Ct 247 Instructions 2020

What is the Ct 247 Instructions

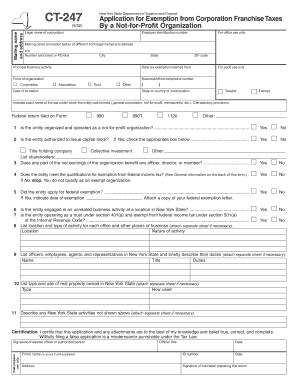

The Ct 247 instructions provide detailed guidance for completing the form CT-247, which is used by businesses in New York State to report certain tax-related information. This form is essential for ensuring compliance with state tax regulations, particularly for entities that may be subject to specific tax obligations. Understanding the instructions is crucial for accurate reporting and avoiding potential penalties.

Steps to Complete the Ct 247 Instructions

Completing the Ct 247 requires careful attention to detail. Here are the key steps involved:

- Gather necessary information, including your business entity details and any relevant financial data.

- Access the Ct 247 form, ensuring you have the latest version available.

- Follow the instructions closely, filling out each section accurately.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal Use of the Ct 247 Instructions

The Ct 247 instructions are legally binding when followed correctly. By adhering to these guidelines, businesses can ensure that their submissions meet the requirements set forth by New York State tax authorities. This compliance is critical for maintaining good standing and avoiding legal repercussions.

Form Submission Methods

There are several ways to submit the Ct 247 form:

- Online: Many businesses prefer to submit forms electronically for efficiency and ease of tracking.

- Mail: Forms can be printed and mailed to the appropriate tax authority address.

- In-Person: Some businesses may choose to deliver their forms directly to the tax office for immediate processing.

Required Documents

When completing the Ct 247, certain documents may be required to support the information provided. These can include:

- Financial statements

- Tax identification numbers

- Previous tax returns

- Any additional documentation specific to your business type

Eligibility Criteria

Eligibility to file the Ct 247 form typically depends on the type of business entity and the specific tax obligations applicable to that entity. Businesses should review the criteria outlined in the instructions to ensure they qualify for submission.

Quick guide on how to complete ct 247 instructions

Prepare Ct 247 Instructions effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without any delays. Manage Ct 247 Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ct 247 Instructions without any hassle

- Locate Ct 247 Instructions and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Ct 247 Instructions to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 247 instructions

Create this form in 5 minutes!

How to create an eSignature for the ct 247 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 247 and how does it relate to airSlate SignNow?

Ct 247 refers to a specific document signing and management process that airSlate SignNow streamlines for businesses. Utilizing ct 247, users can effortlessly eSign and manage documents in a secure and efficient manner, enhancing productivity and compliance.

-

What are the main features of airSlate SignNow with ct 247?

AirSlate SignNow offers a variety of features through ct 247, including electronic signatures, document templates, and real-time tracking. Users can also collaborate on documents and automate workflows, ensuring a seamless signing experience.

-

How does airSlate SignNow pricing work for ct 247 users?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes utilizing ct 247. Each plan is designed to provide a cost-effective solution, ensuring you only pay for the features you need while accessing all the benefits of electronic signing.

-

What benefits does ct 247 provide for businesses using airSlate SignNow?

Using ct 247 with airSlate SignNow helps businesses save time and reduce paper costs. The quick turnaround of document signing and enhanced security measures of ct 247 ensure your business operations run smoothly while maintaining compliance.

-

Can ct 247 integrate with other software applications?

Yes, ct 247 can be seamlessly integrated with various software applications, enhancing the capabilities of airSlate SignNow. This integration allows for smoother data flow between platforms, enabling businesses to optimize their workflow and reduce manual efforts.

-

How secure is document signing with ct 247 in airSlate SignNow?

Document signing with ct 247 in airSlate SignNow adheres to industry-leading security standards. AirSlate SignNow employs encryption, secure authentication, and audit trails to ensure that all documents are protected against unauthorized access while providing users with peace of mind.

-

Is there customer support available for ct 247 users?

Yes, airSlate SignNow provides exceptional customer support for users of ct 247. Whether you need assistance with setup, troubleshooting, or general inquiries, the support team is available to help ensure a smooth user experience.

Get more for Ct 247 Instructions

Find out other Ct 247 Instructions

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple