Form W 4

What is the Form W-4

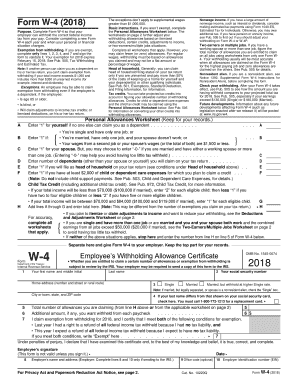

The Form W-4, officially known as the Employee's Withholding Certificate, is a crucial document used by employers in the United States to determine the amount of federal income tax to withhold from an employee's paycheck. This form provides information about the employee's filing status, number of dependents, and any additional amount they wish to withhold. Understanding the W-4 is essential for ensuring that employees have the correct amount withheld for tax purposes, helping to avoid underpayment or overpayment of taxes throughout the year.

How to use the Form W-4

Using the Form W-4 involves several straightforward steps. First, employees must complete the form accurately, providing personal information such as name, address, and Social Security number. Next, they should indicate their filing status, which can be single, married, or head of household. The form also allows employees to claim dependents and specify any additional withholding amounts. Once completed, the employee submits the form to their employer, who will then use the information to calculate the withholding amount from their wages.

Steps to complete the Form W-4

Completing the Form W-4 requires careful attention to detail. Here are the steps to follow:

- Start by entering your personal information, including your name, address, and Social Security number.

- Select your filing status: single, married, or head of household.

- Claim any dependents by providing the number of qualifying children and other dependents.

- Indicate any additional income or deductions that may affect your withholding.

- Sign and date the form before submitting it to your employer.

Legal use of the Form W-4

The Form W-4 is legally binding and must be filled out truthfully to ensure compliance with IRS regulations. Employers are required to keep the form on file and use it to determine the correct amount of federal income tax withholding. Falsifying information on the W-4 can lead to penalties, including fines and back taxes owed to the IRS. It is essential for employees to review and update their W-4 whenever their financial situation changes, such as marriage, divorce, or the birth of a child.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form W-4. These guidelines include instructions on how to calculate the number of allowances and additional withholding amounts. The IRS also updates the form periodically to reflect changes in tax laws, so it is important for employees to use the most current version. Additionally, the IRS recommends that employees use the Tax Withholding Estimator tool available on their website to help determine the appropriate withholding based on their individual circumstances.

Form Submission Methods (Online / Mail / In-Person)

Employees can submit the Form W-4 to their employer through various methods. The most common method is to deliver a printed copy of the completed form in person. Alternatively, some employers may allow electronic submission via email or a secure online portal. It is important to check with the employer for their preferred submission method. Regardless of the method used, employees should ensure that the form is submitted promptly to avoid any delays in processing their withholding adjustments.

Quick guide on how to complete form w 4

Effortlessly prepare Form W 4 on any device

Online document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can acquire the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Form W 4 on any device utilizing the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

The easiest way to modify and electronically sign Form W 4 without hassle

- Obtain Form W 4 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that require reprinting. airSlate SignNow meets your document management needs with just a few clicks from your selected device. Modify and electronically sign Form W 4 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 4 and why is it important?

Form W 4 is an essential tax document that employees in the United States complete to indicate their tax withholding preferences. It ensures that the correct amount of federal income tax is withheld from your paychecks, reflecting your financial situation. Understanding how to fill out Form W 4 correctly can help you avoid owing taxes at the end of the year.

-

How can airSlate SignNow help me manage Form W 4?

airSlate SignNow offers a seamless solution for managing Form W 4 by allowing you to easily send, receive, and eSign this important document electronically. Our intuitive platform simplifies the process, enabling both employers and employees to handle tax form submissions efficiently and securely. With airSlate SignNow, you can store and access your Form W 4 electronically at any time.

-

Is there a cost associated with using airSlate SignNow for Form W 4?

Yes, airSlate SignNow offers a variety of pricing plans to meet your needs, including options for businesses and individuals. The cost provides you with access to features such as document management, electronic signatures, and integrations that enhance your workflow. Consider the potential savings in time and effort when handling Form W 4 with our solution.

-

Can I integrate Form W 4 with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports various integrations with popular platforms, allowing you to streamline your workflow for Form W 4 and other document management processes. Whether you are using CRM, HR, or accounting software, our platform seamlessly connects with many applications to enhance productivity and efficiency.

-

What features does airSlate SignNow provide for electronic signatures on Form W 4?

airSlate SignNow offers advanced features for electronic signatures on Form W 4, including an easy-to-use signing interface, customizable signature workflows, and authentication options to ensure security. Our platform complies with electronic signature laws, making it legally binding and universally accepted. This helps in expediting the completion of Form W 4.

-

How secure is my data when using airSlate SignNow for Form W 4?

Security is a top priority at airSlate SignNow. We implement robust measures, including encryption, secure data storage, and compliance with industry regulations to protect your information when handling Form W 4. Our platform ensures that your documents and user data are safe and accessible only to authorized individuals.

-

Can I track the status of my Form W 4 using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features for your Form W 4. You'll be able to monitor when the document is sent, viewed, and signed, making it easy to keep tabs on its progress. This feature helps ensure that all necessary parties are involved and that your tax documentation is processed on time.

Get more for Form W 4

Find out other Form W 4

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement