Tr 579 Ct Form

What is the Tr 579 Ct

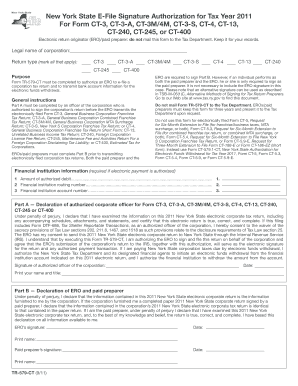

The Tr 579 Ct is a specific form used in various administrative processes within the United States. It is essential for individuals and businesses to understand its purpose and requirements. This form may be related to tax documentation, regulatory compliance, or other official business matters. Understanding the context in which the Tr 579 Ct is utilized can help ensure proper completion and submission.

How to use the Tr 579 Ct

Using the Tr 579 Ct involves several steps to ensure accuracy and compliance. First, gather all necessary information and documentation required to complete the form. Next, fill out the form carefully, ensuring that all fields are completed as required. Once filled, review the information for any errors or omissions. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person.

Steps to complete the Tr 579 Ct

Completing the Tr 579 Ct requires a systematic approach:

- Gather necessary documents and information relevant to the form.

- Access the form through the appropriate platform or source.

- Fill in all required fields accurately, ensuring clarity and correctness.

- Review the completed form for any mistakes or missing information.

- Submit the form as per the instructions provided, ensuring you keep a copy for your records.

Legal use of the Tr 579 Ct

The legal use of the Tr 579 Ct is crucial for ensuring that the document is recognized by relevant authorities. To be legally binding, the form must be completed in accordance with applicable laws and regulations. This includes adhering to any specific requirements for signatures and notarization if necessary. Utilizing a trusted electronic signature service can enhance the legal standing of the form, ensuring compliance with laws like ESIGN and UETA.

How to obtain the Tr 579 Ct

Obtaining the Tr 579 Ct can typically be done through official government websites or authorized agencies. It is important to ensure that you are accessing the most current version of the form. In some cases, the form may also be available through local offices or service centers. If you need assistance, consider reaching out to a professional who can guide you through the process of obtaining the form.

Filing Deadlines / Important Dates

Filing deadlines for the Tr 579 Ct can vary based on the specific purpose of the form. It is essential to be aware of these deadlines to avoid penalties or complications. Mark important dates on your calendar and ensure that you submit the form well in advance of any deadlines. Staying informed about these timelines will help you maintain compliance and avoid any potential issues.

Quick guide on how to complete tr 579 ct

Complete Tr 579 Ct effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Tr 579 Ct on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Tr 579 Ct effortlessly

- Locate Tr 579 Ct and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Tr 579 Ct and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tr 579 ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tr 579 in the context of airSlate SignNow?

The term tr 579 refers to a specific feature or designation within airSlate SignNow that enhances document workflow efficiency. This makes it easier for businesses to manage their e-signatures and document processes seamlessly.

-

How does airSlate SignNow handle tr 579 e-signatures?

airSlate SignNow's approach to tr 579 e-signatures ensures a secure, legally binding process that is compliant with regulations. Users can easily send documents for signing, track their status, and receive instant notifications when the documents are signed.

-

What are the pricing options for utilizing tr 579 features in airSlate SignNow?

airSlate SignNow offers flexible pricing plans that fully incorporate the capabilities of tr 579. Whether you’re a small business or a larger enterprise, there's a plan designed to meet your needs, allowing you to benefit from their robust features without breaking the bank.

-

Can I integrate tr 579 features with other applications?

Yes, airSlate SignNow’s tr 579 functionality can be easily integrated with various applications and platforms like Google Workspace, Salesforce, and more. This integration allows for a streamlined workflow and improved productivity across your existing tools.

-

What benefits does the tr 579 feature provide for businesses?

The tr 579 feature provides signNow benefits, such as enhanced operational efficiency and reduced turnaround time for document processing. With airSlate SignNow, businesses can automate their e-signature processes, leading to better compliance and improved customer satisfaction.

-

Is airSlate SignNow secure for handling tr 579 e-signatures?

Absolutely! airSlate SignNow employs robust security measures including encryption and secure data storage to protect all tr 579 e-signatures. Users can rest assured that their documents are handled safely and comply with relevant legal standards.

-

How can tr 579 enhance team collaboration?

The tr 579 capabilities of airSlate SignNow foster improved collaboration by simplifying the document signing process. Team members can easily send and sign documents remotely, making it more convenient to work together regardless of location, thus promoting efficient teamwork.

Get more for Tr 579 Ct

Find out other Tr 579 Ct

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast