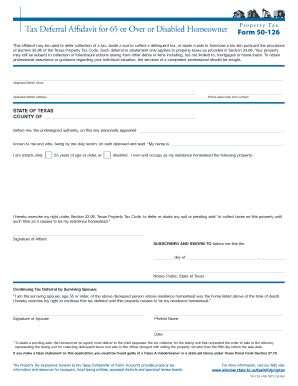

Form 50 126 2010

What is the Form 50-126?

The Form 50-126, also known as the Tax Deferral Affidavit, is a document used in Texas to apply for property tax deferral. This form allows eligible property owners to defer their property taxes, providing financial relief during specific circumstances, such as financial hardship or age-related qualifications. By submitting this affidavit, taxpayers can postpone their tax obligations while maintaining ownership of the property.

How to use the Form 50-126

To effectively use the Form 50-126, individuals must first determine their eligibility based on criteria set by the Texas Comptroller. Once eligibility is confirmed, the form can be filled out with accurate personal and property information. It is essential to provide all required details to ensure the application is processed smoothly. After completing the form, submit it to the local appraisal district to initiate the deferral process.

Steps to complete the Form 50-126

Completing the Form 50-126 involves several key steps:

- Gather necessary documents, including proof of age or financial hardship.

- Fill out the form with accurate personal and property details.

- Review the form for completeness and accuracy.

- Submit the form to the appropriate local appraisal district office.

Following these steps carefully helps ensure that the application is accepted without delays.

Legal use of the Form 50-126

The legal use of the Form 50-126 is governed by Texas property tax laws. To be valid, the affidavit must be completed and submitted in accordance with state regulations. This form serves as a formal request for tax deferral, and failure to comply with legal requirements may result in denial of the application or penalties. It is crucial for applicants to understand their rights and responsibilities when utilizing this form.

Eligibility Criteria

Eligibility for the Form 50-126 is primarily based on specific criteria set forth by the Texas Comptroller. Generally, applicants must be property owners who are either elderly, disabled, or experiencing financial hardship. Additionally, the property in question must be the applicant's primary residence. Meeting these criteria is essential for the successful deferral of property taxes.

Form Submission Methods

The Form 50-126 can be submitted through various methods, ensuring convenience for applicants. Options include:

- Online submission through the local appraisal district's website.

- Mailing the completed form to the appropriate appraisal district office.

- In-person submission at the local appraisal district office.

Choosing the right submission method can help expedite the processing of the tax deferral application.

Key elements of the Form 50-126

Understanding the key elements of the Form 50-126 is vital for successful completion. Important components include:

- Property owner’s name and contact information.

- Property details, including address and identification number.

- Reason for requesting tax deferral, such as age or financial hardship.

- Signature of the property owner, affirming the accuracy of the information provided.

Each of these elements plays a crucial role in the processing and approval of the tax deferral affidavit.

Quick guide on how to complete form 50 126

Complete Form 50 126 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to obtain the desired format and securely archive it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Handle Form 50 126 across any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 50 126 with ease

- Locate Form 50 126 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 50 126 and achieve outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 50 126

Create this form in 5 minutes!

How to create an eSignature for the form 50 126

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax deferral affidavit airSlate SignNow pdf?

A tax deferral affidavit airSlate SignNow pdf is a legally binding document that allows individuals to defer tax payments under certain conditions. By using airSlate SignNow, you can easily customize and electronically sign this document for your specific needs.

-

How much does airSlate SignNow cost for using tax deferral affidavits?

airSlate SignNow offers various pricing plans that are affordable for businesses of all sizes. The costs depend on the features you choose; however, creating and managing tax deferral affidavit airSlate SignNow pdfs remains cost-effective in every plan.

-

What features does airSlate SignNow offer for creating tax deferral affidavits?

With airSlate SignNow, you gain access to template creation, document routing, and collaboration features specifically tailored for tax deferral affidavits. The platform also includes robust security measures to protect your tax deferral affidavit airSlate SignNow pdf.

-

Can I integrate airSlate SignNow with other software for tax deferral affidavits?

Yes, airSlate SignNow offers seamless integrations with various software tools, enhancing your workflow for tax deferral affidavits. You can easily connect it with applications like CRM systems, document management software, and storage solutions for efficient document handling.

-

How secure is the tax deferral affidavit airSlate SignNow pdf?

airSlate SignNow uses advanced security protocols, including encryption and authentication, to ensure that your tax deferral affidavit airSlate SignNow pdf is safe. Compliance with legal standards guarantees that your documents are securely stored and transmitted.

-

How can I track the status of my tax deferral affidavit airSlate SignNow pdf?

Using airSlate SignNow, you can easily track the status of your documents in real-time. The platform allows you to see when a tax deferral affidavit airSlate SignNow pdf is viewed, signed, or completed, providing full transparency throughout the process.

-

Is customer support available for issues related to tax deferral affidavits?

Absolutely! AirSlate SignNow offers dedicated customer support to assist you with any queries regarding tax deferral affidavits. Whether you have questions about creating a tax deferral affidavit airSlate SignNow pdf or need technical assistance, help is just a call or email away.

Get more for Form 50 126

Find out other Form 50 126

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now