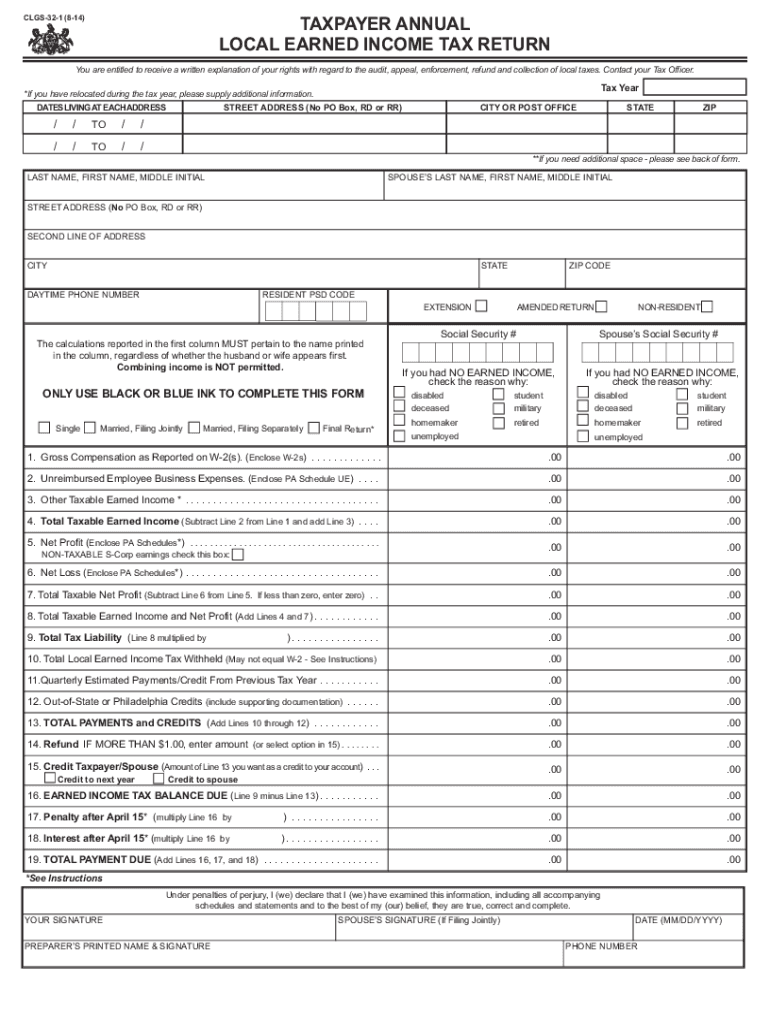

Taxpayer Annual Local Earned Income Tax Return Form

What is the taxpayer annual local earned income tax return?

The taxpayer annual local earned income tax return is a form used by individuals to report their earned income for local tax purposes. This form is essential for local governments to assess and collect taxes based on the income earned by residents within their jurisdiction. It typically includes information such as total wages, tips, and other compensation, as well as any applicable deductions or credits. Understanding this form is crucial for compliance with local tax regulations and ensuring accurate tax assessments.

Steps to complete the taxpayer annual local earned income tax return

Completing the taxpayer annual local earned income tax return involves several key steps:

- Gather necessary documents, including W-2 forms and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of earned income, ensuring accuracy in the amounts listed.

- Include any deductions or credits you may be eligible for, which can reduce your taxable income.

- Review the completed form for accuracy before submission.

- Sign and date the form, confirming that the information provided is correct.

How to obtain the taxpayer annual local earned income tax return

You can obtain the taxpayer annual local earned income tax return through various channels. Most local tax authorities provide the form on their official websites, allowing for easy access and download. Additionally, you may visit local tax offices to request a physical copy. In some cases, tax preparation software may also include this form, streamlining the process of filling it out electronically.

Filing deadlines / important dates

Filing deadlines for the taxpayer annual local earned income tax return can vary by jurisdiction. Generally, local tax returns are due on the same date as federal tax returns, which is typically April fifteenth. However, some localities may have different deadlines or extensions available. It is essential to check with your local tax authority for specific dates to avoid penalties for late filing.

Legal use of the taxpayer annual local earned income tax return

The taxpayer annual local earned income tax return is legally binding when completed and submitted according to local regulations. It serves as an official record of income reported to local authorities and is subject to review and audit. Ensuring that the form is filled out accurately and honestly is crucial, as discrepancies can lead to penalties or legal consequences. Utilizing a reliable eSignature solution can also enhance the legitimacy of the submitted document.

Required documents

To complete the taxpayer annual local earned income tax return, you will typically need several documents, including:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any additional income sources, such as rental income.

- Documentation for any deductions or credits claimed, such as receipts or statements.

Quick guide on how to complete taxpayer annual local earned income tax return 80532352

Effortlessly Prepare Taxpayer Annual Local Earned Income Tax Return on Any Device

Online document management has gained signNow traction among corporations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Taxpayer Annual Local Earned Income Tax Return on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Taxpayer Annual Local Earned Income Tax Return with Ease

- Obtain Taxpayer Annual Local Earned Income Tax Return and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Modify and electronically sign Taxpayer Annual Local Earned Income Tax Return and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer annual local earned income tax return 80532352

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing the 2020 taxpayer annual local earned income tax return using airSlate SignNow?

To file your 2020 taxpayer annual local earned income tax return with airSlate SignNow, first create an account and upload your documents. Then, you can fill in the necessary information, eSign your return, and securely send it to the local tax authority. Our platform streamlines this process to ensure everything is completed efficiently.

-

Are there any costs associated with using airSlate SignNow for the 2020 taxpayer annual local earned income tax return?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs, including options for individuals and businesses. While there may be a fee for accessing premium features, our base services are cost-effective and provide excellent value for managing your 2020 taxpayer annual local earned income tax return.

-

What features does airSlate SignNow offer for managing my 2020 taxpayer annual local earned income tax return?

airSlate SignNow provides a range of features designed to simplify the management of your 2020 taxpayer annual local earned income tax return. Key features include document templates, eSigning capabilities, secure cloud storage, and the ability to track document status in real-time, ensuring you remain organized throughout the filing process.

-

How can airSlate SignNow help me save time when filing my 2020 taxpayer annual local earned income tax return?

By using airSlate SignNow, you can drastically reduce the time spent on your 2020 taxpayer annual local earned income tax return. Our platform automates many manual tasks, such as data entry and document routing, enabling you to focus on other priorities while ensuring your tax return is completed accurately and efficiently.

-

Is airSlate SignNow compliant with local regulations for filing the 2020 taxpayer annual local earned income tax return?

Absolutely! airSlate SignNow prioritizes compliance with local tax regulations, ensuring that your 2020 taxpayer annual local earned income tax return is handled appropriately. We continuously update our platform to conform to changing laws, so you can trust that your filings meet local requirements.

-

Can I integrate airSlate SignNow with other accounting software while preparing my 2020 taxpayer annual local earned income tax return?

Yes, airSlate SignNow seamlessly integrates with a variety of accounting and tax software. This ensures that you can efficiently exchange data and streamline workflows when preparing your 2020 taxpayer annual local earned income tax return, making the process more cohesive and manageable.

-

What support options are available if I have questions about my 2020 taxpayer annual local earned income tax return?

airSlate SignNow offers comprehensive support options, including a knowledge base, live chat, and email assistance. If you have questions or need help with your 2020 taxpayer annual local earned income tax return, our dedicated support team is ready to assist you at any step of the process.

Get more for Taxpayer Annual Local Earned Income Tax Return

Find out other Taxpayer Annual Local Earned Income Tax Return

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online