returns being submitted, and the total number of records transmitted. Understanding the purpose and requirements of this form is crucial for ensuring timely and accurate tax reporting.

Steps to Complete the Transmittal of Tax Returns Reported on Magnetic Media

Completing the Transmittal of Tax Returns involves several important steps to ensure accuracy and compliance. Follow these guidelines to fill out the form correctly:

- Gather necessary information, including your taxpayer identification number and details about the returns being submitted.

- Access the form through the appropriate state or federal tax authority website.

- Carefully fill in each required field, ensuring that all information is accurate and complete.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically, following the specified submission methods outlined by the tax authority.

By adhering to these steps, you can help ensure that your tax returns are processed efficiently and without complications.

Legal Use of the Transmittal of Tax Returns Reported on Magnetic Media

The Transmittal of Tax Returns is legally recognized as a valid method of filing tax returns in the United States. It complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which allows for electronic submissions to be treated the same as paper documents. This legal standing provides assurance to taxpayers that their electronically filed returns are secure and recognized by tax authorities.

Using this form also helps to maintain a clear audit trail, which can be beneficial in the event of an audit or review. It is important to ensure that all information provided is accurate and complete to avoid potential legal issues.

Key Elements of the Transmittal of Tax Returns Reported on Magnetic Media

Understanding the key elements of the Transmittal of Tax Returns is vital for successful completion. Important components include:

- Taxpayer Identification Number: This unique number identifies the taxpayer and links the returns to their account.

- Type of Returns: Specify the types of tax returns being submitted, such as income tax or employment tax.

- Total Records: Indicate the total number of records included in the submission to ensure accurate processing.

- Signature Line: An electronic signature may be required to validate the submission, confirming that the information is accurate and complete.

These elements are crucial for ensuring that the form is processed correctly and that all necessary information is conveyed to the tax authorities.

Filing Deadlines and Important Dates for the Transmittal of Tax Returns

Timely submission of the Transmittal of Tax Returns is essential to avoid penalties and ensure compliance. Key deadlines typically include:

- Annual Filing Deadline: Generally, tax returns must be filed by April 15 for individual taxpayers, with variations for businesses.

- Extensions: If an extension is filed, be aware of the new deadlines to ensure compliance.

- State-Specific Deadlines: Check for any additional state-specific deadlines that may apply to your situation.

Staying informed about these dates can help ensure that you meet all filing requirements and avoid unnecessary complications.

Quick guide on how to complete transmittal of tax returns reported on magnetic media ok

Your assistance manual on how to prepare your Transmittal Of Tax Returns Reported On Magnetic Media Ok

If you're wondering how to fulfill and send your Transmittal Of Tax Returns Reported On Magnetic Media Ok, here are a few concise guidelines on how to simplify tax declaration.

To start, you just need to register your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to edit, create, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and electronic signatures, and revisit to modify responses as needed. Streamline your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your Transmittal Of Tax Returns Reported On Magnetic Media Ok in just a few minutes:

- Establish your account and start working on PDFs within no time.

- Utilize our directory to find any IRS tax form; navigate through variants and schedules.

- Click Get form to access your Transmittal Of Tax Returns Reported On Magnetic Media Ok in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Use the Sign Tool to insert your legally-binding electronic signature (if necessary).

- Review your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting hard copies can increase return errors and delay reimbursements. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

Create this form in 5 minutes!

How to create an eSignature for the transmittal of tax returns reported on magnetic media ok

How to create an eSignature for the Transmittal Of Tax Returns Reported On Magnetic Media Ok in the online mode

How to make an eSignature for the Transmittal Of Tax Returns Reported On Magnetic Media Ok in Chrome

How to make an eSignature for putting it on the Transmittal Of Tax Returns Reported On Magnetic Media Ok in Gmail

How to create an electronic signature for the Transmittal Of Tax Returns Reported On Magnetic Media Ok straight from your smartphone

How to generate an electronic signature for the Transmittal Of Tax Returns Reported On Magnetic Media Ok on iOS

How to make an eSignature for the Transmittal Of Tax Returns Reported On Magnetic Media Ok on Android devices

People also ask

-

What is magnetic media transmittal?

Magnetic media transmittal refers to the process of securely sending digital documents in a format that can be easily read and processed by computers. This method is especially useful for businesses that need to transmit sensitive information or maintain compliance with industry regulations. Utilizing magnetic media transmittal can enhance efficiency and reduce errors in document handling.

-

How does airSlate SignNow support magnetic media transmittal?

airSlate SignNow offers a seamless way to handle the magnetic media transmittal process by providing secure eSignature capabilities and cloud storage solutions. Businesses can easily upload, transmit, and store their documents electronically. This not only streamlines the workflow but also ensures that all documents are legally binding and easily accessible.

-

What are the benefits of using magnetic media transmittal with eSignatures?

By combining magnetic media transmittal with eSignatures, businesses benefit from enhanced security and efficiency. This solution eliminates the need for physical paperwork, which can often get lost or delayed. Additionally, electronic records created through magnetic media transmittal are easier to track and manage, improving overall accountability.

-

Is airSlate SignNow cost-effective for magnetic media transmittal?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to implement magnetic media transmittal. Our pricing plans are scalable, ensuring businesses can find a package that fits their budget. With the savings from reduced paper use and quicker processing times, the investment quickly pays off.

-

Can airSlate SignNow integrate with existing workflow systems for magnetic media transmittal?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and workflow systems, enhancing the magnetic media transmittal process. This integration allows for automatic updates, data synchronization, and efficient handling of documents throughout your organization's operations, saving you time and effort.

-

What types of documents can be sent using magnetic media transmittal through airSlate SignNow?

With airSlate SignNow, you can send a wide range of documents through magnetic media transmittal, including contracts, agreements, invoices, and more. Our platform supports multiple file formats, ensuring that any document can be securely transmitted and signed electronically. This flexibility makes it easy for businesses in various industries to adopt this solution.

-

How secure is the magnetic media transmittal process in airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for magnetic media transmittal. We utilize advanced encryption protocols and secure cloud storage to protect your documents during transmission and at rest. Additionally, our compliance with industry standards helps ensure that your sensitive information remains confidential and secure.

Get more for Transmittal Of Tax Returns Reported On Magnetic Media Ok

Find out other Transmittal Of Tax Returns Reported On Magnetic Media Ok

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast